- South Korea

- /

- Personal Products

- /

- KOSDAQ:A016100

Reflecting on Leaders Cosmetics' (KOSDAQ:016100) Share Price Returns Over The Last Five Years

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. Anyone who held Leaders Cosmetics Co., Ltd. (KOSDAQ:016100) for five years would be nursing their metaphorical wounds since the share price dropped 84% in that time. And we doubt long term believers are the only worried holders, since the stock price has declined 24% over the last twelve months. On the other hand the share price has bounced 5.0% over the last week. The buoyant market could have helped drive the share price pop, since stocks are up 2.1% in the same period.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Leaders Cosmetics

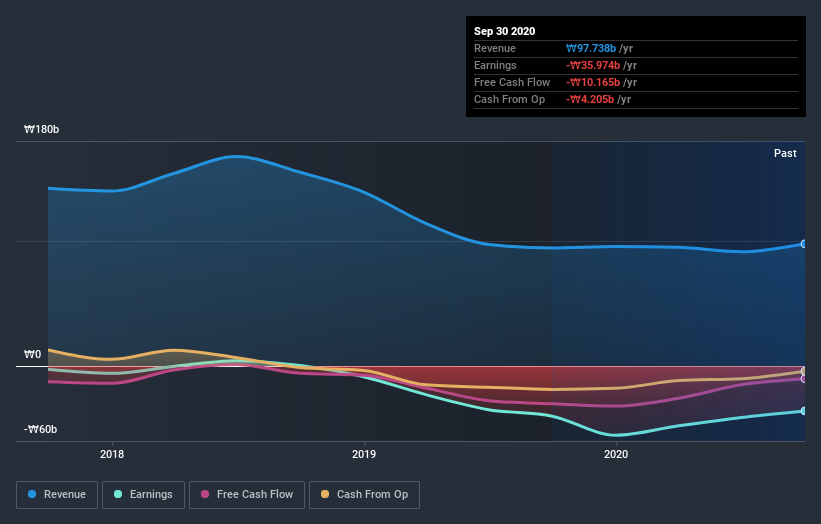

Leaders Cosmetics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Leaders Cosmetics saw its revenue shrink by 13% per year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 13% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Leaders Cosmetics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Leaders Cosmetics shareholders are down 24% for the year, but the market itself is up 47%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Leaders Cosmetics (1 can't be ignored!) that you should be aware of before investing here.

Of course Leaders Cosmetics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Leaders Cosmetics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Leaders Cosmetics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A016100

Leaders Cosmetics

Manufactures and sells cosmetic products in South Korea.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives