- South Korea

- /

- Personal Products

- /

- KOSE:A051900

After Leaping 27% LG H&H Co., Ltd. (KRX:051900) Shares Are Not Flying Under The Radar

LG H&H Co., Ltd. (KRX:051900) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

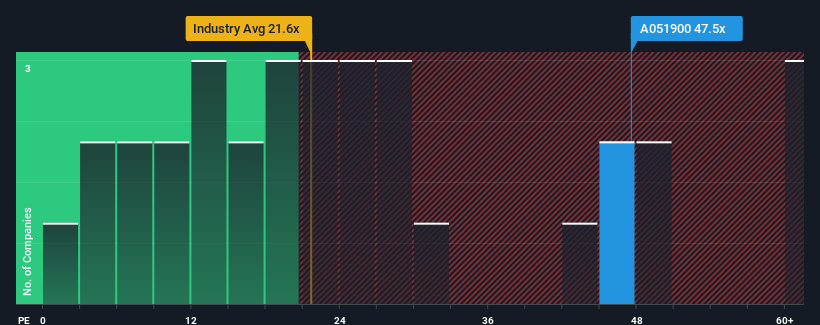

Following the firm bounce in price, LG H&H's price-to-earnings (or "P/E") ratio of 47.5x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 13x and even P/E's below 7x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

LG H&H hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for LG H&H

Is There Enough Growth For LG H&H?

There's an inherent assumption that a company should far outperform the market for P/E ratios like LG H&H's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 40%. The last three years don't look nice either as the company has shrunk EPS by 82% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 44% per year over the next three years. That's shaping up to be materially higher than the 19% per year growth forecast for the broader market.

With this information, we can see why LG H&H is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in LG H&H have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that LG H&H maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for LG H&H that we have uncovered.

If you're unsure about the strength of LG H&H's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A051900

LG H&H

Operates as cosmetics, household goods, and beverage company in South Korea and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives