- South Korea

- /

- Personal Products

- /

- KOSDAQ:A241710

Does Cosmecca Korea (KOSDAQ:241710) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Cosmecca Korea Co., Ltd. (KOSDAQ:241710) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Cosmecca Korea

What Is Cosmecca Korea's Debt?

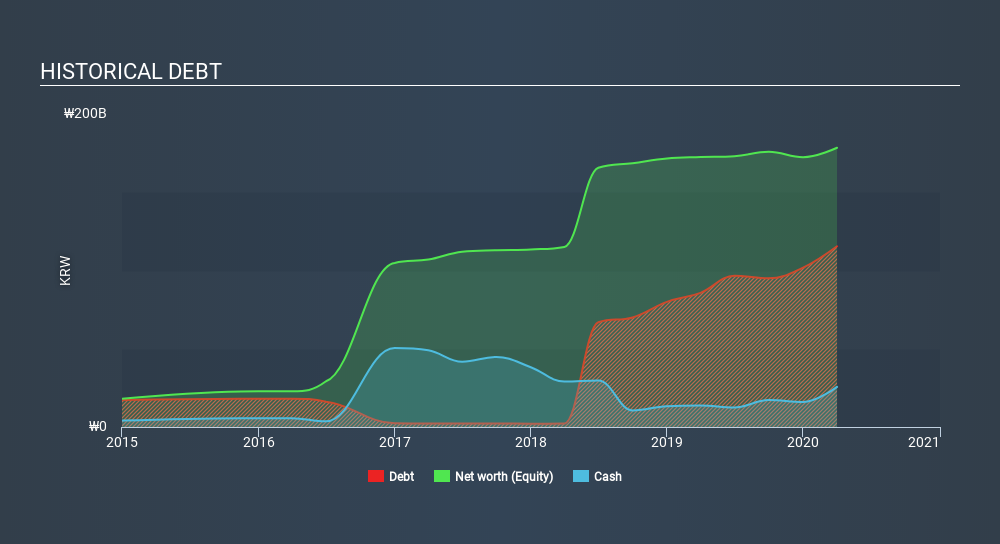

As you can see below, at the end of March 2020, Cosmecca Korea had ₩115.5b of debt, up from ₩85.7b a year ago. Click the image for more detail. On the flip side, it has ₩25.6b in cash leading to net debt of about ₩89.8b.

How Healthy Is Cosmecca Korea's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Cosmecca Korea had liabilities of ₩162.8b due within 12 months and liabilities of ₩45.1b due beyond that. On the other hand, it had cash of ₩25.6b and ₩65.1b worth of receivables due within a year. So its liabilities total ₩117.2b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of ₩115.3b, we think shareholders really should watch Cosmecca Korea's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Cosmecca Korea has a debt to EBITDA ratio of 3.3 and its EBIT covered its interest expense 2.6 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Worse, Cosmecca Korea's EBIT was down 20% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Cosmecca Korea's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Cosmecca Korea burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Cosmecca Korea's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. And even its level of total liabilities fails to inspire much confidence. After considering the datapoints discussed, we think Cosmecca Korea has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Cosmecca Korea (at least 1 which is concerning) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KOSDAQ:A241710

Cosmecca Korea

Engages in the research and development, manufacture, and sale of skincare products in South Korea and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026