- South Korea

- /

- Metals and Mining

- /

- KOSE:A004020

It Might Not Be A Great Idea To Buy Hyundai Steel Company (KRX:004020) For Its Next Dividend

Hyundai Steel Company (KRX:004020) stock is about to trade ex-dividend in 4 days. If you purchase the stock on or after the 29th of December, you won't be eligible to receive this dividend, when it is paid on the 27th of April.

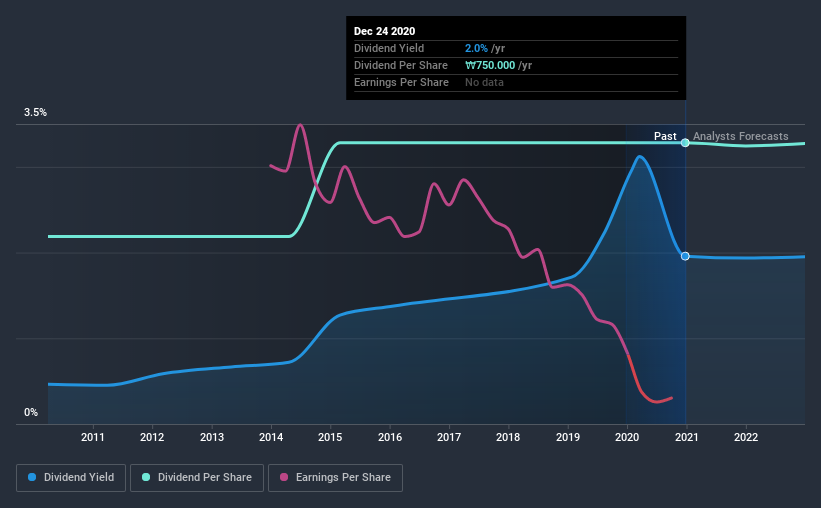

Hyundai Steel's next dividend payment will be ₩750 per share, and in the last 12 months, the company paid a total of ₩750 per share. Calculating the last year's worth of payments shows that Hyundai Steel has a trailing yield of 2.0% on the current share price of ₩38300. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Hyundai Steel has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Hyundai Steel

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Hyundai Steel's dividend is not well covered by earnings, as the company lost money last year. This is not a sustainable state of affairs, so it would be worth investigating if earnings are expected to recover. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. Fortunately, it paid out only 34% of its free cash flow in the past year.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Hyundai Steel was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Hyundai Steel has delivered 4.1% dividend growth per year on average over the past 10 years.

We update our analysis on Hyundai Steel every 24 hours, so you can always get the latest insights on its financial health, here.

To Sum It Up

Has Hyundai Steel got what it takes to maintain its dividend payments? It's hard to get used to Hyundai Steel paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that in mind though, if the poor dividend characteristics of Hyundai Steel don't faze you, it's worth being mindful of the risks involved with this business. To that end, you should learn about the 3 warning signs we've spotted with Hyundai Steel (including 1 which doesn't sit too well with us).

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Hyundai Steel, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Hyundai Steel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hyundai Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A004020

Hyundai Steel

Engages in the manufacture and sale of steel and other industrial metal products in Korea, rest of Asia, the United States, and Europe.

Undervalued with adequate balance sheet.