- South Korea

- /

- Chemicals

- /

- KOSDAQ:A900310

How Much Did Coloray International Investment's(KOSDAQ:900310) Shareholders Earn From Share Price Movements Over The Last Three Years?

Coloray International Investment Co., Ltd. (KOSDAQ:900310) shareholders should be happy to see the share price up 17% in the last quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 40% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Coloray International Investment

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

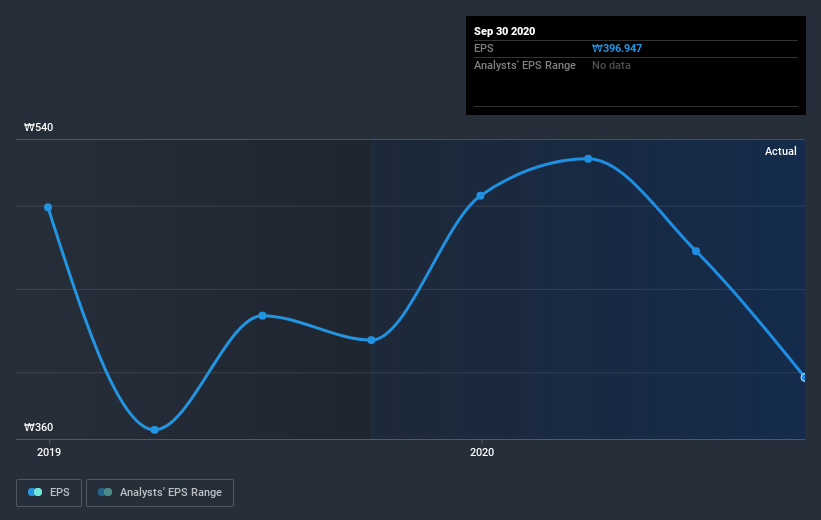

Coloray International Investment saw its EPS decline at a compound rate of 14% per year, over the last three years. This fall in EPS isn't far from the rate of share price decline, which was 16% per year. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Coloray International Investment's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Coloray International Investment produced a TSR of 2.9% over the last year. Unfortunately this falls short of the market return of around 43%. On the bright side, that's certainly better than the yearly loss of about 11% endured over the last three years, implying that the company is doing better recently. We hope the turnaround in fortunes continues. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Coloray International Investment (1 is potentially serious!) that you should be aware of before investing here.

But note: Coloray International Investment may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Coloray International Investment, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A900310

Coloray International Investment

Through its subsidiaries, manufactures, distributes, and sells pearl pigments and mica powder in China.

Excellent balance sheet moderate.

Market Insights

Community Narratives