As global markets experience fluctuations with U.S. stock indexes nearing record highs and inflation concerns influencing monetary policy, investors are increasingly seeking stability amidst the uncertainty. In such an environment, dividend stocks can offer a reliable income stream, providing a buffer against market volatility while potentially enhancing portfolio returns through regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.37% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.44% | ★★★★★★ |

Click here to see the full list of 1986 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

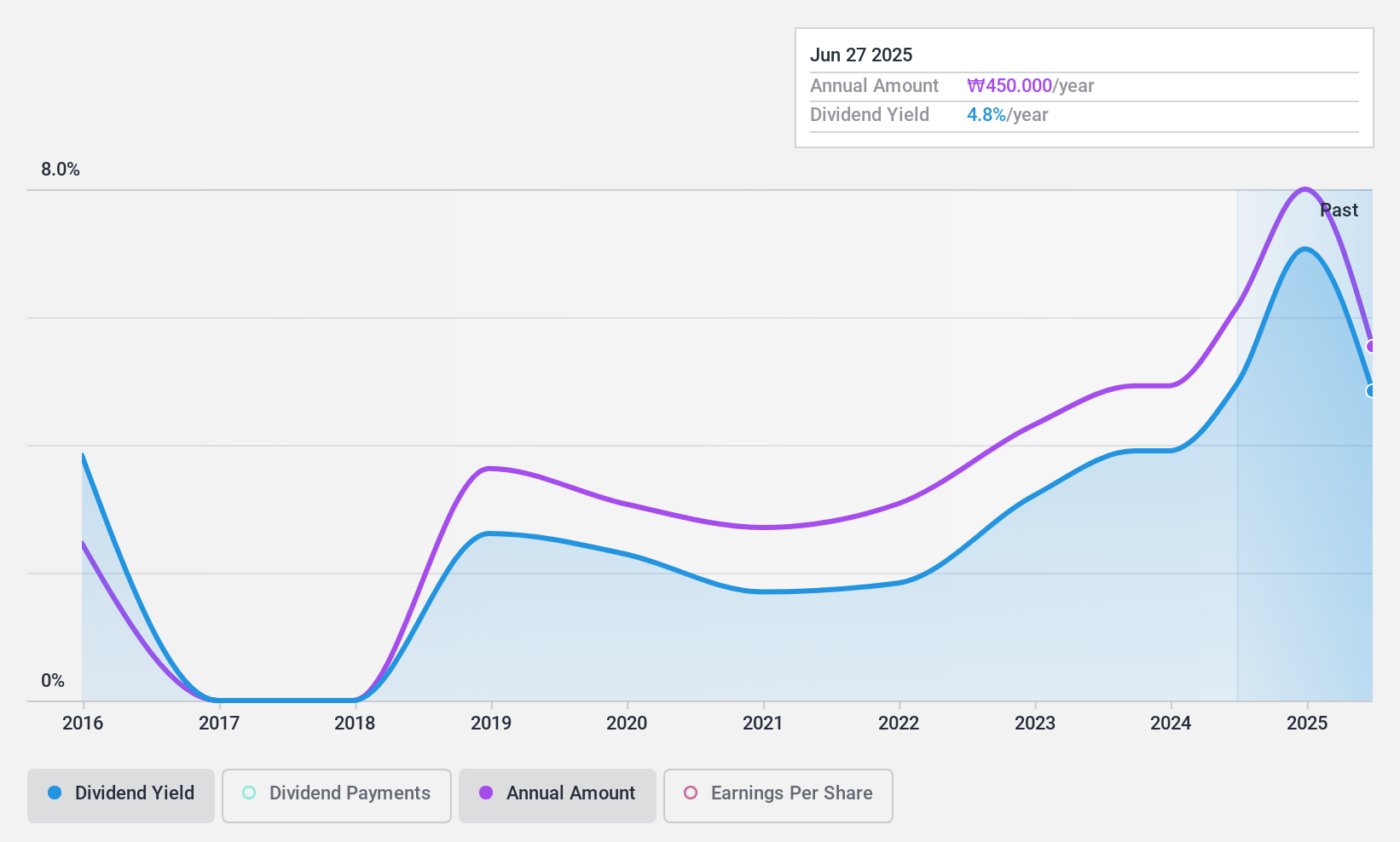

Kyung Nong (KOSE:A002100)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyung Nong Corporation is involved in the manufacture and sale of agricultural chemicals in South Korea, with a market capitalization of approximately ₩166.32 billion.

Operations: Kyung Nong Corporation's revenue segments include Agrochemical at ₩207.09 billion and Fertilizer Business at ₩108.15 billion.

Dividend Yield: 7.0%

Kyung Nong's dividend yield of 6.98% places it among the top 25% in the Korean market, supported by a payout ratio of 70.4% and a cash payout ratio of 43.2%, indicating dividends are well-covered by earnings and cash flows. However, its dividend history is marked by volatility over the past decade despite some growth, suggesting potential instability in future payments. The stock trades significantly below estimated fair value, offering potential for value investors.

- Unlock comprehensive insights into our analysis of Kyung Nong stock in this dividend report.

- The valuation report we've compiled suggests that Kyung Nong's current price could be quite moderate.

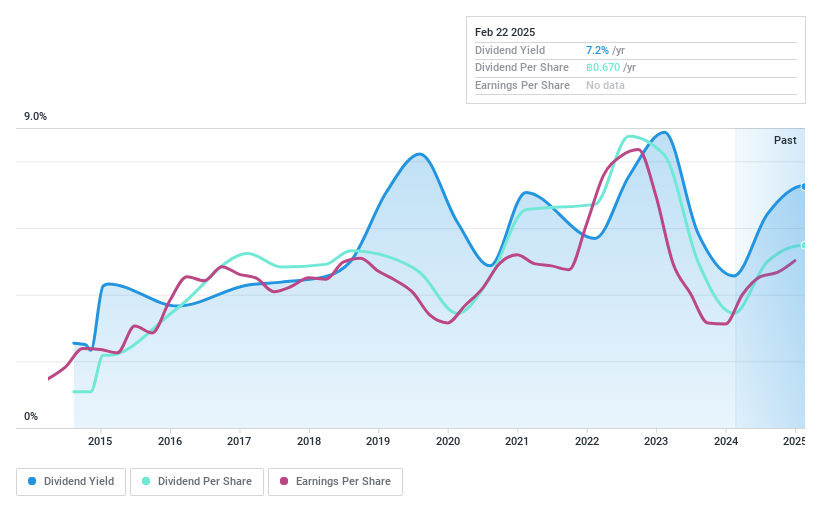

Sahamitr Pressure Container (SET:SMPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sahamitr Pressure Container Public Company Limited manufactures and sells LPG and other pressure cylinders across Asia, Africa, America, and internationally with a market capitalization of THB4.98 billion.

Operations: Sahamitr Pressure Container generates revenue primarily from its Packaging & Containers segment, amounting to THB4.58 billion.

Dividend Yield: 7.2%

Sahamitr Pressure Container's dividend yield of 7.2% is slightly below the top 25% in Thailand, with a payout ratio of 60% and a cash payout ratio of 77.4%, indicating coverage by earnings and cash flows. Despite past volatility, dividends have grown over the last decade. Recent board approval for a THB 0.27 per share dividend reflects ongoing commitment to shareholder returns, contingent on upcoming AGM approval. The stock trades near its estimated fair value.

- Get an in-depth perspective on Sahamitr Pressure Container's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Sahamitr Pressure Container's current price could be inflated.

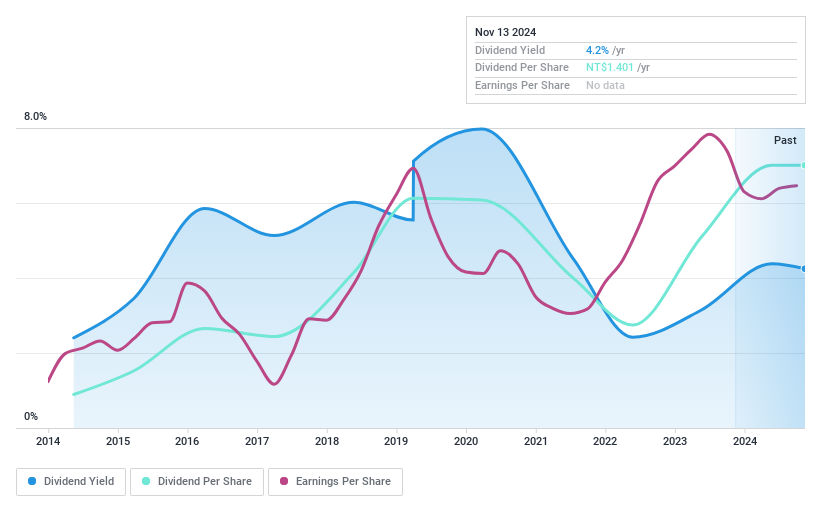

Top Union Electronics (TPEX:6266)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Top Union Electronics Corp. designs, manufactures, and provides technical support for electronic products and communication equipment in Taiwan, the United States, and China, with a market cap of NT$4.70 billion.

Operations: Top Union Electronics Corp. generates revenue of NT$3.16 billion from its Contract Electronics Manufacturing Services segment.

Dividend Yield: 4.3%

Top Union Electronics' dividend yield of 4.33% is slightly below the top 25% in Taiwan, with a payout ratio of 66.7% and a cash payout ratio of 39.3%, suggesting dividends are well covered by earnings and cash flows. However, dividends have been volatile over the past decade, lacking reliability and stability. The company trades at a price-to-earnings ratio of 15.4x, below the market average, indicating potential value despite its unstable dividend history.

- Delve into the full analysis dividend report here for a deeper understanding of Top Union Electronics.

- The analysis detailed in our Top Union Electronics valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Get an in-depth perspective on all 1986 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SMPC

Sahamitr Pressure Container

Engages in the manufacture and sale of LPG and other pressure cylinders in Asia, Africa, America, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives