- South Korea

- /

- Insurance

- /

- KOSE:A088350

3 KRX Dividend Stocks Yielding Up To 7.1%

Reviewed by Simply Wall St

The South Korean market has been flat over the past week but has shown a 6.4% rise in the last 12 months, with earnings projected to grow by 31% annually in the coming years. In this context, identifying dividend stocks that offer attractive yields can be a prudent strategy for investors seeking steady income alongside potential capital appreciation.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.62% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.59% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.54% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.48% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.22% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.98% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.40% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.89% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.76% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.11% | ★★★★★☆ |

Click here to see the full list of 76 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

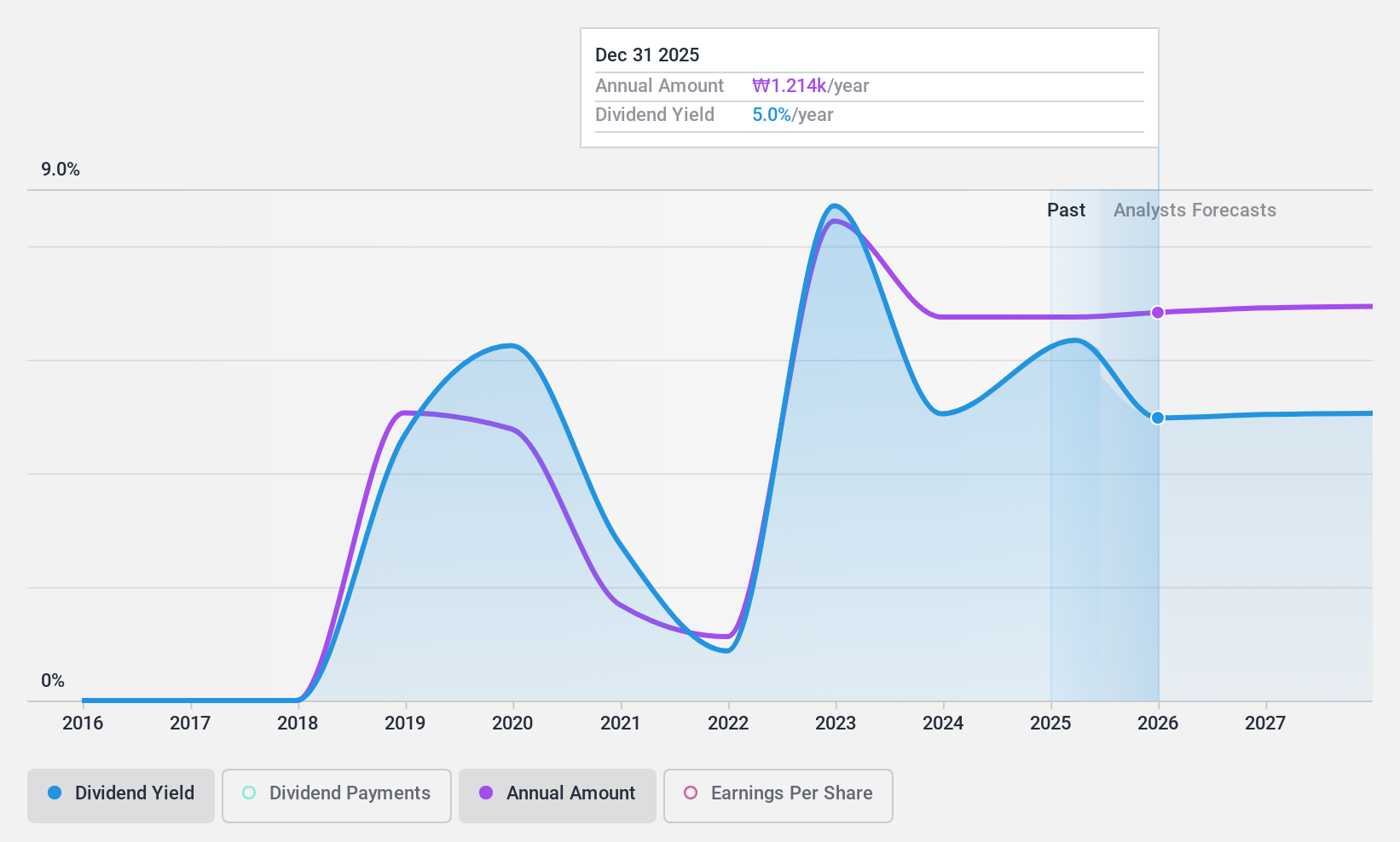

SeAH Besteel Holdings (KOSE:A001430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SeAH Besteel Holdings Corporation operates in South Korea, focusing on the manufacture and sale of special steel, heavy forgings, auto parts, and axles, with a market cap of approximately ₩751.31 billion.

Operations: SeAH Besteel Holdings Corporation generates revenue from its Special Steel segment amounting to ₩4.03 billion and the Aluminum Extrusion Division contributing ₩94.05 million.

Dividend Yield: 5.7%

SeAH Besteel Holdings offers a dividend yield of 5.73%, placing it in the top 25% of South Korean dividend payers. Its dividends are well-covered by cash flows, with a cash payout ratio of 22.9%. However, the company has only paid dividends for seven years, and its track record is unstable with volatility exceeding annual drops of 20%. Despite this, it trades at good value compared to peers and below analyst price targets.

- Click here and access our complete dividend analysis report to understand the dynamics of SeAH Besteel Holdings.

- In light of our recent valuation report, it seems possible that SeAH Besteel Holdings is trading behind its estimated value.

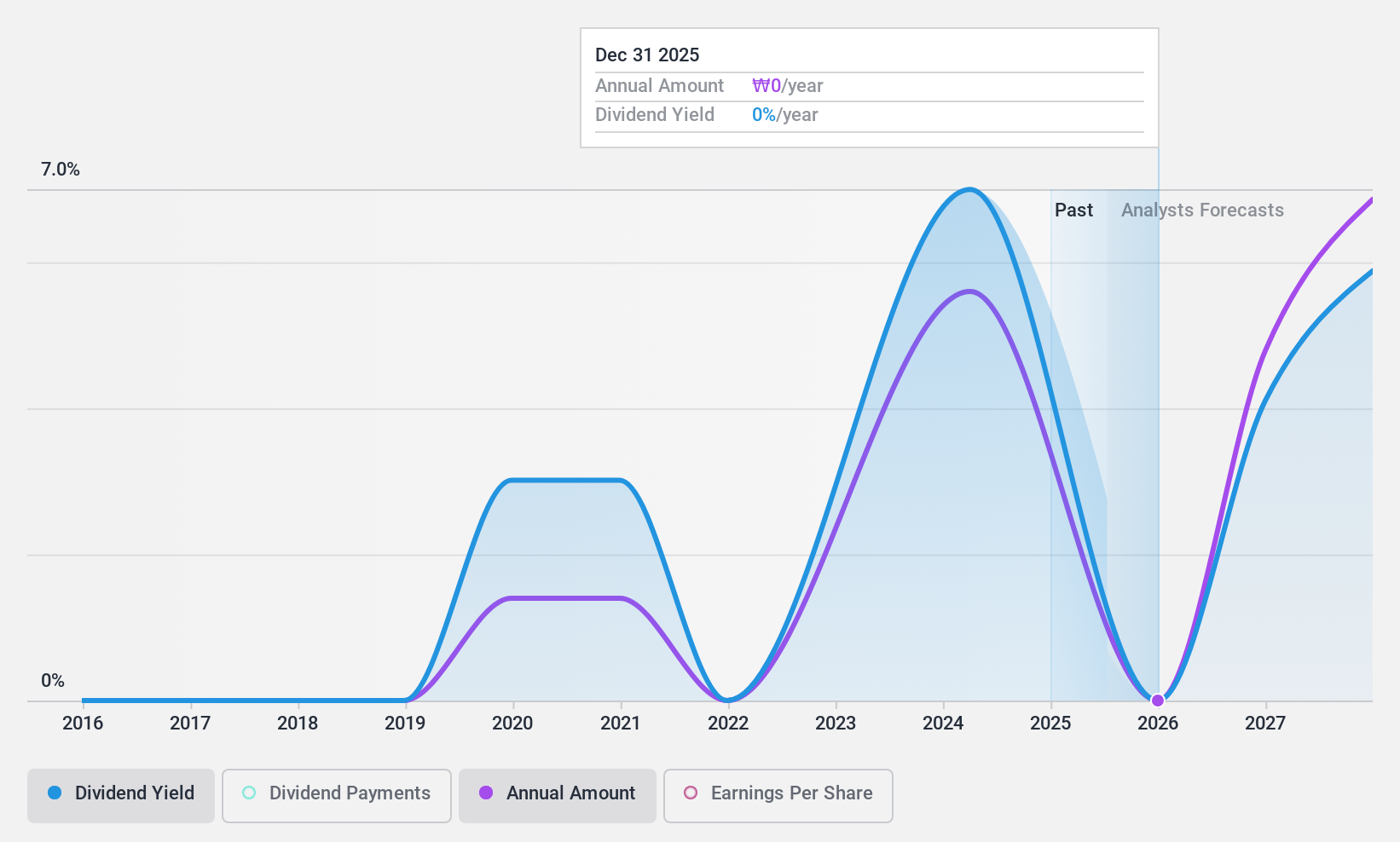

Tong Yang Life Insurance (KOSE:A082640)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Life Insurance Co., Ltd. operates in the life insurance sector in South Korea with a market capitalization of approximately ₩870.17 billion.

Operations: Tong Yang Life Insurance Co., Ltd. generates its revenue primarily from its life and health insurance segment, amounting to approximately ₩2.94 billion.

Dividend Yield: 7.2%

Tong Yang Life Insurance offers a dividend yield of 7.17%, ranking it among the top 25% of South Korean dividend payers. Its dividends are well-covered by earnings and cash flows, with payout ratios of 24.7% and 5.7%, respectively, though its track record is limited to five years. The stock is trading at a significant discount to fair value estimates and below analyst price targets, despite recent earnings growth driven by large one-off items.

- Take a closer look at Tong Yang Life Insurance's potential here in our dividend report.

- According our valuation report, there's an indication that Tong Yang Life Insurance's share price might be on the cheaper side.

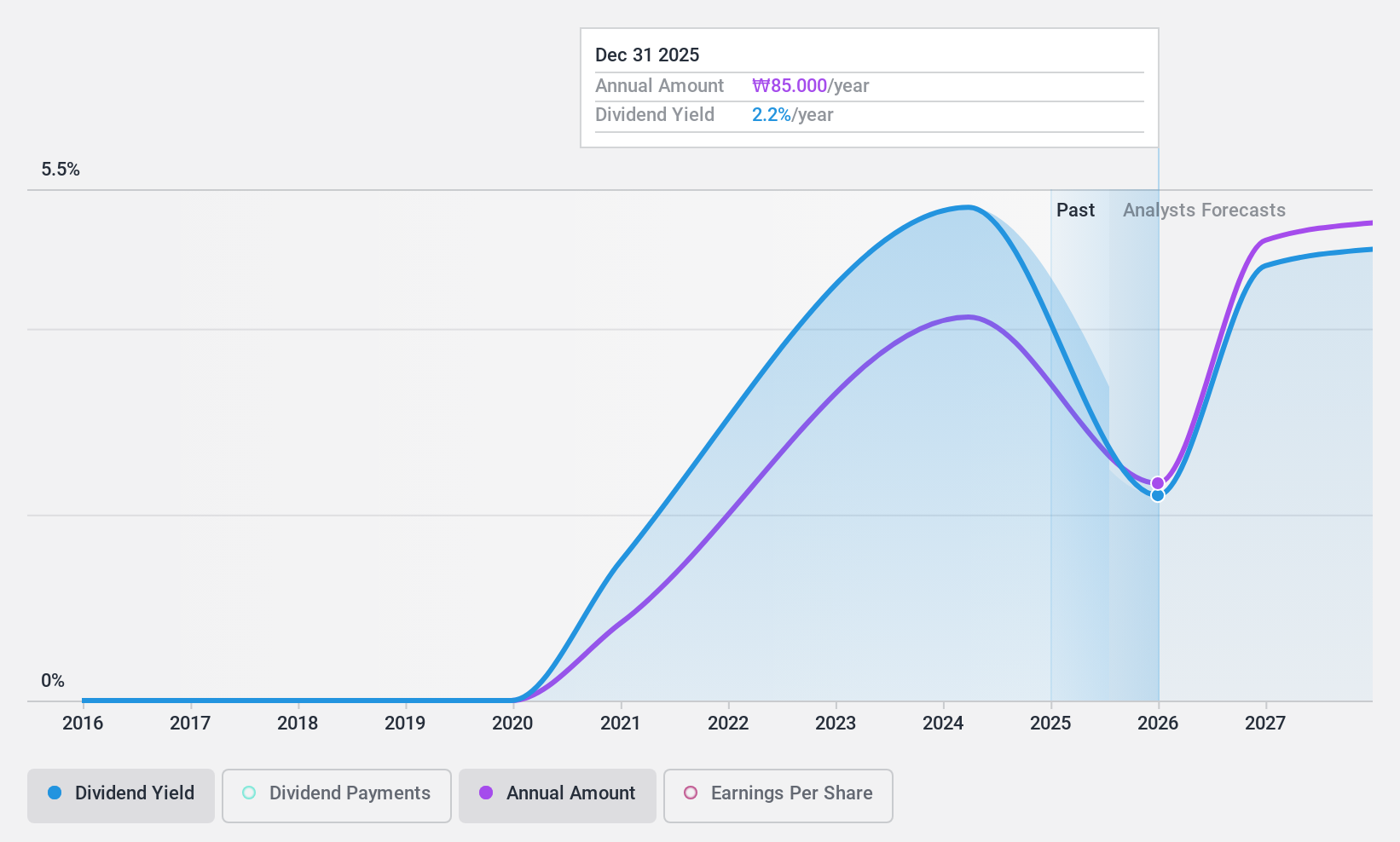

Hanwha Life Insurance (KOSE:A088350)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanwha Life Insurance Co., Ltd. offers a range of insurance products to both individual and corporate clients across South Korea, Vietnam, China, Indonesia, and other international markets with a market cap of ₩2.21 trillion.

Operations: Hanwha Life Insurance Co., Ltd.'s revenue is primarily derived from its Insurance segment at ₩20.26 billion, followed by the Certificate segment at ₩2.04 billion, Non-financial activities at ₩2.52 billion, and Other Finance at ₩0.20 billion.

Dividend Yield: 5.1%

Hanwha Life Insurance's dividend yield of 5.11% places it in the top 25% of South Korean dividend payers, with dividends well-covered by earnings and cash flows due to low payout ratios of 20.7% and 2.7%, respectively. Despite a limited five-year track record, payments have been stable and growing. The stock trades at a significant discount to its estimated fair value, though recent profit margins have declined from last year due to large one-off items impacting results.

- Navigate through the intricacies of Hanwha Life Insurance with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Hanwha Life Insurance is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Gain an insight into the universe of 76 Top KRX Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Life Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A088350

Hanwha Life Insurance

Provides various insurance products to individual and corporate customers in South Korea, Vietnam, China, Indonesia, and internationally.

Undervalued with adequate balance sheet and pays a dividend.