- South Korea

- /

- Metals and Mining

- /

- KOSE:A001080

Did Manho Rope & Wire's (KRX:001080) Share Price Deserve to Gain 20%?

Manho Rope & Wire Co., Ltd. (KRX:001080) shareholders might be concerned after seeing the share price drop 11% in the last month. Taking a longer term view we see the stock is up over one year. In that time, it is up 20%, which isn't bad, but is below the market return of 32%.

See our latest analysis for Manho Rope & Wire

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Manho Rope & Wire actually shrank its EPS by 53%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We doubt the modest 1.1% dividend yield is doing much to support the share price. Unfortunately Manho Rope & Wire's fell 6.0% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

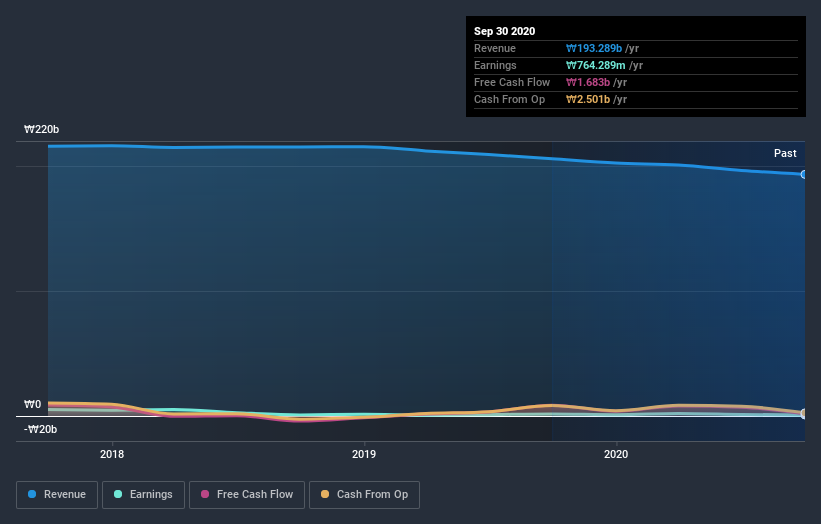

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Manho Rope & Wire stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Manho Rope & Wire provided a TSR of 21% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 2% over half a decade This suggests the company might be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Manho Rope & Wire you should be aware of, and 1 of them can't be ignored.

But note: Manho Rope & Wire may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Manho Rope & Wire or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A001080

Manho Rope & Wire

Engages in the manufacture and sale of ropes and steel wires in South Korea.

Low not a dividend payer.

Similar Companies

Market Insights

Community Narratives