- South Korea

- /

- Chemicals

- /

- KOSDAQ:A278280

After Leaping 30% Chunbo Co., Ltd. (KOSDAQ:278280) Shares Are Not Flying Under The Radar

Chunbo Co., Ltd. (KOSDAQ:278280) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

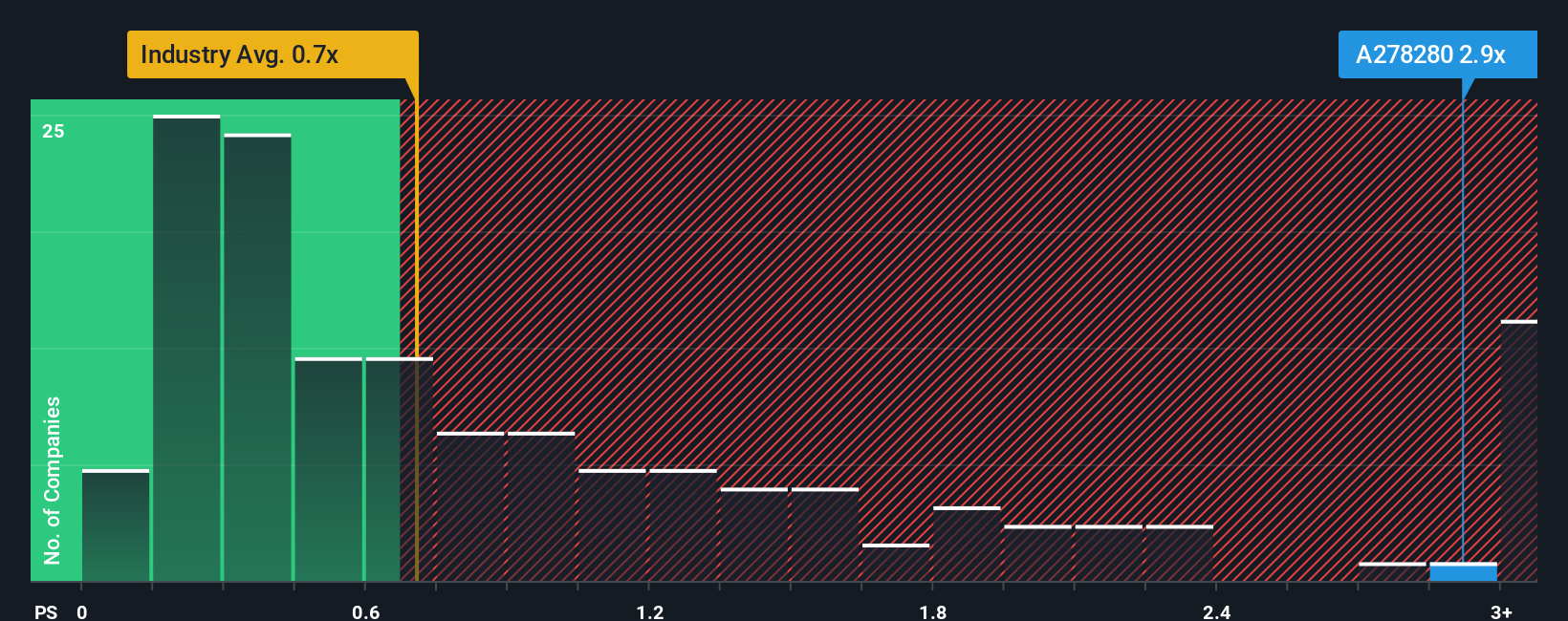

Since its price has surged higher, given around half the companies in Korea's Chemicals industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Chunbo as a stock to avoid entirely with its 2.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Chunbo

How Has Chunbo Performed Recently?

While the industry has experienced revenue growth lately, Chunbo's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Chunbo will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Chunbo would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 56% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 37% as estimated by the six analysts watching the company. With the industry only predicted to deliver 9.3%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Chunbo's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Chunbo's P/S Mean For Investors?

The strong share price surge has lead to Chunbo's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Chunbo shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Chunbo, and understanding these should be part of your investment process.

If you're unsure about the strength of Chunbo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A278280

Chunbo

Operates in the fine chemical materials industry in South Korea and internationally.

Low risk with limited growth.

Market Insights

Community Narratives