- South Korea

- /

- Chemicals

- /

- KOSDAQ:A318160

Cell Bio Human Tech Co.,Ltd (KOSDAQ:318160) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

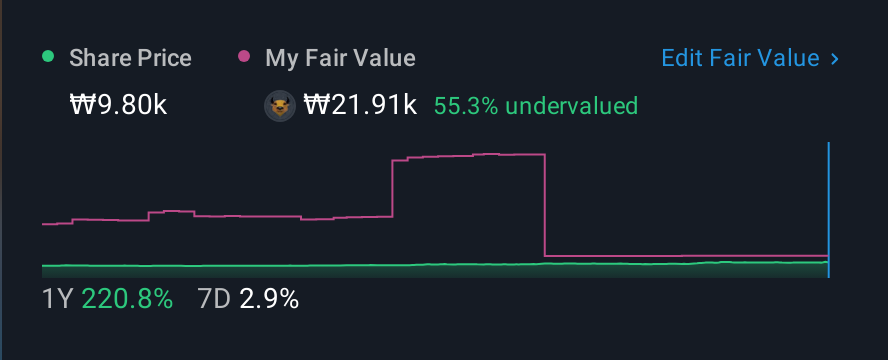

Cell Bio Human Tech Co.,Ltd (KOSDAQ:318160) shares have continued their recent momentum with a 30% gain in the last month alone. The annual gain comes to 159% following the latest surge, making investors sit up and take notice.

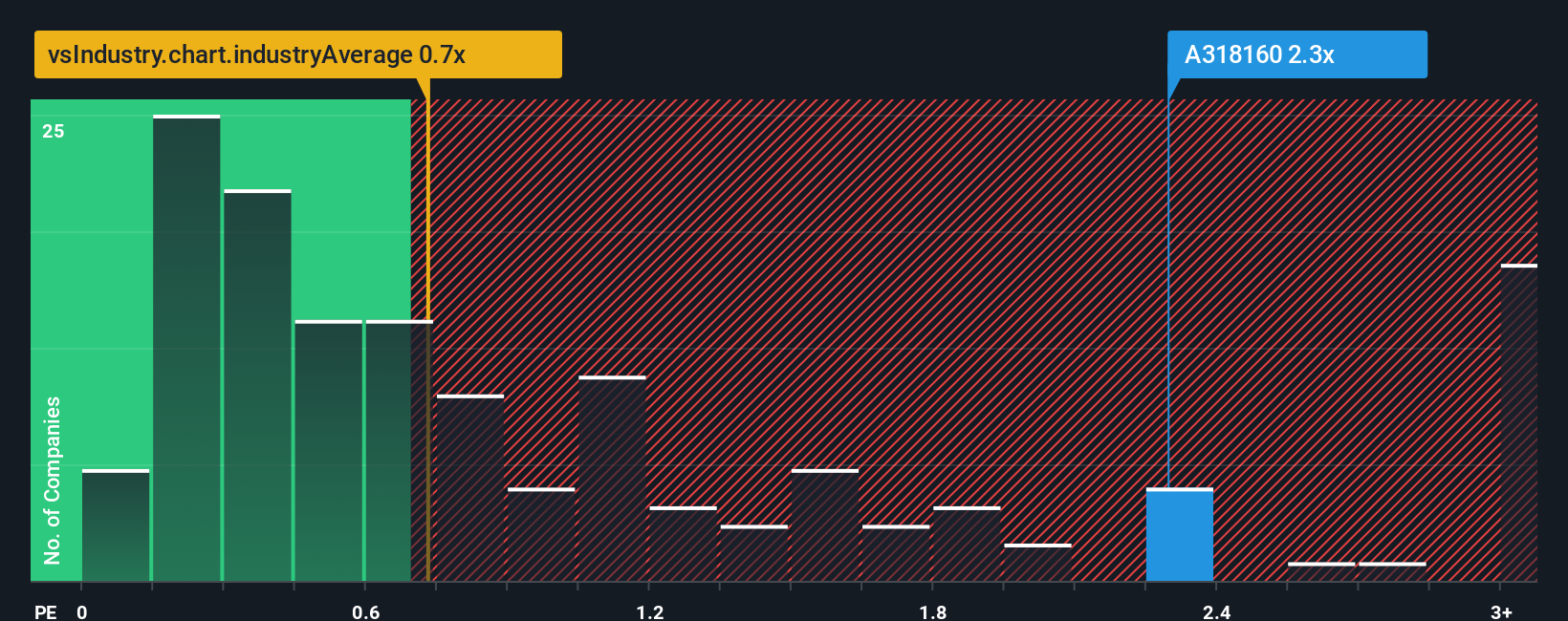

Since its price has surged higher, when almost half of the companies in Korea's Chemicals industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Cell Bio Human TechLtd as a stock probably not worth researching with its 2.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Cell Bio Human TechLtd

How Has Cell Bio Human TechLtd Performed Recently?

The revenue growth achieved at Cell Bio Human TechLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cell Bio Human TechLtd will help you shine a light on its historical performance.How Is Cell Bio Human TechLtd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Cell Bio Human TechLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 9.9%. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 7.7% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Cell Bio Human TechLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Cell Bio Human TechLtd's P/S?

Cell Bio Human TechLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Cell Bio Human TechLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Cell Bio Human TechLtd (of which 1 is concerning!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A318160

Cell Bio Human TechLtd

Develops and manufactures cellulose mask pack material by using cellulose reaction technology.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives