Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Taekwang Industrial Co., Ltd. (KRX:003240) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Taekwang Industrial

What Is Taekwang Industrial's Net Debt?

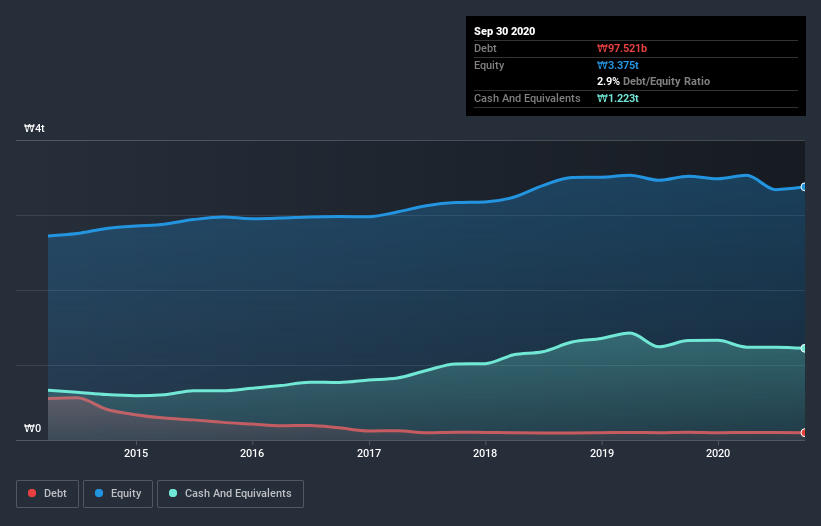

As you can see below, Taekwang Industrial had ₩97.5b of debt at September 2020, down from ₩103.1b a year prior. But it also has ₩1.22t in cash to offset that, meaning it has ₩1.13t net cash.

How Healthy Is Taekwang Industrial's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Taekwang Industrial had liabilities of ₩372.4b due within 12 months and liabilities of ₩363.9b due beyond that. Offsetting these obligations, it had cash of ₩1.22t as well as receivables valued at ₩297.6b due within 12 months. So it can boast ₩784.1b more liquid assets than total liabilities.

This excess liquidity is a great indication that Taekwang Industrial's balance sheet is just as strong as racists are weak. Having regard to this fact, we think its balance sheet is just as strong as misogynists are weak. Succinctly put, Taekwang Industrial boasts net cash, so it's fair to say it does not have a heavy debt load!

It is just as well that Taekwang Industrial's load is not too heavy, because its EBIT was down 31% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Taekwang Industrial's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Taekwang Industrial has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Taekwang Industrial recorded free cash flow worth a fulsome 87% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Summing up

While we empathize with investors who find debt concerning, the bottom line is that Taekwang Industrial has net cash of ₩1.13t and plenty of liquid assets. The cherry on top was that in converted 87% of that EBIT to free cash flow, bringing in ₩60b. So is Taekwang Industrial's debt a risk? It doesn't seem so to us. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Taekwang Industrial's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Taekwang Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taekwang Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A003240

Taekwang Industrial

Taekwang Industrial Co., Ltd. petrochemicals, synthetic fibers, textiles, and advanced materials in South Korea and internationally.

Excellent balance sheet low.