Insider Favorites Three Growth Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are closely watching sectors that may benefit from potential deregulation and policy shifts. Amidst this backdrop, growth companies with high insider ownership stand out as intriguing options for those seeking alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. manufactures and sells electrolytes and additives for secondary batteries and EDLC, with a market cap of ₩2.93 trillion.

Operations: The company's revenue is derived from its Electronic Components & Parts segment, amounting to ₩339.69 billion.

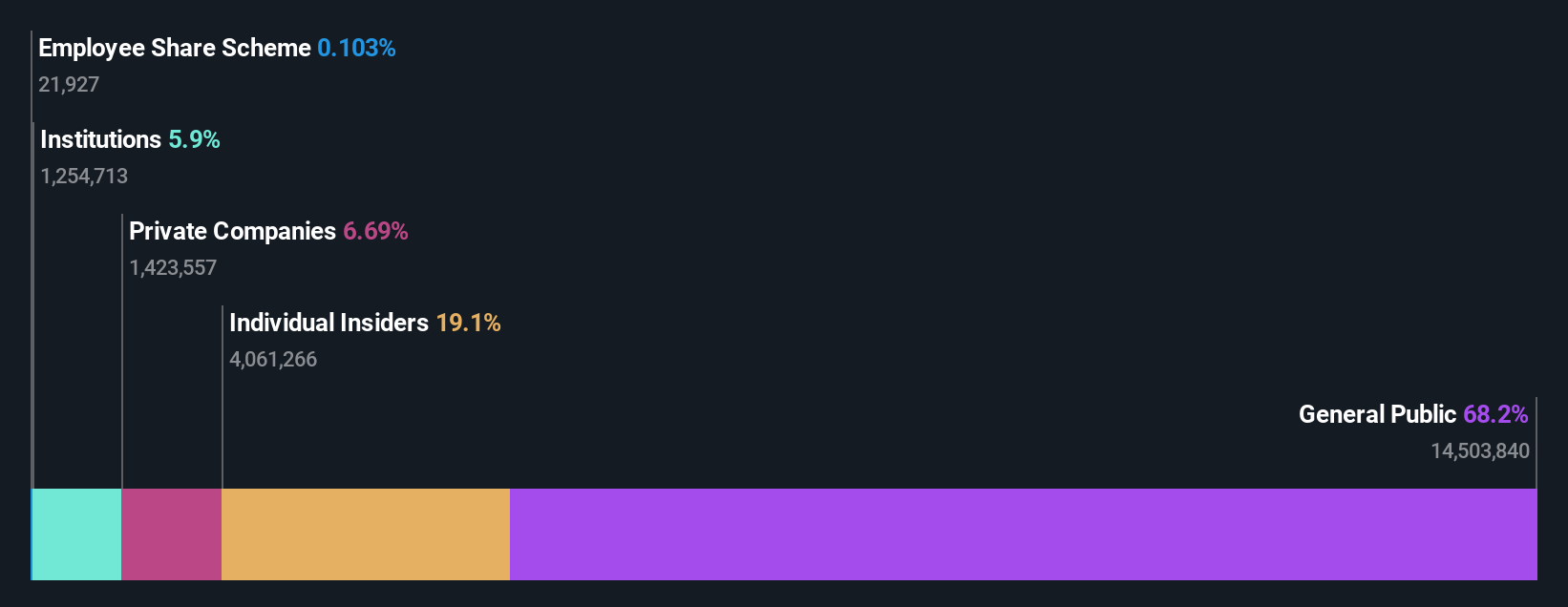

Insider Ownership: 19.4%

Enchem's revenue is expected to grow significantly at 68% annually, surpassing the Korean market average of 9.5%. The company is forecasted to become profitable within three years, indicating strong growth potential. However, its share price has been highly volatile recently and shareholders have experienced dilution over the past year. Despite these challenges, Enchem's substantial growth forecasts position it as a compelling subject for those interested in high insider ownership dynamics.

- Click here to discover the nuances of Enchem with our detailed analytical future growth report.

- The analysis detailed in our Enchem valuation report hints at an inflated share price compared to its estimated value.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

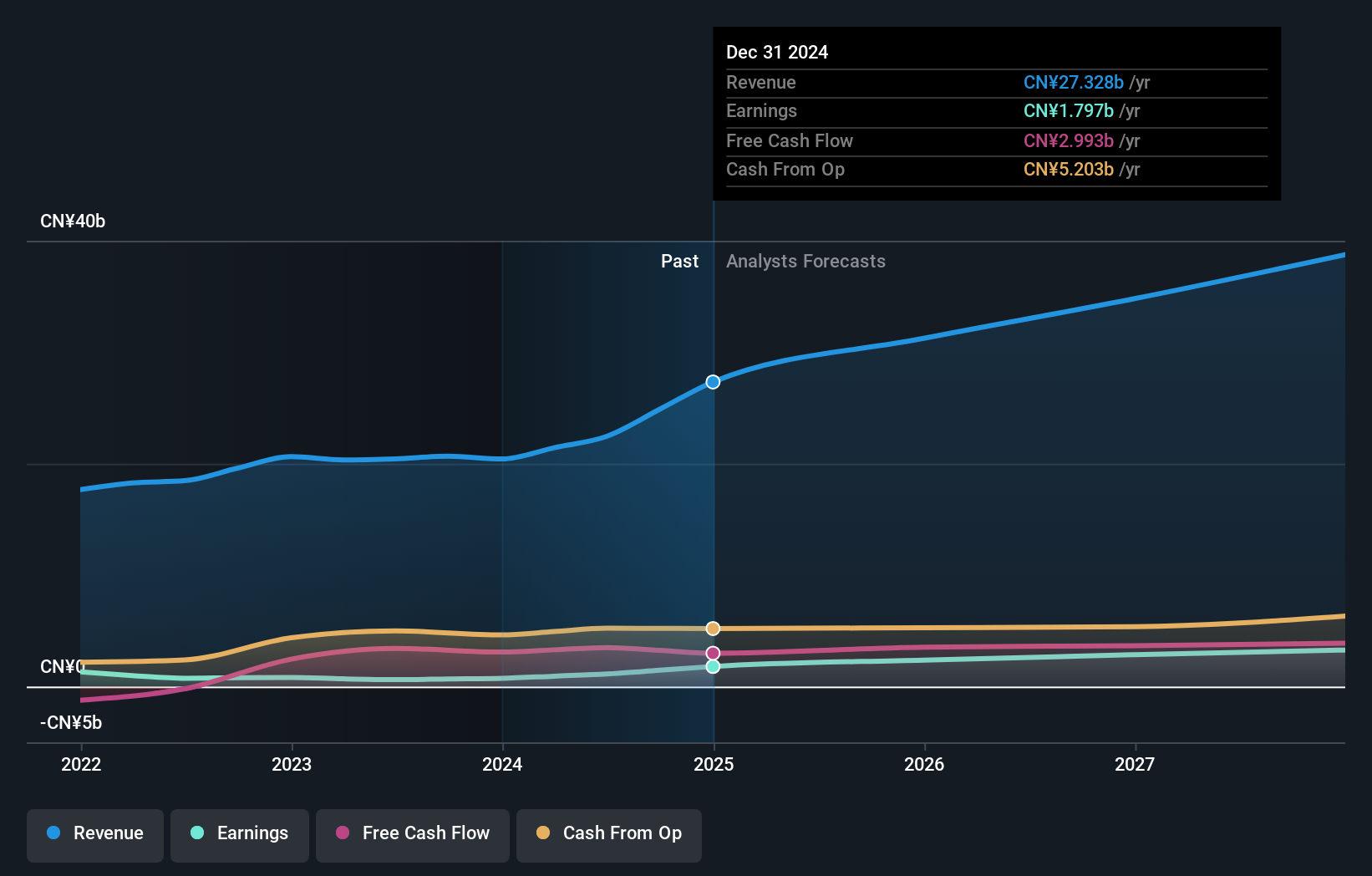

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across multiple regions including Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe with a market cap of HK$35.96 billion.

Operations: The company's revenue is primarily derived from its Optics Products (CN¥4.07 billion), Acoustics Products (CN¥7.64 billion), Sensor and Semiconductor Products (CN¥920.28 million), and Electromagnetic Drives and Precision Mechanics (CN¥8.28 billion) segments.

Insider Ownership: 36.7%

AAC Technologies Holdings has shown strong growth, with earnings rising by 81.3% over the past year and sales reaching CNY 11.25 billion for the first half of 2024. Earnings are projected to grow at an annual rate of 21.74%, outpacing the Hong Kong market average of 11.6%. Despite trading slightly below its estimated fair value, its return on equity is expected to remain low at 9.7%. The company recently changed its principal business address in Hong Kong.

- Delve into the full analysis future growth report here for a deeper understanding of AAC Technologies Holdings.

- Our valuation report here indicates AAC Technologies Holdings may be overvalued.

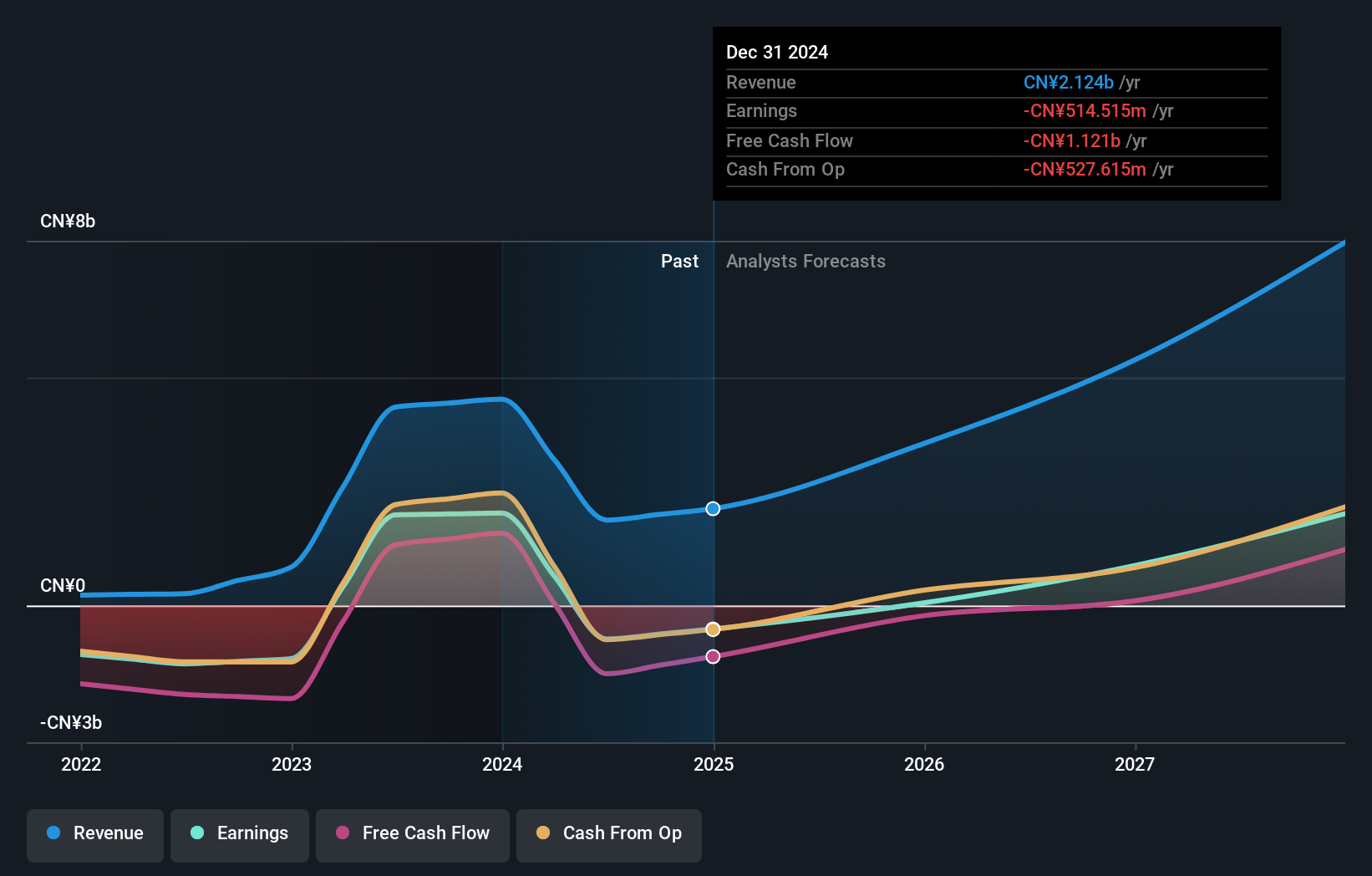

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on researching, developing, manufacturing, and commercializing antibody drugs with a market cap of HK$57.53 billion.

Operations: The company's revenue is primarily derived from the research, development, production, and sale of biopharmaceutical products, totaling CN¥1.87 billion.

Insider Ownership: 19.8%

Akeso is positioned for significant growth, with revenue expected to increase by 33.4% annually, outpacing the Hong Kong market. Despite recent shareholder dilution and a net loss of CNY 238.59 million in H1 2024, Akeso's innovative pipeline of bispecific antibodies, including AK132 and cadonilimab, shows promising clinical results in cancer immunotherapy. Trading at 45.9% below its estimated fair value suggests potential undervaluation amidst its strategic advancements in oncology treatments and global market expansion efforts.

- Click here and access our complete growth analysis report to understand the dynamics of Akeso.

- Our expertly prepared valuation report Akeso implies its share price may be too high.

Make It Happen

- Click this link to deep-dive into the 1540 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives