- South Korea

- /

- Personal Products

- /

- KOSDAQ:A052260

The HYUNDAI BIOLANDLtd (KOSDAQ:052260) Share Price Is Up 55% And Shareholders Are Holding On

While HYUNDAI BIOLAND Co.,Ltd (KOSDAQ:052260) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 12% in the last quarter. But that doesn't change the fact that the returns over the last year have been pleasing. Looking at the full year, the company has easily bested an index fund by gaining 55%.

View our latest analysis for HYUNDAI BIOLANDLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, HYUNDAI BIOLANDLtd actually shrank its EPS by 46%.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the modest 1.4% dividend yield is doing much to support the share price. HYUNDAI BIOLANDLtd's revenue actually dropped 11% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

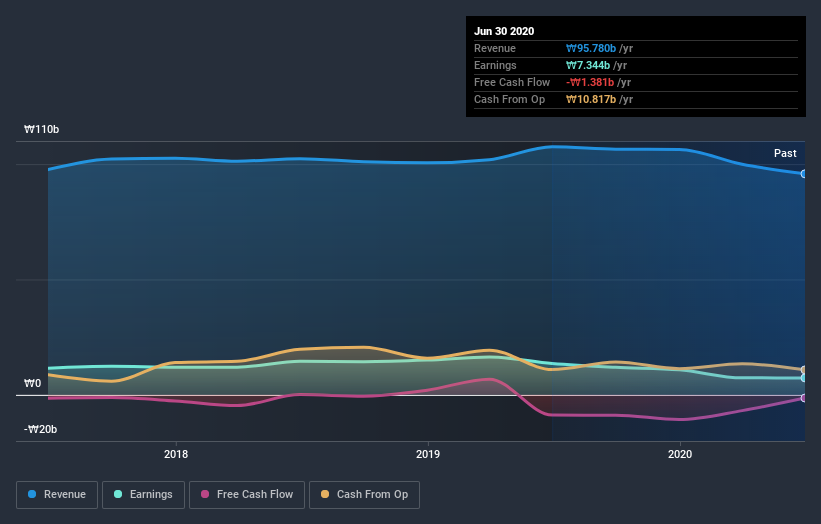

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at HYUNDAI BIOLANDLtd's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, HYUNDAI BIOLANDLtd's TSR for the last year was 57%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that HYUNDAI BIOLANDLtd has rewarded shareholders with a total shareholder return of 57% in the last twelve months. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 1.2% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand HYUNDAI BIOLANDLtd better, we need to consider many other factors. Take risks, for example - HYUNDAI BIOLANDLtd has 1 warning sign we think you should be aware of.

But note: HYUNDAI BIOLANDLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading HYUNDAI BIOLANDLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HYUNDAI BIOLANDLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A052260

HYUNDAI BIOLANDLtd

Engages in the manufacture and sale of natural materials for cosmetics, nutraceuticals, and regenerative medicines worldwide.

Undervalued with excellent balance sheet.