- South Korea

- /

- Chemicals

- /

- KOSDAQ:A417010

NanoTIM Co. Ltd.'s (KOSDAQ:417010) CEO Yunsung Choi is the most upbeat insider, and their holdings increased by 11% last week

Key Insights

- Significant insider control over NanoTIM implies vested interests in company growth

- Yunsung Choi owns 52% of the company

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

To get a sense of who is truly in control of NanoTIM Co. Ltd. (KOSDAQ:417010), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are individual insiders with 54% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As a result, insiders were the biggest beneficiaries of last week’s 11% gain.

Let's take a closer look to see what the different types of shareholders can tell us about NanoTIM.

See our latest analysis for NanoTIM

What Does The Lack Of Institutional Ownership Tell Us About NanoTIM?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

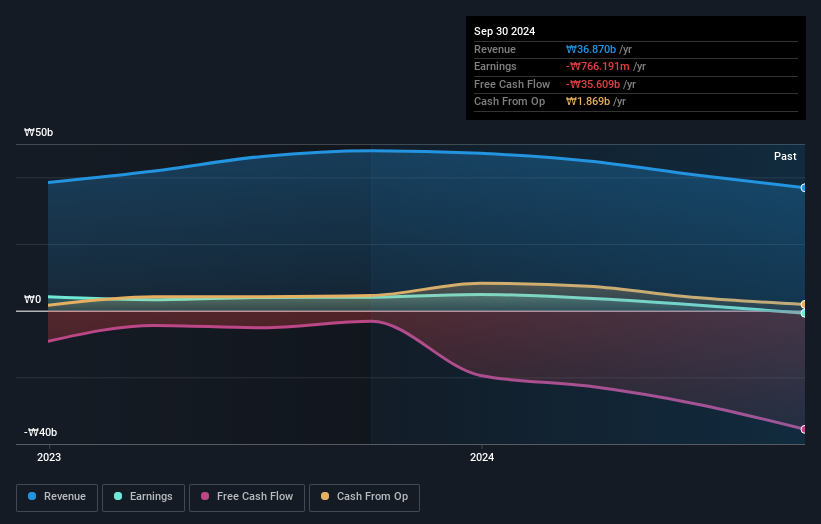

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. Alternatively, there might be something about the company that has kept institutional investors away. NanoTIM's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Hedge funds don't have many shares in NanoTIM. Looking at our data, we can see that the largest shareholder is the CEO Yunsung Choi with 52% of shares outstanding. With such a huge stake, we infer that they have significant control of the future of the company. It's usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider with such skin in the game. For context, the second largest shareholder holds about 5.5% of the shares outstanding, followed by an ownership of 1.2% by the third-largest shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. As far as we can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of NanoTIM

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders own more than half of NanoTIM Co. Ltd.. This gives them effective control of the company. Given it has a market cap of ₩155b, that means they have ₩84b worth of shares. Most would be pleased to see the board is investing alongside them. You may wish todiscover (for free) if they have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a 41% stake in NanoTIM. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

With an ownership of 5.5%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand NanoTIM better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with NanoTIM , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if NanoTIM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A417010

NanoTIM

Nanotim Co. Ltd provides thermal solutions using thermal interface materials in South Korea.

Slight and overvalued.

Market Insights

Community Narratives