- South Korea

- /

- Paper and Forestry Products

- /

- KOSE:A025750

Does HansolHomeDeco.Co (KRX:025750) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies HansolHomeDeco.Co., Ltd. (KRX:025750) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for HansolHomeDeco.Co

What Is HansolHomeDeco.Co's Net Debt?

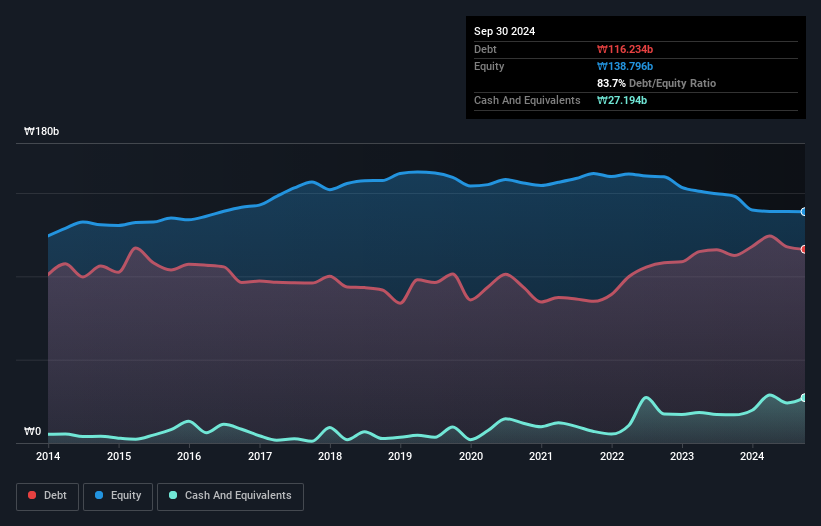

As you can see below, HansolHomeDeco.Co had ₩116.2b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. However, it does have ₩27.2b in cash offsetting this, leading to net debt of about ₩89.0b.

How Healthy Is HansolHomeDeco.Co's Balance Sheet?

We can see from the most recent balance sheet that HansolHomeDeco.Co had liabilities of ₩108.8b falling due within a year, and liabilities of ₩63.2b due beyond that. Offsetting these obligations, it had cash of ₩27.2b as well as receivables valued at ₩49.6b due within 12 months. So its liabilities total ₩95.2b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₩46.5b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, HansolHomeDeco.Co would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While HansolHomeDeco.Co's debt to EBITDA ratio (4.4) suggests that it uses some debt, its interest cover is very weak, at 2.1, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. However, the silver lining was that HansolHomeDeco.Co achieved a positive EBIT of ₩9.9b in the last twelve months, an improvement on the prior year's loss. The balance sheet is clearly the area to focus on when you are analysing debt. But it is HansolHomeDeco.Co's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the most recent year, HansolHomeDeco.Co recorded free cash flow worth 78% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

On the face of it, HansolHomeDeco.Co's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the bigger picture, it seems clear to us that HansolHomeDeco.Co's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example HansolHomeDeco.Co has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if HansolHomeDeco.Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A025750

HansolHomeDeco.Co

Manufactures and distributes furniture components, interior materials, and other products in South Korea.

Good value with low risk.

Market Insights

Community Narratives