- South Korea

- /

- Chemicals

- /

- KOSDAQ:A318160

Is Now The Time To Put Cell Bio Human TechLtd (KOSDAQ:318160) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Cell Bio Human TechLtd (KOSDAQ:318160), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Cell Bio Human TechLtd Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Cell Bio Human TechLtd's EPS has grown 36% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Cell Bio Human TechLtd is growing revenues, and EBIT margins improved by 6.8 percentage points to 19%, over the last year. Both of which are great metrics to check off for potential growth.

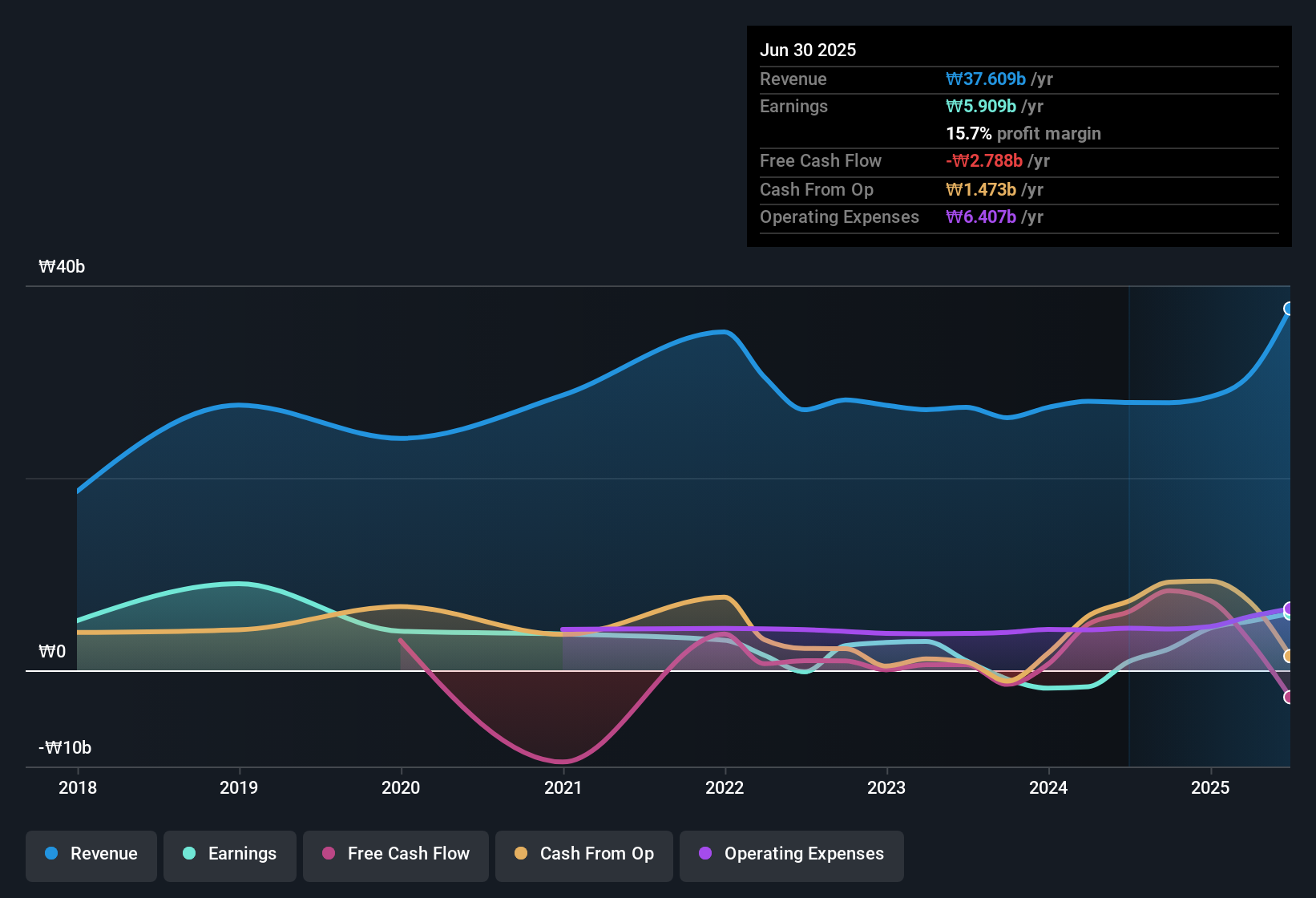

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

See our latest analysis for Cell Bio Human TechLtd

Since Cell Bio Human TechLtd is no giant, with a market capitalisation of ₩86b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Cell Bio Human TechLtd Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Cell Bio Human TechLtd will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 41% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have ₩35b invested in the business, at the current share price. So there's plenty there to keep them focused!

Should You Add Cell Bio Human TechLtd To Your Watchlist?

You can't deny that Cell Bio Human TechLtd has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. It is worth noting though that we have found 3 warning signs for Cell Bio Human TechLtd (1 makes us a bit uncomfortable!) that you need to take into consideration.

Although Cell Bio Human TechLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of South Korean companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A318160

Cell Bio Human TechLtd

Develops and manufactures cellulose mask pack material by using cellulose reaction technology.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives