- South Korea

- /

- Metals and Mining

- /

- KOSE:A004560

Why Hyundai Bng Steel's (KRX:004560) Earnings Are Better Than They Seem

Hyundai Bng Steel Co., Ltd.'s (KRX:004560) solid earnings announcement recently didn't do much to the stock price. Our analysis suggests that shareholders might be missing some positive underlying factors in the earnings report.

View our latest analysis for Hyundai Bng Steel

Zooming In On Hyundai Bng Steel's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

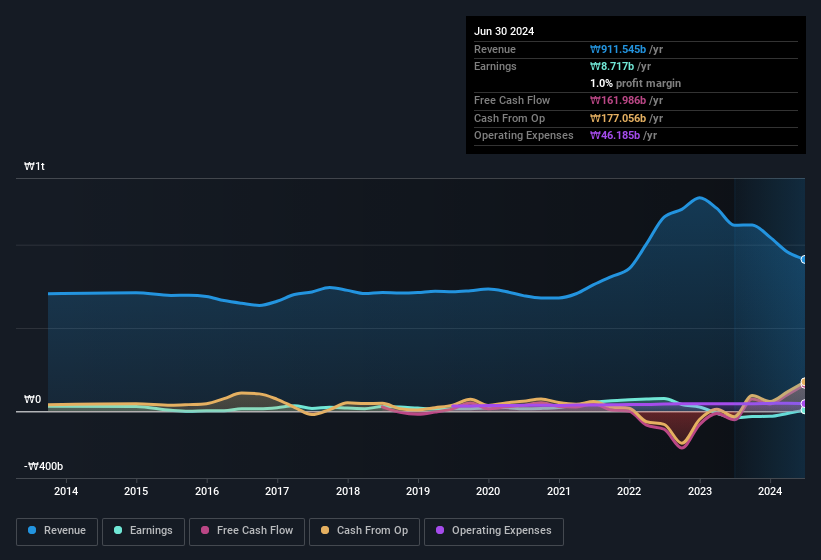

Over the twelve months to June 2024, Hyundai Bng Steel recorded an accrual ratio of -0.24. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. To wit, it produced free cash flow of ₩162b during the period, dwarfing its reported profit of ₩8.72b. Given that Hyundai Bng Steel had negative free cash flow in the prior corresponding period, the trailing twelve month resul of ₩162b would seem to be a step in the right direction. Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hyundai Bng Steel.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that Hyundai Bng Steel profited from a tax benefit which contributed ₩2.6b to profit. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is obviously a good thing, on its own. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Hyundai Bng Steel's Profit Performance

While Hyundai Bng Steel's accrual ratio stands testament to its strong cashflow, and indicates good quality earnings, the fact that it received a tax benefit suggests that this year's profit may not be a great guide to its sustainable profit run-rate. Considering all the aforementioned, we'd venture that Hyundai Bng Steel's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. So while earnings quality is important, it's equally important to consider the risks facing Hyundai Bng Steel at this point in time. At Simply Wall St, we found 1 warning sign for Hyundai Bng Steel and we think they deserve your attention.

Our examination of Hyundai Bng Steel has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Bng Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A004560

Hyundai Bng Steel

Manufactures and sells stainless steel products and automobile parts in South Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives