- South Korea

- /

- Personal Products

- /

- KOSE:A044820

If You Had Bought Cosmax BTI's (KRX:044820) Shares Five Years Ago You Would Be Down 78%

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Cosmax BTI, Inc. (KRX:044820) for five whole years - as the share price tanked 78%. Furthermore, it's down 10% in about a quarter. That's not much fun for holders.

See our latest analysis for Cosmax BTI

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

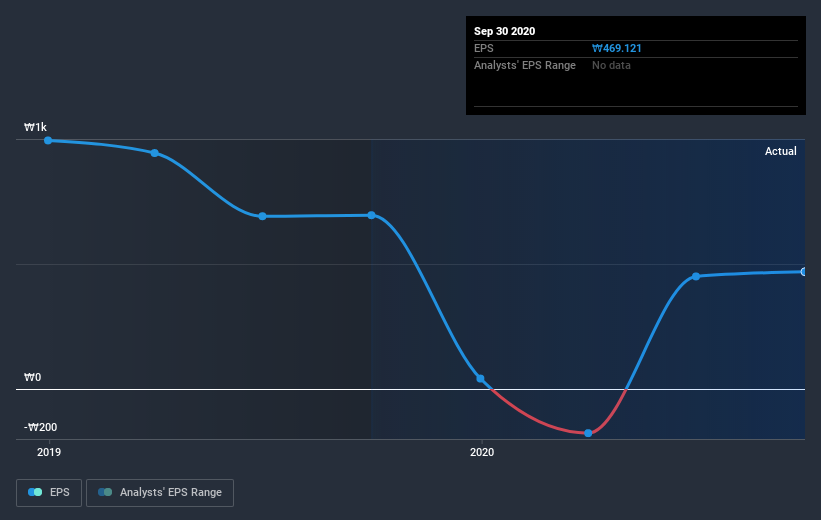

Looking back five years, both Cosmax BTI's share price and EPS declined; the latter at a rate of 14% per year. This reduction in EPS is less than the 26% annual reduction in the share price. This implies that the market is more cautious about the business these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Cosmax BTI's key metrics by checking this interactive graph of Cosmax BTI's earnings, revenue and cash flow.

A Different Perspective

Cosmax BTI provided a TSR of 36% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 12% per year, over five years. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Cosmax BTI (2 are a bit unpleasant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Cosmax BTI or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A044820

Cosmax BTI

Engages in the research, development, production, and sale of cosmetics, health functional foods, pharmaceuticals, and special containers in South Korea.

Proven track record with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026