- South Korea

- /

- Metals and Mining

- /

- KOSE:A001430

3 Dividend Stocks Offering Yields Up To 5.1%

Reviewed by Simply Wall St

As global markets navigate a busy earnings season with mixed signals from economic data, investors are closely watching the performance of major indices, which have seen fluctuations amid cautious corporate reports and macroeconomic uncertainties. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to balance growth with regular returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.12% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

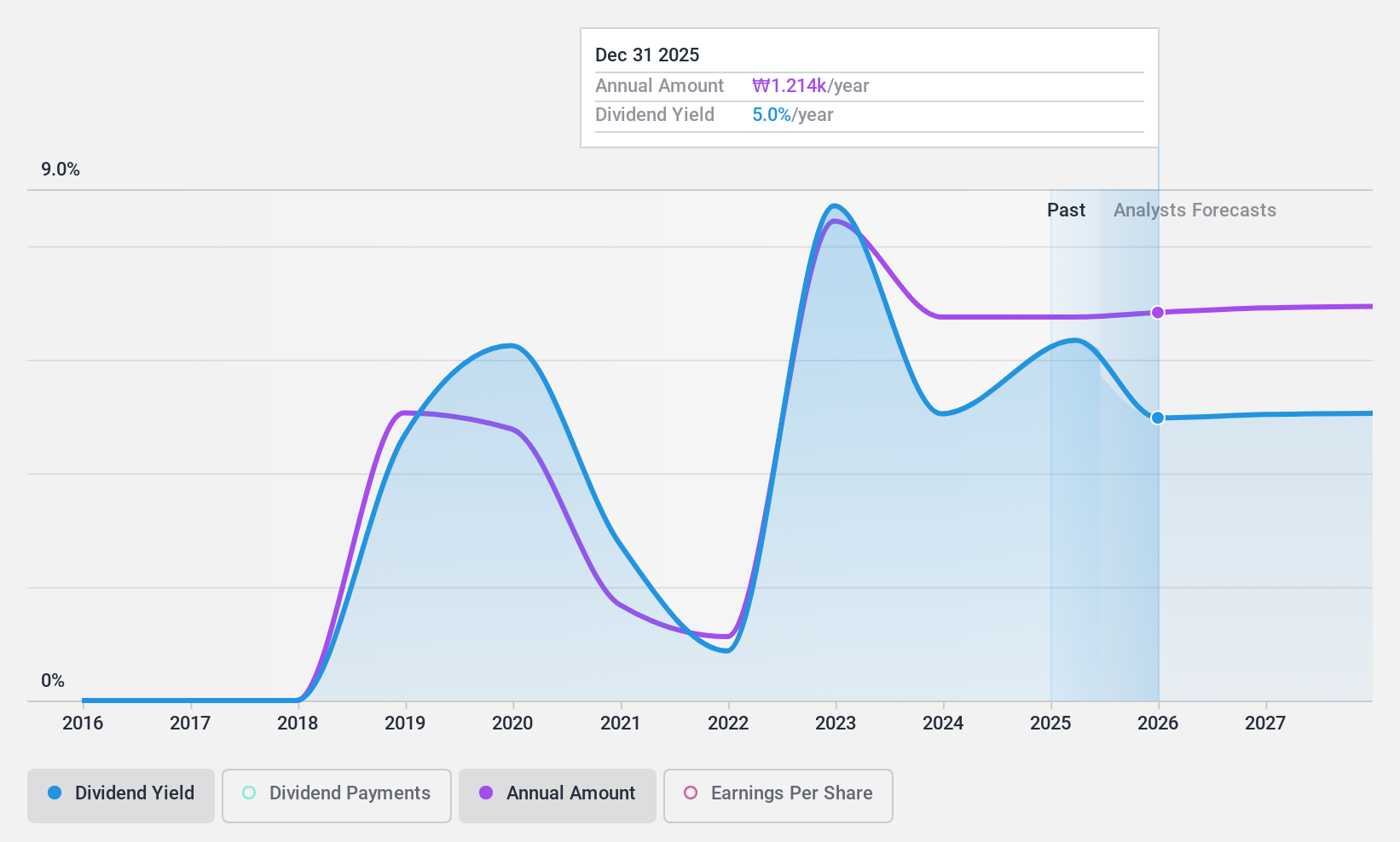

SeAH Besteel Holdings (KOSE:A001430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SeAH Besteel Holdings Corporation is involved in the manufacture and sale of special steel, heavy forgings, auto parts, and axles in South Korea with a market cap of ₩697.88 billion.

Operations: SeAH Besteel Holdings Corporation generates revenue primarily from its Special Steel segment, which accounts for ₩4.03 billion, and the Aluminum Extrusion Division, contributing ₩94.05 million.

Dividend Yield: 5.1%

SeAH Besteel Holdings offers a dividend yield in the top 25% of the KR market, supported by a payout ratio of 50.4% and a cash payout ratio of 22.9%, indicating dividends are well-covered by earnings and cash flow. However, its dividend history is relatively short at seven years, with volatility in payments suggesting an unstable track record. The stock trades below the KR market average P/E ratio, presenting potential value for investors seeking dividends despite its unreliable payment history.

- Navigate through the intricacies of SeAH Besteel Holdings with our comprehensive dividend report here.

- According our valuation report, there's an indication that SeAH Besteel Holdings' share price might be on the expensive side.

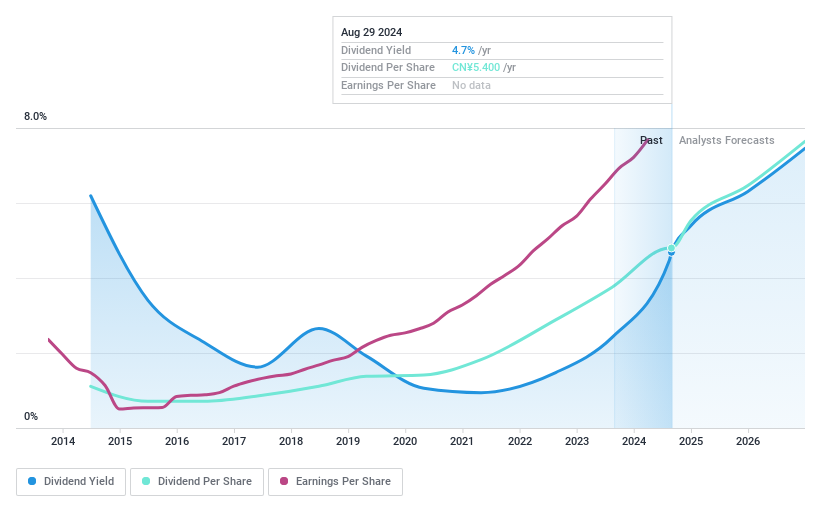

Luzhou LaojiaoLtd (SZSE:000568)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzhou Laojiao Co., Ltd is a Chinese company that produces liquor products, with a market cap of CN¥205.93 billion.

Operations: Luzhou Laojiao Co., Ltd's revenue segments are not provided in the text.

Dividend Yield: 3.5%

Luzhou Laojiao Ltd. provides a dividend yield in the top 25% of the CN market, with dividends covered by earnings and cash flows, indicated by payout ratios of 55.6% and 62%, respectively. Despite recent growth in dividend payments over the past decade, their history has been volatile. The stock trades significantly below its estimated fair value, offering potential appeal to investors focused on dividends despite an unstable track record in consistency.

- Get an in-depth perspective on Luzhou LaojiaoLtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Luzhou LaojiaoLtd is priced lower than what may be justified by its financials.

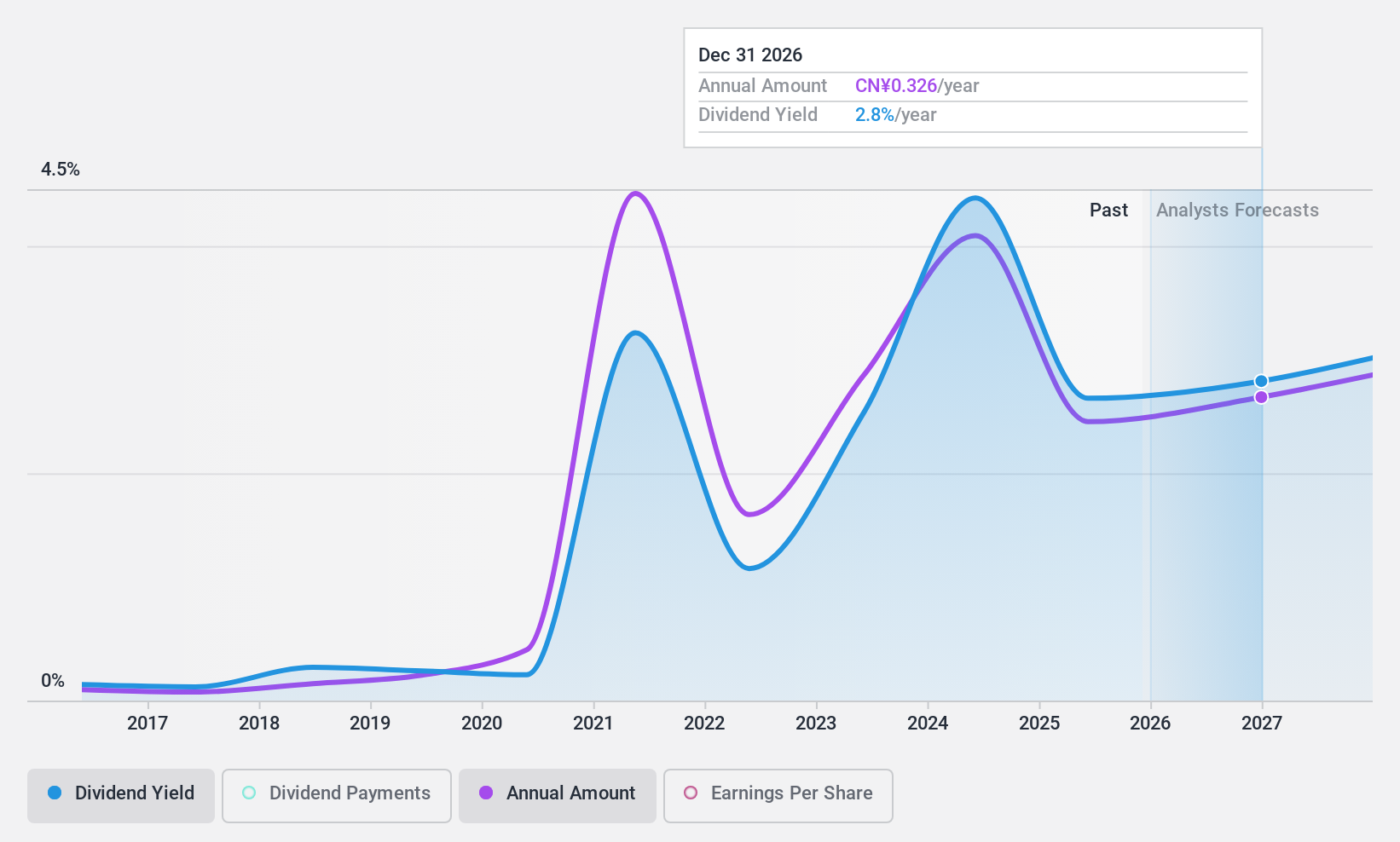

Sanquan Food (SZSE:002216)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanquan Food Co., Ltd. is a Chinese company that produces and sells frozen food products, with a market cap of CN¥9.85 billion.

Operations: Sanquan Food Co., Ltd.'s revenue primarily comes from the sale of quick-frozen food and room temperature food, totaling CN¥6.77 billion.

Dividend Yield: 4.1%

Sanquan Food offers a dividend yield in the top 25% of the CN market, supported by earnings and cash flows with payout ratios of 74.5% and 51.6%, respectively. However, its dividends have been volatile over the past decade, lacking stability despite some growth. The stock trades at a good value compared to peers and is significantly below its estimated fair value, though recent earnings showed declines in revenue and net income for the nine months ended September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Sanquan Food.

- Our expertly prepared valuation report Sanquan Food implies its share price may be lower than expected.

Summing It All Up

- Get an in-depth perspective on all 1933 Top Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001430

SeAH Besteel Holdings

Engages in the manufacture and sale of special steel, heavy forgings, auto parts, and axles in South Korea.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives