- South Korea

- /

- Chemicals

- /

- KOSDAQ:A007770

Are Dividend Investors Making A Mistake With Hanil Chemical Ind. Co., Ltd. (KOSDAQ:007770)?

Dividend paying stocks like Hanil Chemical Ind. Co., Ltd. (KOSDAQ:007770) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

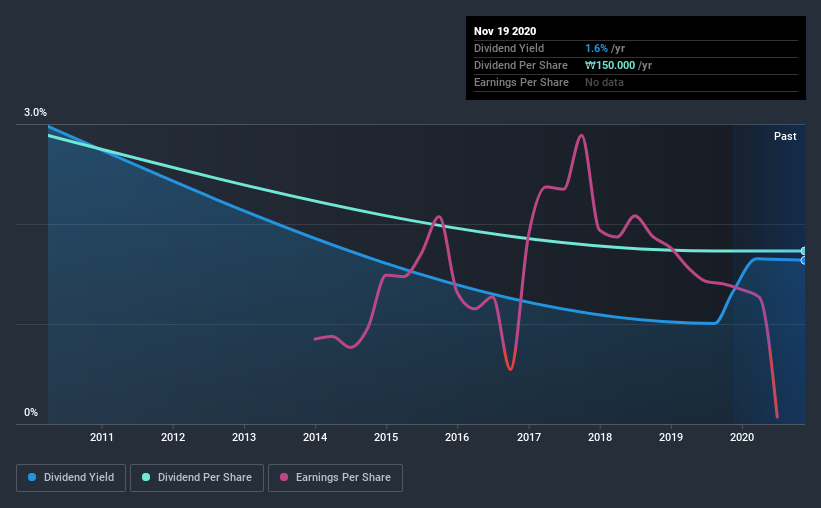

While Hanil Chemical Ind's 1.6% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Some simple analysis can reduce the risk of holding Hanil Chemical Ind for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Although Hanil Chemical Ind pays a dividend, it was loss-making during the past year. When a company recently reported a loss, we should investigate if its cash flows covered the dividend.

Last year, Hanil Chemical Ind paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

Consider getting our latest analysis on Hanil Chemical Ind's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Hanil Chemical Ind has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. While its dividends have not been hugely volatile, its most recent dividend is still meaningfully below where it was 10 years ago. During the past 10-year period, the first annual payment was ₩250 in 2010, compared to ₩150 last year. This works out to be a decline of approximately 5.0% per year over that time.

A shrinking dividend over a 10-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Hanil Chemical Ind's earnings per share have shrunk at 10% a year over the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Hanil Chemical Ind's earnings per share, which support the dividend, have been anything but stable.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Hanil Chemical Ind's dividend is not well covered by free cash flow, plus it paid a dividend while being unprofitable. Moreover, earnings have been shrinking. While the dividends have been fairly steady, we'd wonder for how much longer this will be sustainable if earnings continue to decline. There are a few too many issues for us to get comfortable with Hanil Chemical Ind from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 3 warning signs for Hanil Chemical Ind (1 makes us a bit uncomfortable!) that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading Hanil Chemical Ind or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanil Chemical Ind might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A007770

Hanil Chemical Ind

Manufactures and sells zinc oxide and other chemical materials in South Korea and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives