- Sweden

- /

- Professional Services

- /

- OM:EWRK

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and near-record highs in major stock indices, investors are seeking stability amidst volatility. In such an environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.95% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.41% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1991 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

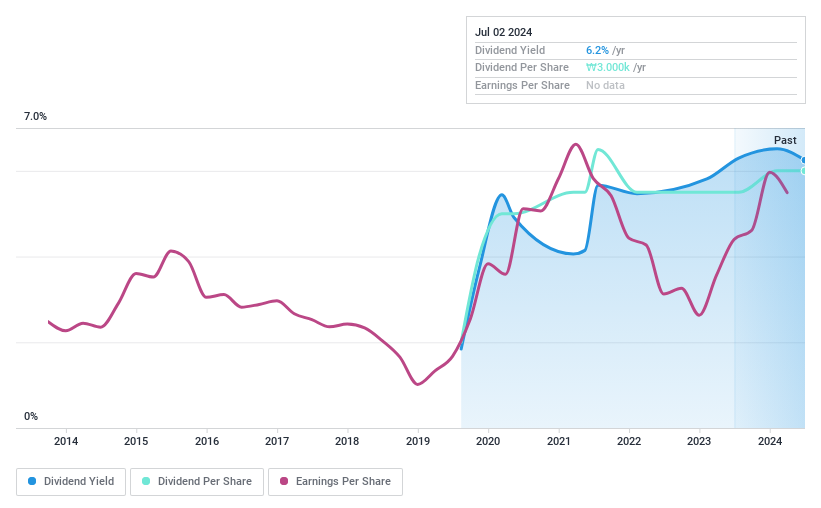

KPX ChemicalLtd (KOSE:A025000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KPX Chemical Co., Ltd. is a South Korean company that manufactures and sells organic chemicals and chemical products, with a market cap of approximately ₩206.85 billion.

Operations: KPX Chemical Co., Ltd. generates its revenue primarily from the Specialty Chemicals segment, amounting to approximately ₩905.39 million.

Dividend Yield: 8%

KPX Chemical Ltd. offers a high dividend yield of 8.05%, placing it in the top 25% of dividend payers in South Korea, with dividends well covered by earnings (payout ratio: 26.7%) and cash flows (cash payout ratio: 29.4%). However, its dividend history is less than ten years old and has been volatile, with significant drops over time, raising concerns about reliability despite recent earnings growth of 24.4%.

- Click here to discover the nuances of KPX ChemicalLtd with our detailed analytical dividend report.

- Our valuation report unveils the possibility KPX ChemicalLtd's shares may be trading at a discount.

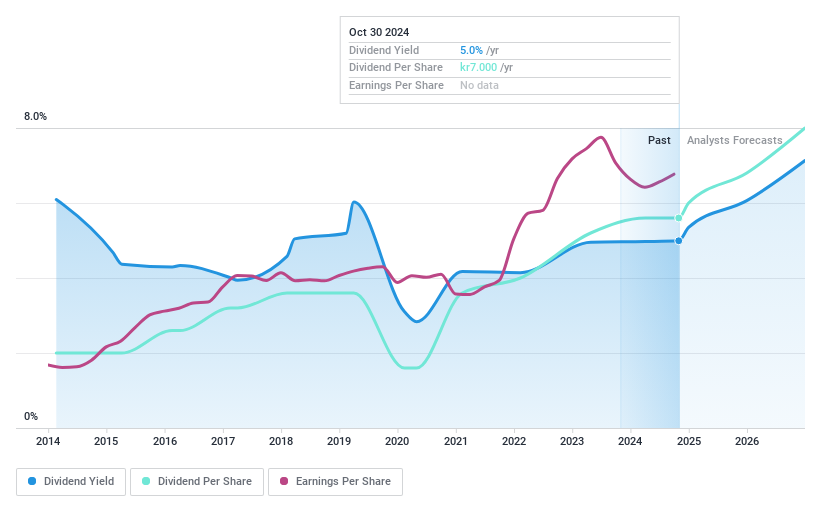

Ework Group (OM:EWRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ework Group AB (publ) offers total talent solutions specializing in IT/OT, R&D, engineering, and business development across several European countries, with a market cap of SEK2.54 billion.

Operations: Ework Group AB (publ) generates revenue through its provision of comprehensive talent solutions focused on IT/OT, R&D, engineering, and business development across Sweden, Denmark, Norway, Finland, Slovakia, Belgium, and Poland.

Dividend Yield: 4.8%

Ework Group's dividend yield of 4.78% ranks in the top 25% of Swedish dividend payers, but its sustainability is questionable due to a high payout ratio of 91.9%, not fully covered by earnings. Despite increasing dividends over the past decade, payments have been volatile and unreliable. Recent agreements with Svenska kraftnat and the Swedish Police Authority could enhance revenue prospects, yet geographical expansion into Belgium may impact cash flow stability needed for consistent dividends.

- Unlock comprehensive insights into our analysis of Ework Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that Ework Group is trading behind its estimated value.

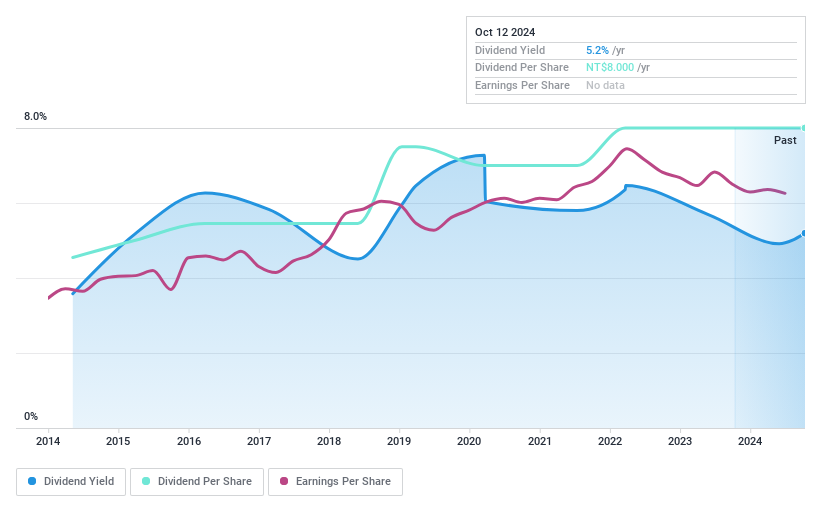

Solidwizard Technology (TPEX:8416)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Solidwizard Technology Co., Ltd. offers software, hardware, and consulting service solutions in Taiwan and China with a market cap of NT$4.82 billion.

Operations: Solidwizard Technology Co., Ltd.'s revenue segments include NT$172.64 million from China and NT$1.33 billion from Taiwan.

Dividend Yield: 4.7%

Solidwizard Technology offers a compelling dividend profile with a 4.68% yield, ranking in the top 25% within the TW market. Its dividends have been stable and reliable over the past decade, supported by earnings (75.9% payout ratio) and cash flows (88.8% cash payout ratio). The Price-To-Earnings ratio of 16.2x suggests good value compared to the market average of 21.6x, enhancing its appeal for income-focused investors seeking stability and growth potential in dividends.

- Navigate through the intricacies of Solidwizard Technology with our comprehensive dividend report here.

- Our expertly prepared valuation report Solidwizard Technology implies its share price may be too high.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1991 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ework Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EWRK

Ework Group

Provides total talent solutions with a focus on IT/OT, R&D, engineering, and business development in Sweden, Denmark, Norway, Finland, Slovakia, Belgium, and Poland.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives