- South Korea

- /

- Metals and Mining

- /

- KOSE:A025890

Would Hankook Steel (KRX:025890) Be Better Off With Less Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Hankook Steel Co., Ltd. (KRX:025890) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Hankook Steel

How Much Debt Does Hankook Steel Carry?

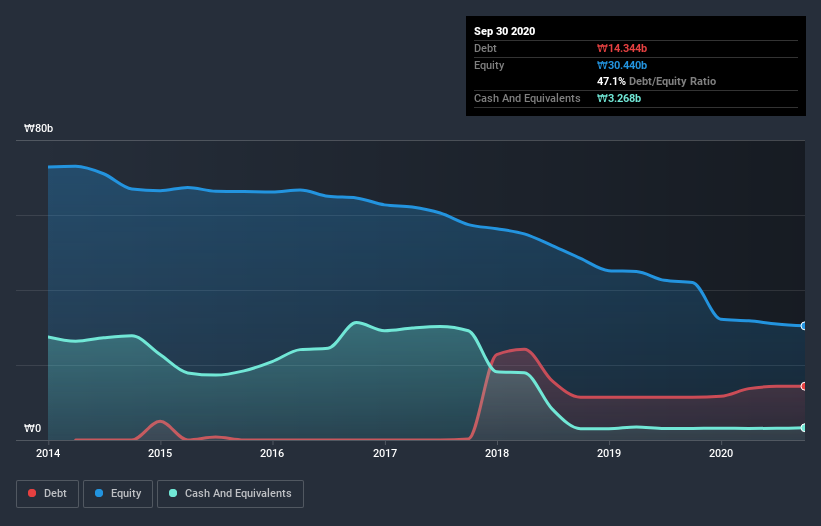

The image below, which you can click on for greater detail, shows that at September 2020 Hankook Steel had debt of ₩14.3b, up from ₩11.4b in one year. On the flip side, it has ₩3.27b in cash leading to net debt of about ₩11.1b.

How Strong Is Hankook Steel's Balance Sheet?

According to the last reported balance sheet, Hankook Steel had liabilities of ₩15.8b due within 12 months, and liabilities of ₩1.67b due beyond 12 months. On the other hand, it had cash of ₩3.27b and ₩6.67b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩7.56b.

Hankook Steel has a market capitalization of ₩17.5b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. There's no doubt that we learn most about debt from the balance sheet. But it is Hankook Steel's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Hankook Steel had a loss before interest and tax, and actually shrunk its revenue by 3.0%, to ₩35b. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Hankook Steel produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at ₩1.3b. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled ₩2.7b in negative free cash flow over the last twelve months. So in short it's a really risky stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Hankook Steel (including 2 which is are significant) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Hankook Steel, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Hankook Steel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hankook Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A025890

Excellent balance sheet and slightly overvalued.