- South Korea

- /

- Personal Products

- /

- KOSDAQ:A241710

Cosmecca Korea (KOSDAQ:241710) Share Prices Have Dropped 53% In The Last Three Years

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Cosmecca Korea Co., Ltd. (KOSDAQ:241710) shareholders. Regrettably, they have had to cope with a 53% drop in the share price over that period. The good news is that the stock is up 1.4% in the last week.

View our latest analysis for Cosmecca Korea

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

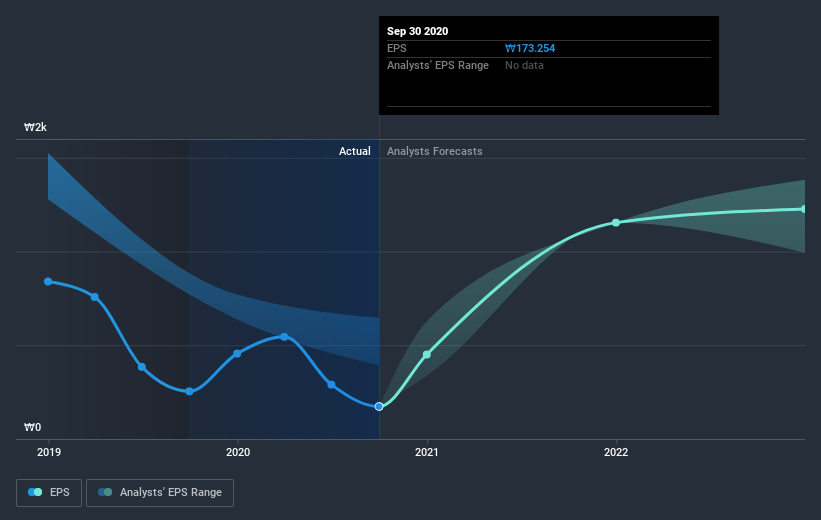

During the three years that the share price fell, Cosmecca Korea's earnings per share (EPS) dropped by 54% each year. This fall in the EPS is worse than the 22% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. This positive sentiment is also reflected in the generous P/E ratio of 81.38.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Cosmecca Korea's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Over the last year Cosmecca Korea shareholders have received a TSR of 35%. Unfortunately this falls short of the market return of around 50%. The silver lining is that the recent rise is far preferable to the annual loss of 15% that shareholders have suffered over the last three years. We hope the turnaround in fortunes continues. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Cosmecca Korea (of which 1 can't be ignored!) you should know about.

But note: Cosmecca Korea may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Cosmecca Korea or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A241710

Cosmecca Korea

Engages in the research and development, manufacture, and sale of skincare products in South Korea and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026