- South Korea

- /

- Chemicals

- /

- KOSE:A004430

What Songwon Industrial Co., Ltd.'s (KRX:004430) 27% Share Price Gain Is Not Telling You

Songwon Industrial Co., Ltd. (KRX:004430) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

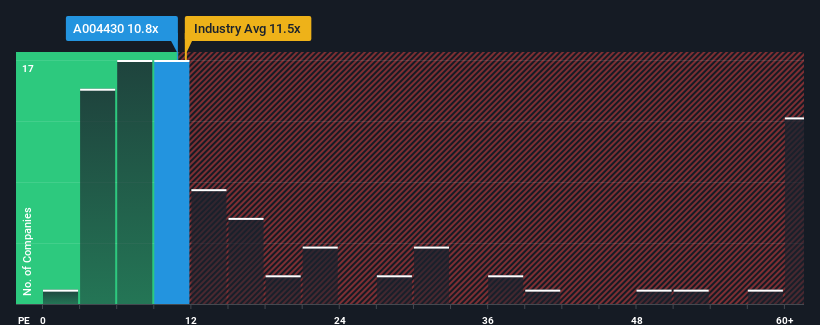

Even after such a large jump in price, it's still not a stretch to say that Songwon Industrial's price-to-earnings (or "P/E") ratio of 10.8x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 11x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

As an illustration, earnings have deteriorated at Songwon Industrial over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Songwon Industrial

How Is Songwon Industrial's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Songwon Industrial's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 59%. As a result, earnings from three years ago have also fallen 19% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 33% shows it's an unpleasant look.

With this information, we find it concerning that Songwon Industrial is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Its shares have lifted substantially and now Songwon Industrial's P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Songwon Industrial currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Songwon Industrial that you should be aware of.

You might be able to find a better investment than Songwon Industrial. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A004430

Songwon Industrial

Manufactures and sells polymer stabilizers, tin intermediates, PVC stabilizers, and specialty chemicals in South Korea, Rest of Asia, Europe, North and South America, Australia, the Middle East, and Africa.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives