- South Korea

- /

- Chemicals

- /

- KOSDAQ:A005290

Discover These 3 Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts from the ECB and SNB, alongside expectations for a Federal Reserve cut, small-cap stocks have faced challenges with the Russell 2000 Index underperforming against larger peers. Amidst this backdrop of shifting economic indicators and market sentiment, discovering lesser-known stocks with strong fundamentals can be an effective strategy to enhance portfolio diversification.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nippon Denko | 20.08% | 5.07% | 47.43% | ★★★★★★ |

| Lelon Electronics | 20.09% | 6.53% | 15.44% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| AzureWave Technologies | NA | 3.00% | 29.49% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Dongjin Semichem (KOSDAQ:A005290)

Simply Wall St Value Rating: ★★★★★★

Overview: Dongjin Semichem Co., Ltd. is a company that focuses on manufacturing and supplying electronic materials and foaming agents, with a market capitalization of ₩1.11 trillion.

Operations: Dongjin Semichem generates revenue primarily from its electronic materials segment, with ₩949.60 billion in South Korea and ₩478.00 billion overseas, alongside its foaming agents segment, which includes ₩93.80 billion in South Korea and ₩18.48 billion overseas. The company incurs intercompany transaction adjustments amounting to -₩187.69 billion.

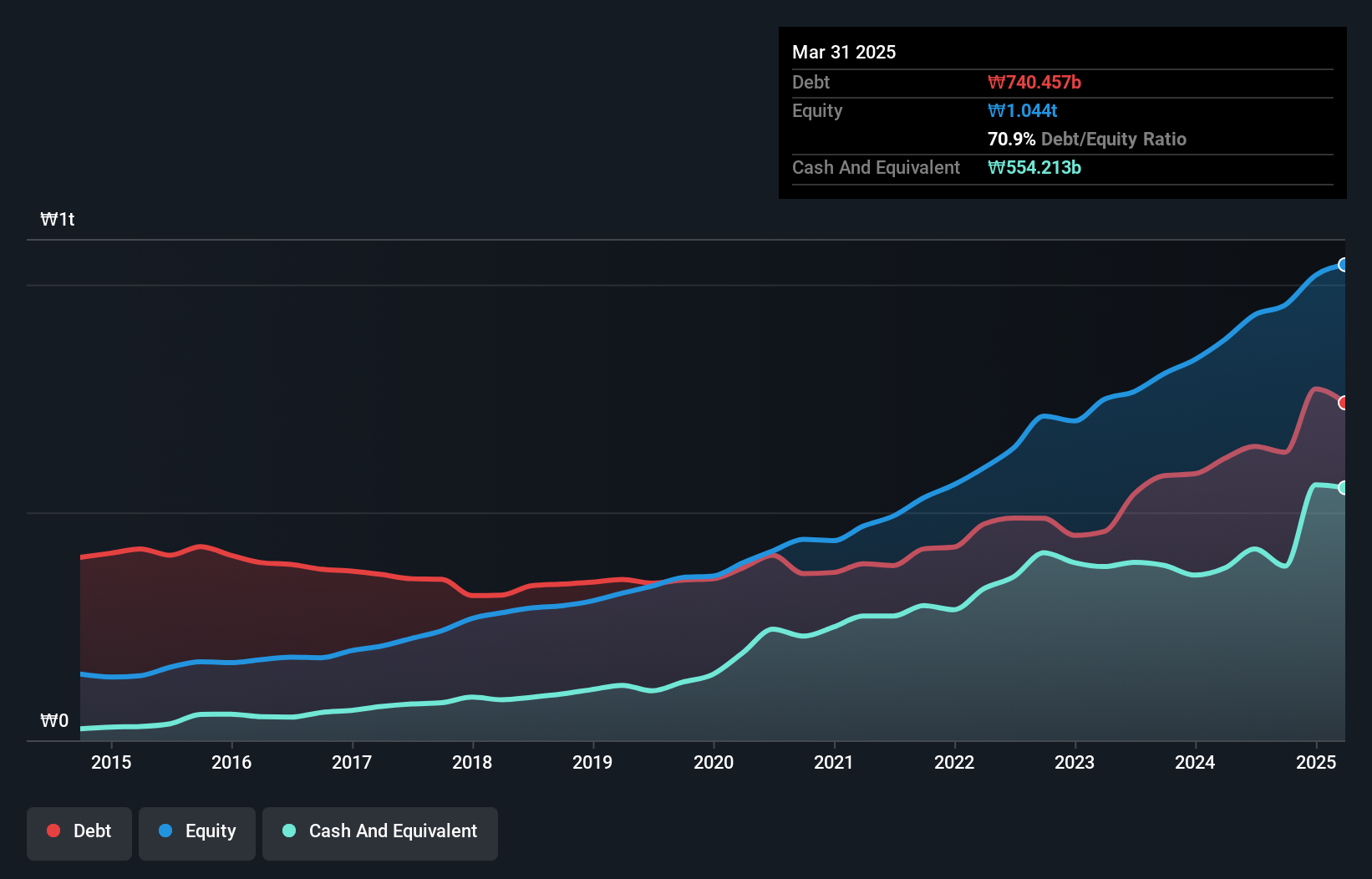

Dongjin Semichem, a notable player in the chemicals sector, is trading at 71% below its estimated fair value, suggesting potential undervaluation. Over the past five years, earnings have grown at an impressive 17.1% annually, although recent growth of 9.5% lagged behind the industry average of 21%. The company's financial health appears solid with a net debt to equity ratio of 26.2%, deemed satisfactory by industry standards. Interest payments are well covered with EBIT covering them 11.6 times over, indicating robust profitability and efficient debt management practices that may appeal to investors seeking undervalued opportunities in this space.

Dalian Dalicap TechnologyLtd (SZSE:301566)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dalian Dalicap Technology Co., Ltd. specializes in the research, development, manufacture, and sale of RF microwave ceramic capacitors both in China and internationally, with a market cap of CN¥8.05 billion.

Operations: Dalian Dalicap Technology Co., Ltd. generates revenue primarily from the sale of RF microwave ceramic capacitors. The company's financial performance is influenced by its cost structure, which includes manufacturing and development expenses.

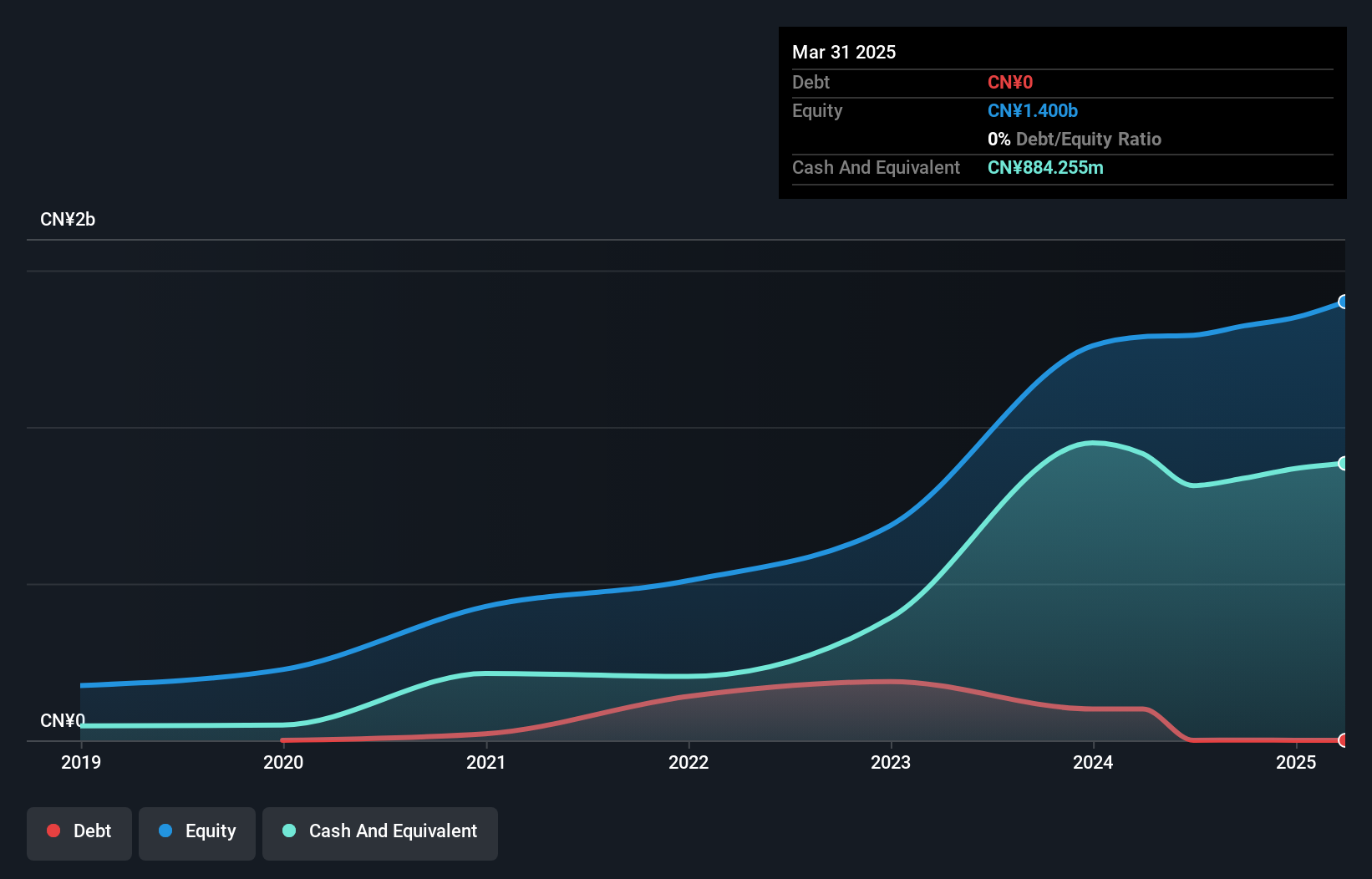

Dalian Dalicap Technology, a notable player in the electronics sector, has shown resilience with earnings growth of 3.3% over the past year, outpacing the industry's 1.9%. The company's debt to equity ratio rose from 0% to 0.07% in five years, indicating an increase but still manageable levels. Recently reported sales for nine months ending September were CNY 251 million compared to CNY 273 million last year, with net income at CNY 88 million versus CNY 99 million previously. Despite these figures showing some contraction, its high-quality earnings and positive free cash flow suggest solid operational footing moving forward.

- Click to explore a detailed breakdown of our findings in Dalian Dalicap TechnologyLtd's health report.

Learn about Dalian Dalicap TechnologyLtd's historical performance.

Micronics Japan (TSE:6871)

Simply Wall St Value Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. is engaged in the development, manufacturing, and sales of testing and measurement equipment for semiconductors and LCD testing systems globally, with a market capitalization of ¥146.26 billion.

Operations: Micronics Japan generates revenue primarily from its Probe Card Business, which accounts for ¥49.56 billion, while the TE Business contributes ¥2.19 billion.

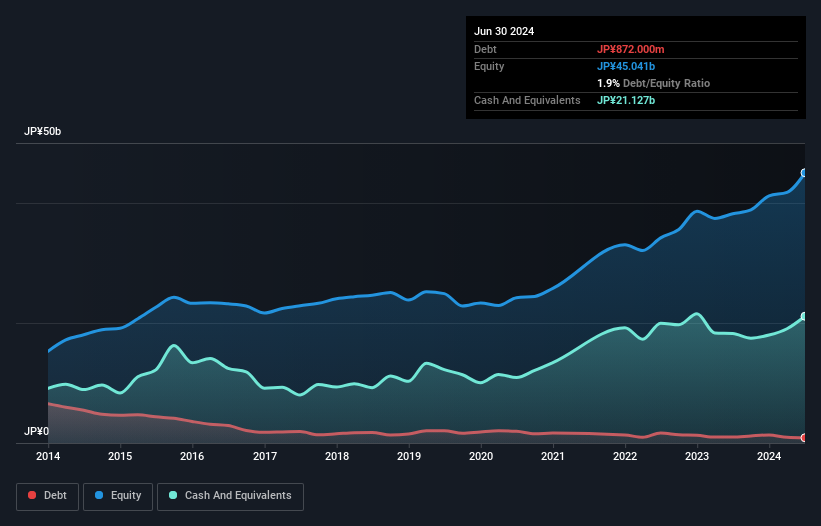

Micronics Japan, a promising player in the semiconductor space, has seen its earnings surge by 68.9% over the past year, significantly outpacing the industry's 6.7%. This growth positions it well below its estimated fair value by 57.3%, suggesting potential undervaluation. The company's debt-to-equity ratio has impressively decreased from 7.1 to 2.5 over five years, indicating prudent financial management and reduced leverage risk. Despite recent share price volatility, Micronics Japan's high-quality earnings and positive free cash flow underscore its robust financial health and potential for continued growth in this dynamic sector.

Next Steps

- Discover the full array of 4626 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A005290

Dongjin Semichem

Manufactures and supplies electronic materials and foaming agents.

Flawless balance sheet and good value.

Market Insights

Community Narratives