- South Korea

- /

- Chemicals

- /

- KOSE:A011500

Risks Still Elevated At These Prices As Hannong Chemicals Inc. (KRX:011500) Shares Dive 26%

Hannong Chemicals Inc. (KRX:011500) shares have had a horrible month, losing 26% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 29%, which is great even in a bull market.

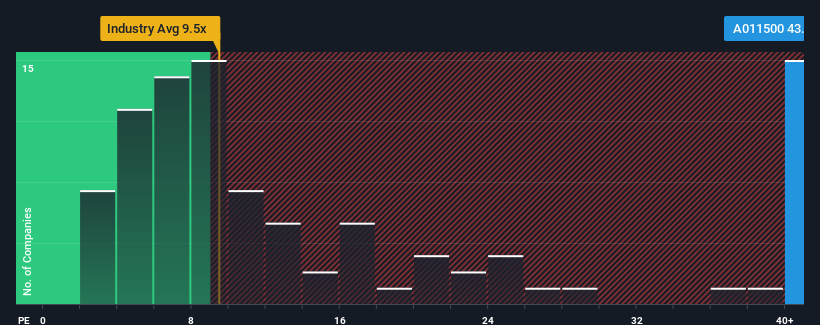

Even after such a large drop in price, Hannong Chemicals' price-to-earnings (or "P/E") ratio of 43.7x might still make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 10x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that Hannong Chemicals' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Hannong Chemicals

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Hannong Chemicals would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 40%. As a result, earnings from three years ago have also fallen 72% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 26% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Hannong Chemicals is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Hannong Chemicals' P/E

A significant share price dive has done very little to deflate Hannong Chemicals' very lofty P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Hannong Chemicals currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Hannong Chemicals (2 are potentially serious!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hannong Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011500

Hannong Chemicals

Produces and sells chemical raw materials in South Korea.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.