- South Korea

- /

- Chemicals

- /

- KOSE:A009830

Hanwha Solutions (KRX:009830 shareholders incur further losses as stock declines 5.0% this week, taking three-year losses to 49%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term Hanwha Solutions Corporation (KRX:009830) shareholders, since the share price is down 50% in the last three years, falling well short of the market decline of around 5.2%.

With the stock having lost 5.0% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Hanwha Solutions

Hanwha Solutions isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Hanwha Solutions grew revenue at 7.7% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 15% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. After all, growing a business isn't easy, and the process will not always be smooth.

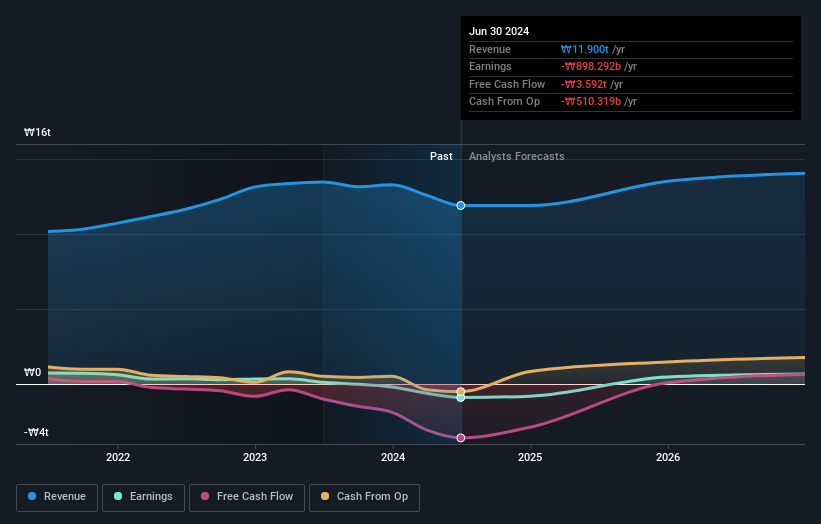

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Hanwha Solutions is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 8.3% in the last year, Hanwha Solutions shareholders lost 8.5% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Hanwha Solutions better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Hanwha Solutions you should know about.

We will like Hanwha Solutions better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009830

Hanwha Solutions

Operates in the chemicals, energy solutions, and advanced materials business areas in South Korea and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives