As global markets navigate a complex landscape marked by resilient labor markets and inflation concerns, investors are increasingly focused on strategies that offer stability and income. In this environment, dividend stocks can provide a reliable income stream, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.31% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.17% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

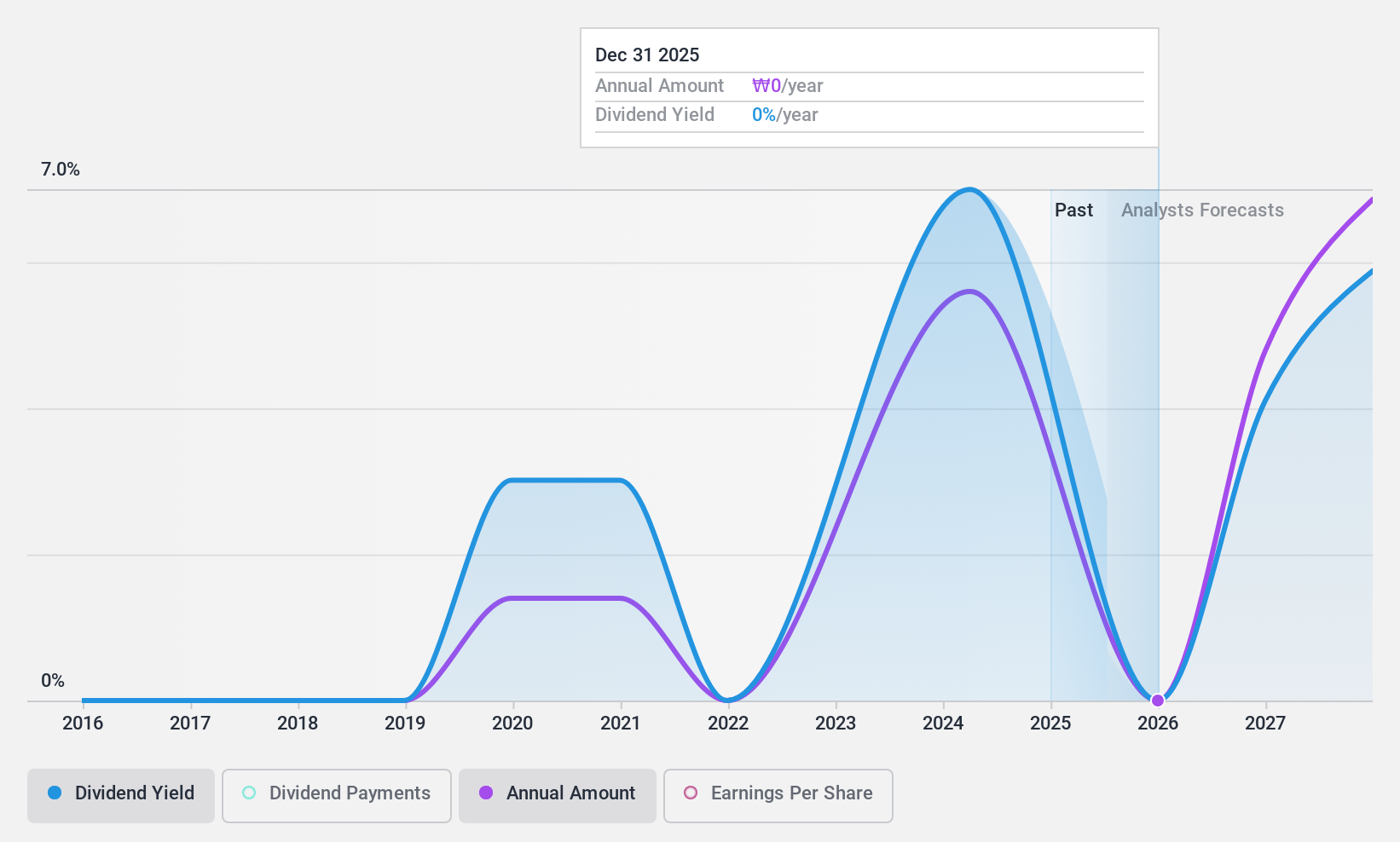

Tong Yang Life Insurance (KOSE:A082640)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Life Insurance Co., Ltd. operates in the life insurance sector in South Korea with a market capitalization of approximately ₩725.93 billion.

Operations: Tong Yang Life Insurance Co., Ltd. generates revenue primarily from its life and health insurance segment, totaling approximately ₩3.06 billion.

Dividend Yield: 8.6%

Tong Yang Life Insurance offers a compelling dividend yield of 8.59%, ranking in the top 25% within the KR market. Despite being a relatively new dividend payer with only five years of history, its dividends are well-covered by earnings (18.9% payout ratio) and cash flows (9.6% cash payout ratio). The company's recent earnings surge—net income for Q3 2024 at KRW 89,259.49 million—supports its sustainable dividend strategy amidst good relative value compared to peers.

- Dive into the specifics of Tong Yang Life Insurance here with our thorough dividend report.

- The valuation report we've compiled suggests that Tong Yang Life Insurance's current price could be quite moderate.

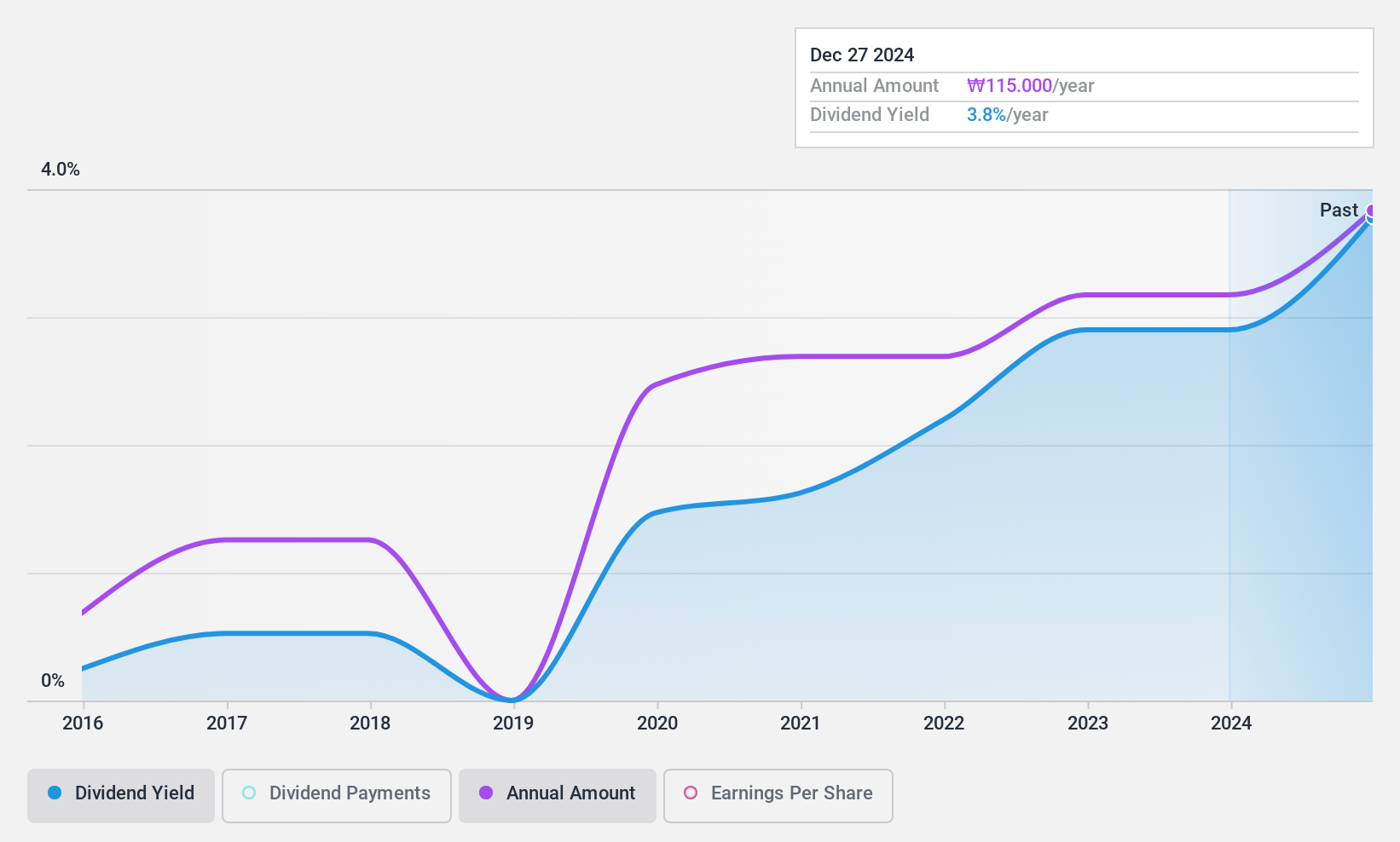

JW Holdings (KOSE:A096760)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JW Holdings Corporation, with a market cap of ₩220.54 billion, operates as a healthcare company alongside its subsidiaries in South Korea, the United States, Japan, China, and other international markets.

Operations: JW Holdings Corporation generates revenue primarily from Medicines (₩1.11 billion), with additional contributions from its Holding Business (₩53.86 million) and Medical Equipment (₩21.57 million) segments.

Dividend Yield: 3.8%

JW Holdings maintains a reliable dividend, growing steadily over the past decade with minimal volatility. Its payout ratio of 10.8% and cash payout ratio of 6.6% indicate strong coverage by earnings and cash flows, despite being below the top tier in yield at 3.76%. Recent buyback initiatives aim to enhance shareholder value amidst robust earnings growth—409.8% increase year-over-year—though high debt levels might pose financial risks moving forward.

- Take a closer look at JW Holdings' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that JW Holdings is trading behind its estimated value.

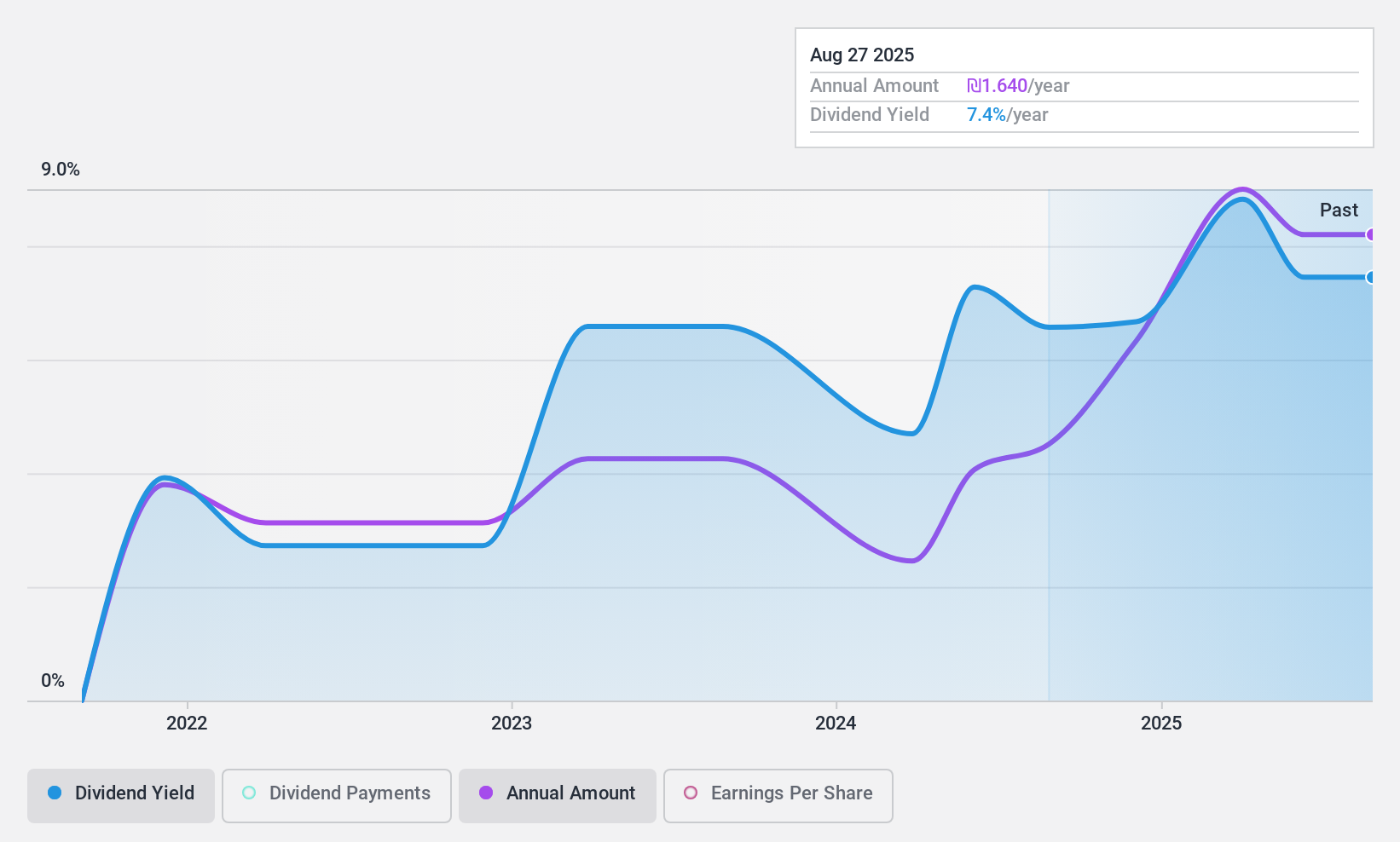

ETGA Group (TASE:ETGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ETGA Group Ltd operates in logistics and financing activities within Israel, with a market capitalization of ₪424.42 million.

Operations: ETGA Group Ltd generates revenue from its logistics segment, amounting to ₪416.61 million, and non-bank financing activities, contributing ₪40.69 million.

Dividend Yield: 6.6%

ETGA Group's dividend yield is competitive in the IL market, but its payments have been volatile over the past three years. Despite a high payout ratio of 89.9%, dividends are covered by earnings and cash flows, with a cash payout ratio of 38.2%. Recent earnings growth supports potential sustainability; third-quarter revenue rose to ILS 183.9 million from ILS 85.03 million year-over-year, though high debt levels could challenge financial stability long-term.

- Navigate through the intricacies of ETGA Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that ETGA Group's share price might be on the cheaper side.

Turning Ideas Into Actions

- Reveal the 2007 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ETGA Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ETGA

Good value with proven track record and pays a dividend.