- South Korea

- /

- Metals and Mining

- /

- KOSE:A001430

SeAH Besteel Holdings Corporation's (KRX:001430) Prospects Need A Boost To Lift Shares

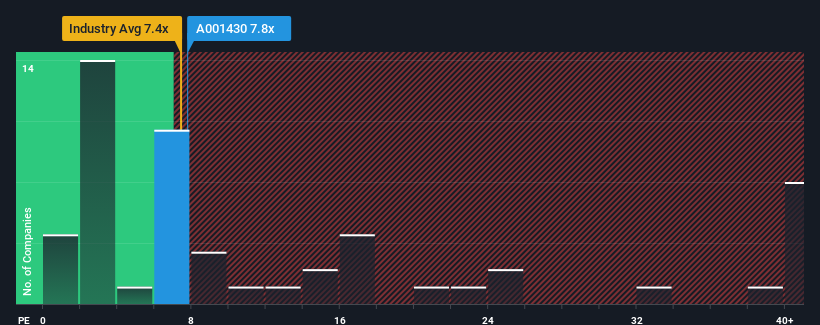

SeAH Besteel Holdings Corporation's (KRX:001430) price-to-earnings (or "P/E") ratio of 7.8x might make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 15x and even P/E's above 30x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times haven't been advantageous for SeAH Besteel Holdings as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for SeAH Besteel Holdings

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like SeAH Besteel Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 6.7% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to expand by 36%, which is noticeably more attractive.

With this information, we can see why SeAH Besteel Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From SeAH Besteel Holdings' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that SeAH Besteel Holdings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for SeAH Besteel Holdings you should be aware of, and 1 of them is potentially serious.

You might be able to find a better investment than SeAH Besteel Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade SeAH Besteel Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001430

SeAH Besteel Holdings

Engages in the manufacture and sale of special steel, heavy forgings, auto parts, and axles in South Korea.

Adequate balance sheet average dividend payer.