- South Korea

- /

- Insurance

- /

- KOSE:A003690

3 KRX Dividend Stocks Offering At Least 5.3% Yield

Reviewed by Simply Wall St

The South Korean stock market has recently experienced a downturn, with the KOSPI index declining over several sessions amid global economic uncertainties and fluctuating oil prices. In such volatile times, dividend stocks offering attractive yields can provide investors with a measure of stability and income, making them an appealing choice for those looking to navigate the current market landscape.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.71% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.56% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 3.83% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.45% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.24% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.90% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.44% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.78% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.11% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.83% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top KRX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

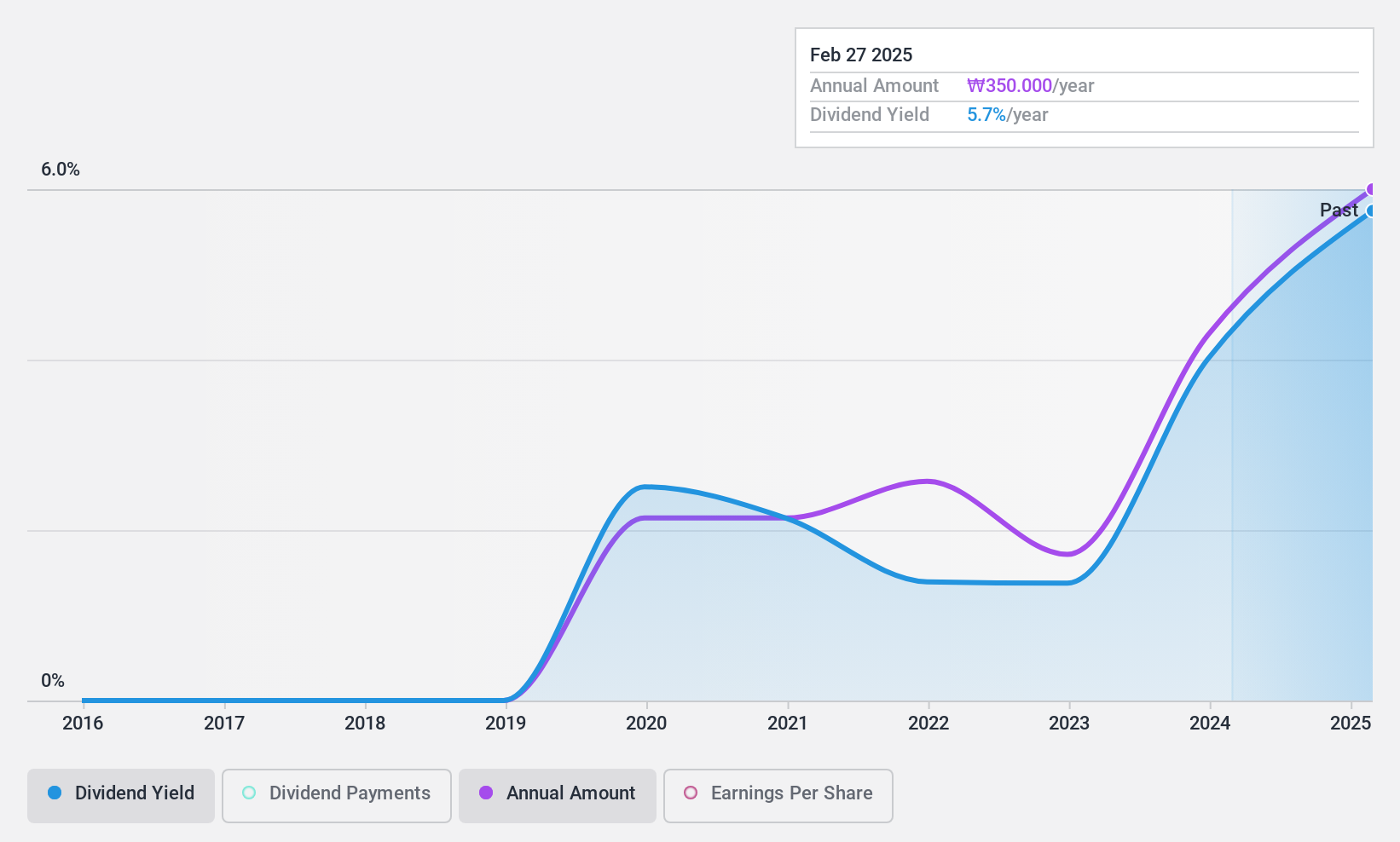

Samhwa Paints Industrial (KOSE:A000390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samhwa Paints Industrial Co., Ltd. manufactures and sells a range of paints both in South Korea and internationally, with a market cap of ₩167.73 billion.

Operations: Samhwa Paints Industrial Co., Ltd.'s revenue primarily comes from its Paints and Chemicals segment, which generated ₩657.78 billion.

Dividend Yield: 5.6%

Samhwa Paints Industrial's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 47.5% and 29.9%, respectively. Despite a top-tier dividend yield of 5.63% in the South Korean market, the company has an unstable track record with volatile dividends over its five-year history of payments. Its price-to-earnings ratio at 8.4x suggests good value compared to the broader KR market average of 11.5x.

- Take a closer look at Samhwa Paints Industrial's potential here in our dividend report.

- According our valuation report, there's an indication that Samhwa Paints Industrial's share price might be on the expensive side.

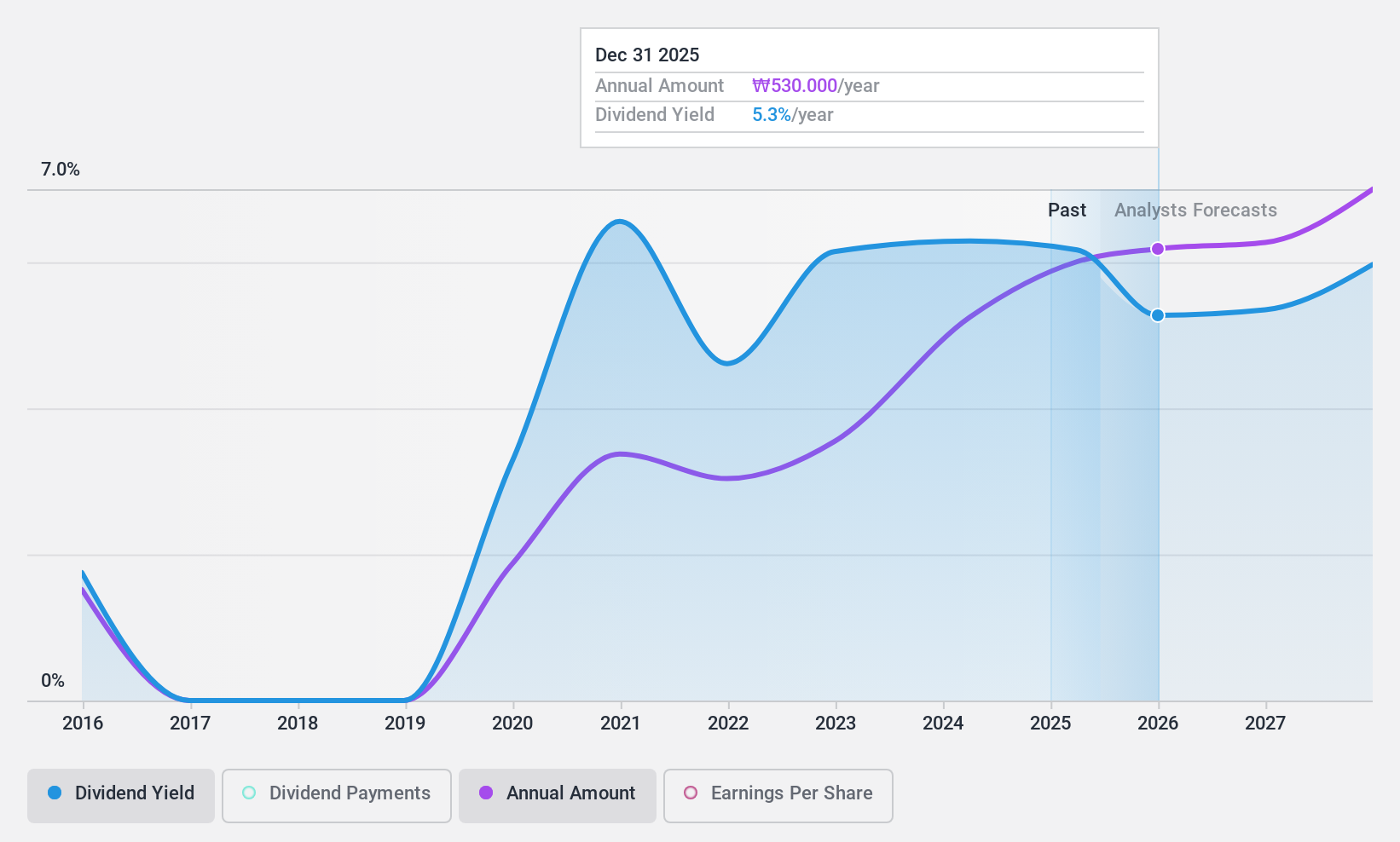

Korean Reinsurance (KOSE:A003690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korean Reinsurance Company offers life and non-life reinsurance products both in Korea and internationally, with a market cap of ₩1.24 trillion.

Operations: Korean Reinsurance Company's revenue primarily comes from its reinsurance segment, amounting to approximately ₩4.26 trillion.

Dividend Yield: 6.4%

Korean Reinsurance offers a compelling dividend yield of 6.39%, ranking in the top 25% of South Korean dividend payers, though its payment history is under a decade. The company's dividends are well-covered by earnings and cash flow, with payout ratios at 47.3% and 6.5%, respectively. Recent financial results show decreased profitability, impacting stability perceptions despite solid coverage metrics and significant undervaluation at current trading levels relative to fair value estimates.

- Get an in-depth perspective on Korean Reinsurance's performance by reading our dividend report here.

- The analysis detailed in our Korean Reinsurance valuation report hints at an deflated share price compared to its estimated value.

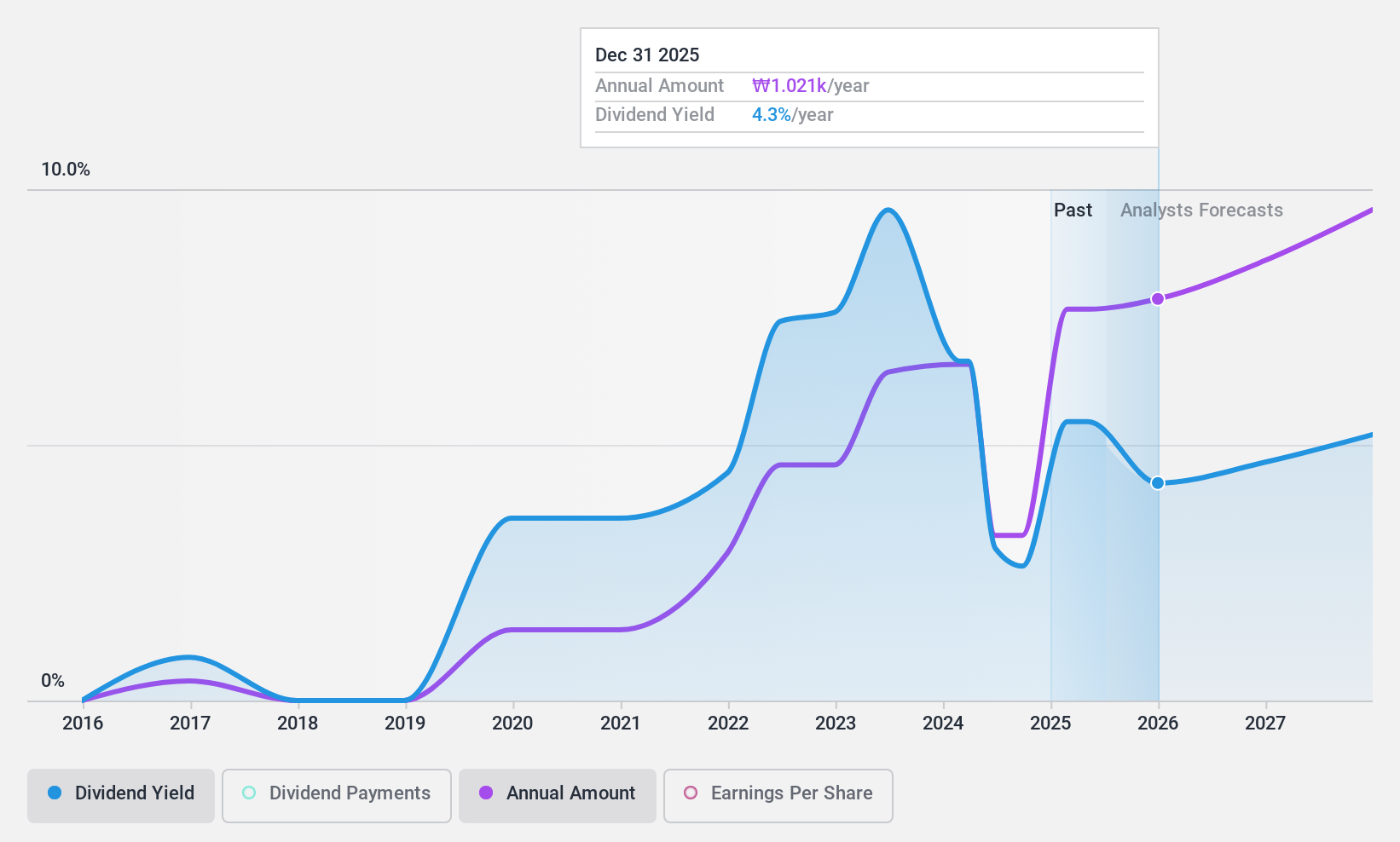

JB Financial Group (KOSE:A175330)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Financial Group Co., Ltd. operates through its subsidiaries to offer banking products and services both in South Korea and internationally, with a market cap of ₩3.05 trillion.

Operations: JB Financial Group Co., Ltd. generates revenue primarily from its Banking Sector with ₩1.18 trillion, followed by the Capital Segment at ₩375.05 billion, and the Asset Management Division contributing ₩20.19 billion.

Dividend Yield: 5.4%

JB Financial Group's dividend yield is among the top 25% in South Korea, supported by a low payout ratio of 27.1%, ensuring coverage by earnings. Despite a relatively short nine-year dividend history, payments have been stable and growing without significant volatility. The company trades significantly below its estimated fair value, suggesting potential undervaluation. Recent share buyback plans aim to enhance shareholder value, potentially benefiting dividend investors further through reduced share count and increased per-share metrics.

- Click here to discover the nuances of JB Financial Group with our detailed analytical dividend report.

- Our valuation report here indicates JB Financial Group may be undervalued.

Make It Happen

- Take a closer look at our Top KRX Dividend Stocks list of 75 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Korean Reinsurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003690

Korean Reinsurance

A reinsurance company, provides life and non-life reinsurance products in Korea and internationally.

6 star dividend payer with excellent balance sheet.