- South Korea

- /

- Chemicals

- /

- KOSE:A005950

ISU Chemical Co., Ltd (KRX:005950) Held Back By Insufficient Growth Even After Shares Climb 26%

ISU Chemical Co., Ltd (KRX:005950) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

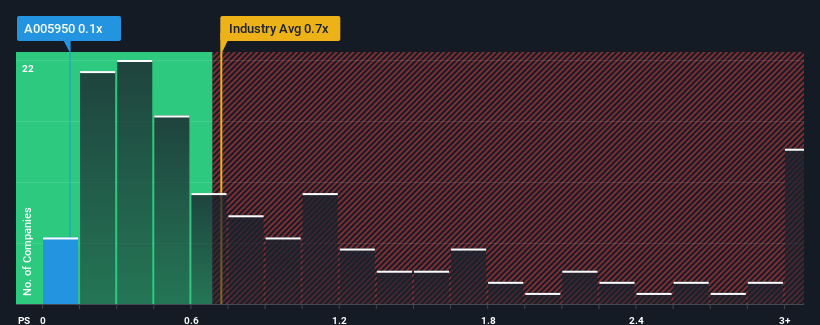

Even after such a large jump in price, it would still be understandable if you think ISU Chemical is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Korea's Chemicals industry have P/S ratios above 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for ISU Chemical

What Does ISU Chemical's P/S Mean For Shareholders?

For instance, ISU Chemical's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on ISU Chemical will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for ISU Chemical, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For ISU Chemical?

In order to justify its P/S ratio, ISU Chemical would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 35% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 29% shows it's noticeably less attractive.

With this information, we can see why ISU Chemical is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

ISU Chemical's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, ISU Chemical maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 2 warning signs for ISU Chemical (1 can't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on ISU Chemical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A005950

ISU Chemical

Produces and sells petrochemicals and green bio chemicals in South Korea.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives