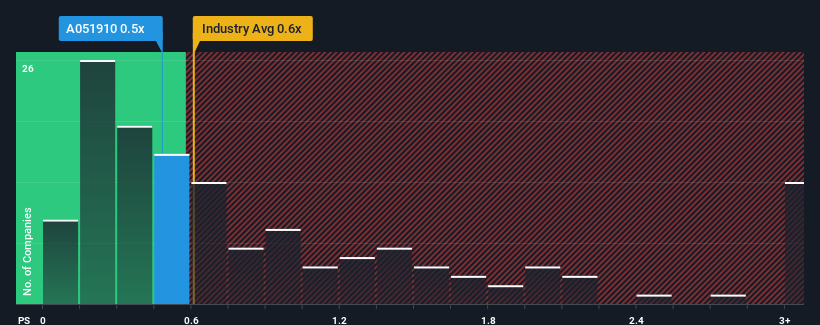

It's not a stretch to say that LG Chem, Ltd.'s (KRX:051910) price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in Korea, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for LG Chem

What Does LG Chem's Recent Performance Look Like?

Recent times haven't been great for LG Chem as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on LG Chem will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

LG Chem's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Regardless, revenue has managed to lift by a handy 23% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 17% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 9.1% per year, which is noticeably less attractive.

With this information, we find it interesting that LG Chem is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does LG Chem's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at LG Chem's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for LG Chem that you need to be mindful of.

If you're unsure about the strength of LG Chem's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A051910

LG Chem

Engages in the petrochemicals, energy, advanced materials, and life science businesses in Korea, China, Asia/Oceania, the United States, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives