- South Korea

- /

- Personal Products

- /

- KOSDAQ:A175250

Icure Pharmaceutical Incorporation (KOSDAQ:175250) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Icure Pharmaceutical Incorporation (KOSDAQ:175250) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

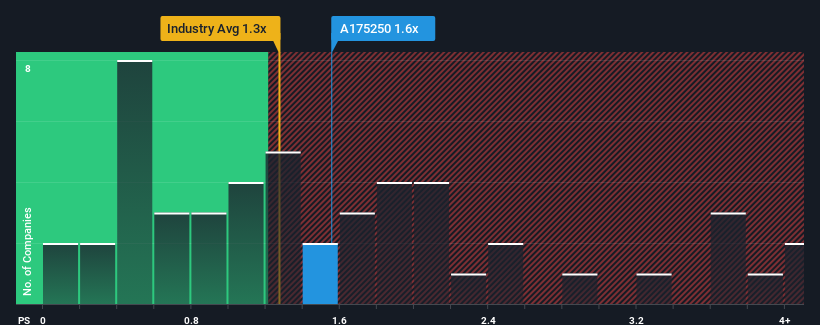

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Icure Pharmaceutical Incorporation's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Personal Products industry in Korea is also close to 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Icure Pharmaceutical Incorporation

How Icure Pharmaceutical Incorporation Has Been Performing

For example, consider that Icure Pharmaceutical Incorporation's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Icure Pharmaceutical Incorporation's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Icure Pharmaceutical Incorporation?

In order to justify its P/S ratio, Icure Pharmaceutical Incorporation would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.9%. As a result, revenue from three years ago have also fallen 32% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's somewhat alarming that Icure Pharmaceutical Incorporation's P/S sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What Does Icure Pharmaceutical Incorporation's P/S Mean For Investors?

Icure Pharmaceutical Incorporation appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Icure Pharmaceutical Incorporation revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Icure Pharmaceutical Incorporation (of which 3 are potentially serious!) you should know about.

If these risks are making you reconsider your opinion on Icure Pharmaceutical Incorporation, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A175250

Icure Pharmaceutical Incorporation

A biopharmaceutical company, researches, develops, and sells pharmaceutical and cosmetic products in South Korea.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives