- South Korea

- /

- Personal Products

- /

- KOSDAQ:A900120

How Much Did CKH Food & Health's(KOSDAQ:900120) Shareholders Earn From Share Price Movements Over The Last Five Years?

It is a pleasure to report that the CKH Food & Health Limited (KOSDAQ:900120) is up 130% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 84% in that time. So we don't gain too much confidence from the recent recovery. The important question is if the business itself justifies a higher share price in the long term.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for CKH Food & Health

CKH Food & Health isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade CKH Food & Health reduced its trailing twelve month revenue by 28% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 13% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

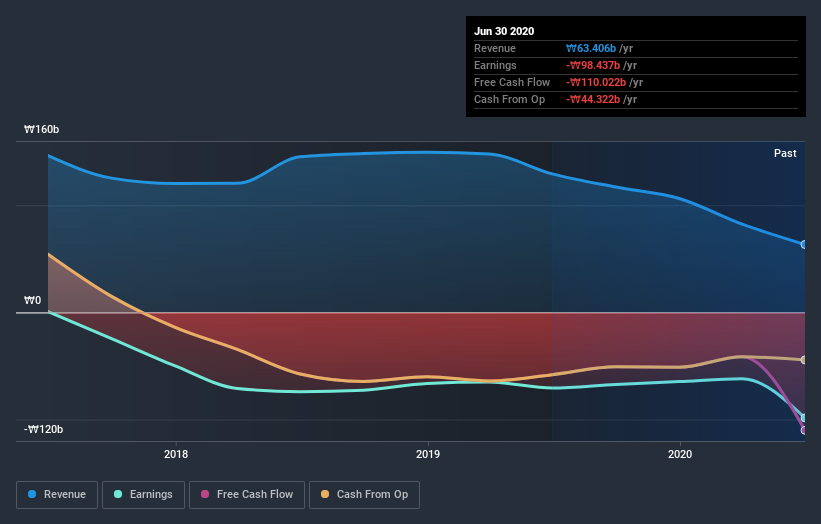

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on CKH Food & Health's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that CKH Food & Health has rewarded shareholders with a total shareholder return of 46% in the last twelve months. That certainly beats the loss of about 13% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand CKH Food & Health better, we need to consider many other factors. Take risks, for example - CKH Food & Health has 3 warning signs (and 1 which can't be ignored) we think you should know about.

Of course CKH Food & Health may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade CKH Food & Health, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade CXI Healthcare Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A900120

CXI Healthcare Technology Group

Engages in the manufacture and distribution of health foods.

Flawless balance sheet and good value.

Market Insights

Community Narratives