As global markets navigate a landscape of rate cuts and fluctuating indices, investors are keenly observing the performance of major stock indexes, with most ending the week lower despite the Nasdaq Composite reaching a new milestone. Amidst these shifts, opportunities may arise in undervalued stocks that have not yet caught up with broader market trends. Identifying such stocks often involves looking for those with strong fundamentals that may be temporarily overlooked due to current economic conditions or sector-specific challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.67 | US$53.13 | 49.8% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.59 | CN¥19.09 | 49.8% |

| Musashi Seimitsu Industry (TSE:7220) | ¥4020.00 | ¥8038.95 | 50% |

| Xiamen Bank (SHSE:601187) | CN¥5.68 | CN¥11.35 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.18 | HK$18.27 | 49.8% |

| BYD Electronic (International) (SEHK:285) | HK$39.85 | HK$79.36 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.30 | CLP579.37 | 49.7% |

| Constellium (NYSE:CSTM) | US$10.91 | US$21.69 | 49.7% |

Here's a peek at a few of the choices from the screener.

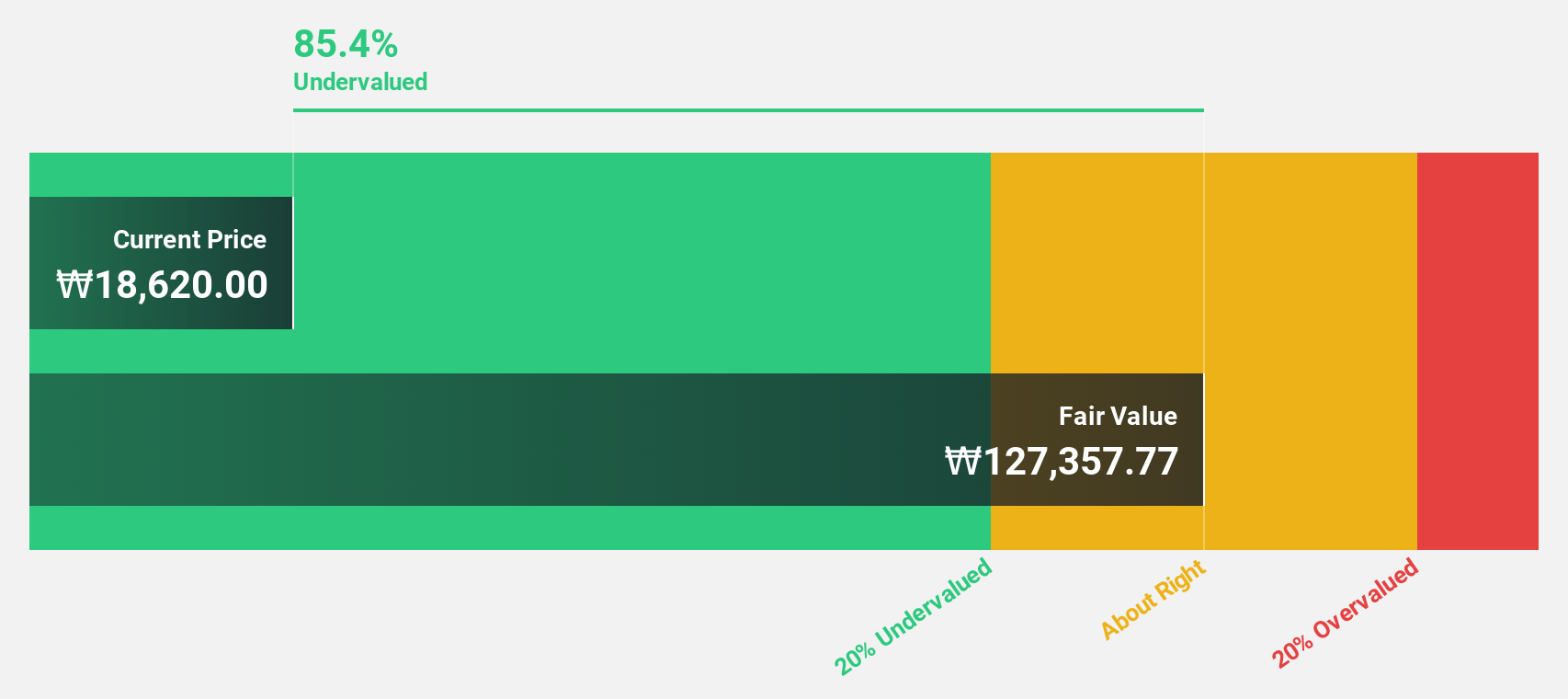

Vuno (KOSDAQ:A338220)

Overview: Vuno Inc. is a medical artificial intelligence solution development company with a market cap of ₩379.15 billion.

Operations: The company's revenue is primarily generated from its artificial intelligence medical software production, amounting to ₩23.72 billion.

Estimated Discount To Fair Value: 20.1%

Vuno is trading at ₩27,300, over 20% below its estimated fair value of ₩34,175.91. Despite a volatile share price and past shareholder dilution, the company is expected to achieve profitability within three years with earnings projected to grow annually by 117.58%. Revenue growth is anticipated at 44.9% per year, significantly outpacing the Korean market's average growth rate of 5.3%, suggesting potential undervaluation based on cash flows.

- The analysis detailed in our Vuno growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Vuno's balance sheet health report.

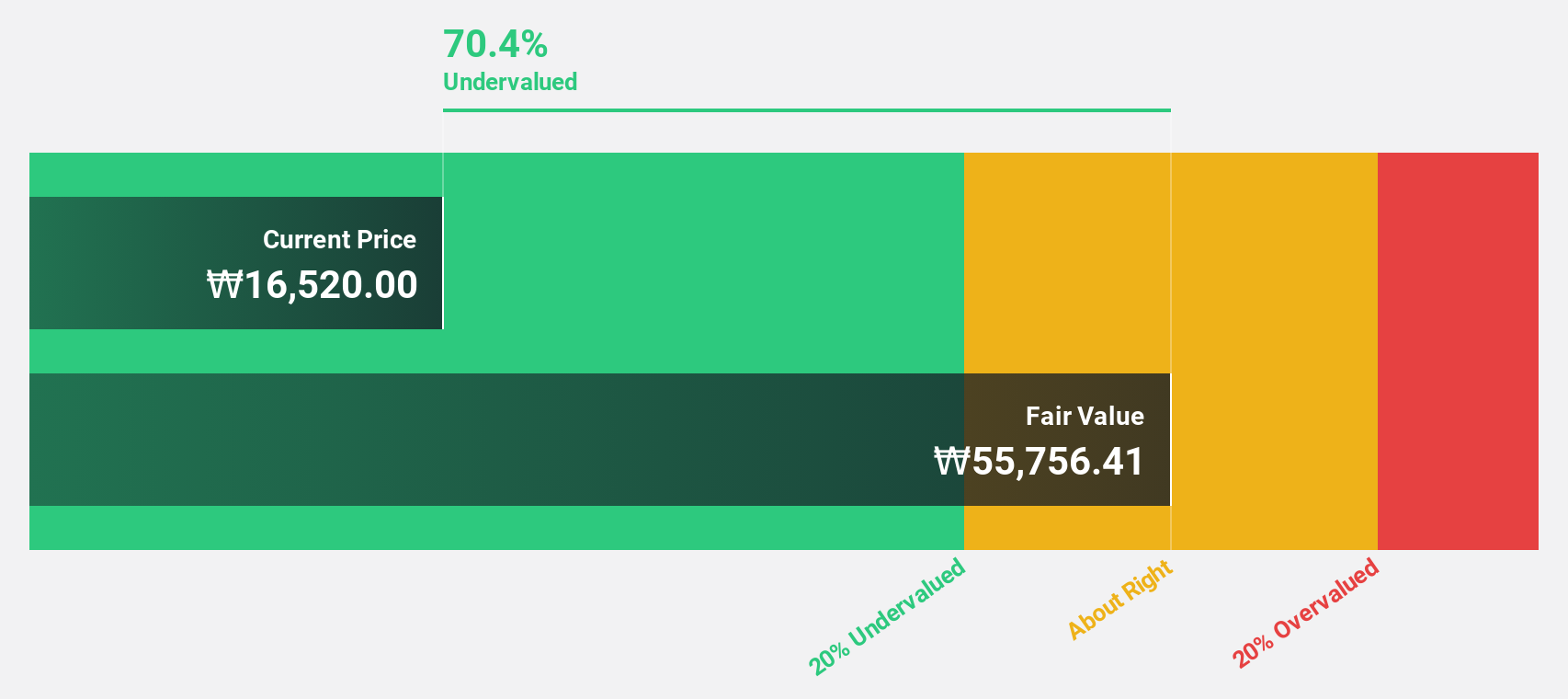

Solum (KOSE:A248070)

Overview: Solum Co., Ltd. is engaged in the manufacturing and marketing of power modules, digital tuners, and electronic shelf labels for both domestic and international customers, with a market cap of approximately ₩992.89 billion.

Operations: The company's revenue is primarily generated from its ICT Business, which accounts for ₩432.21 million, and its Electronic Components Division, contributing ₩1.14 billion.

Estimated Discount To Fair Value: 45.7%

Solum is trading at ₩20,400, significantly below its estimated fair value of ₩37,603.3. Despite a drop in net profit margins from 5.8% to 2.8%, the company is expected to see earnings grow by 50% annually over the next three years, surpassing market averages. Although revenue growth is slower than some benchmarks at 16% per year, it still outpaces the Korean market's average rate of 5.3%. However, Solum carries a high level of debt which could impact financial flexibility despite completing a share buyback worth KRW 3,356.47 million recently.

- The growth report we've compiled suggests that Solum's future prospects could be on the up.

- Dive into the specifics of Solum here with our thorough financial health report.

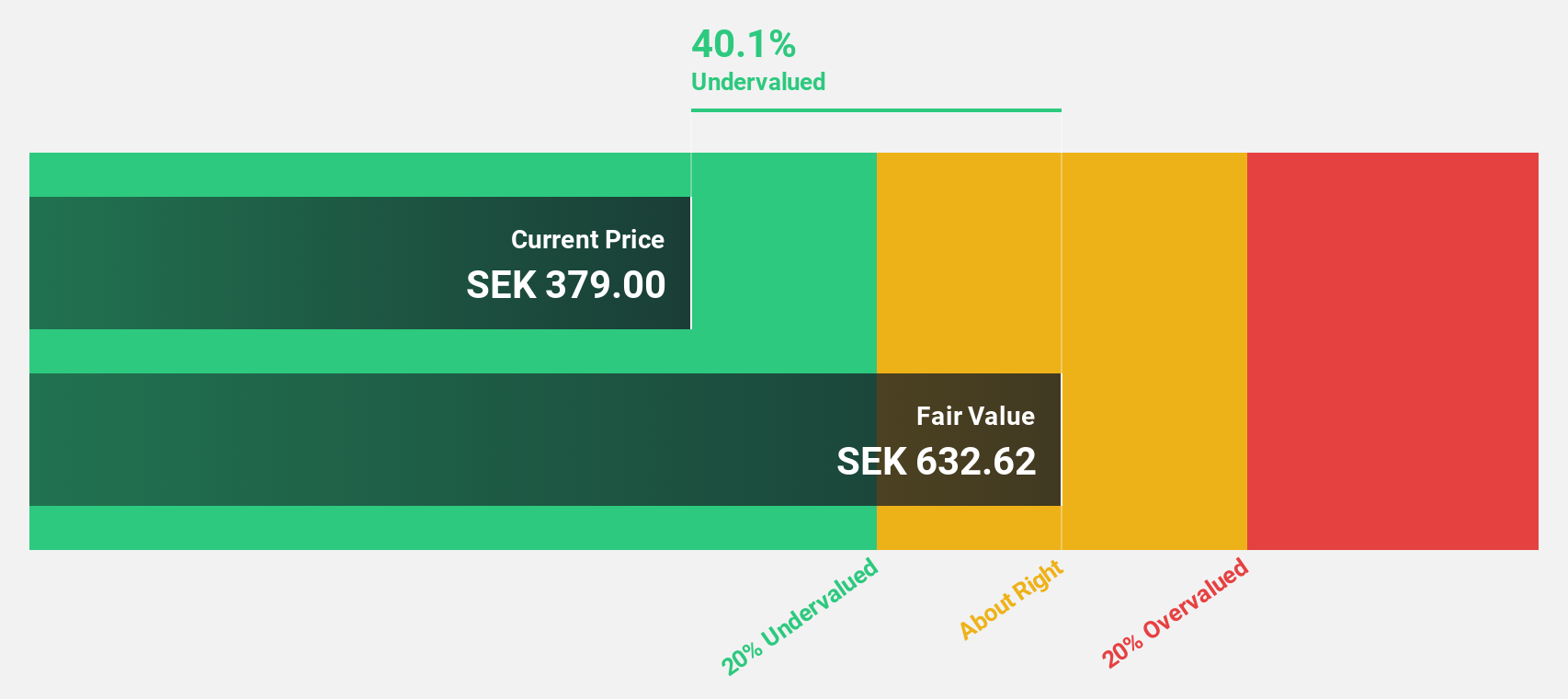

TF Bank (OM:TFBANK)

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions via its proprietary IT platform, with a market cap of SEK7.78 billion.

Operations: TF Bank generates revenue from three main segments: Credit Cards (SEK563.14 million), Consumer Lending (SEK602.16 million), and Ecommerce Solutions excluding Credit Cards (SEK380.14 million).

Estimated Discount To Fair Value: 41.2%

TF Bank is trading at SEK 362, significantly below its estimated fair value of SEK 615.74, indicating it may be undervalued based on cash flows. The bank's earnings and revenue are forecasted to grow significantly over the next three years, with earnings expected to rise by 29.7% annually, outpacing the Swedish market average. However, TF Bank has a high level of bad loans (11.4%), which could pose risks despite strong growth prospects and recent financial performance improvements.

- According our earnings growth report, there's an indication that TF Bank might be ready to expand.

- Unlock comprehensive insights into our analysis of TF Bank stock in this financial health report.

Summing It All Up

- Click through to start exploring the rest of the 871 Undervalued Stocks Based On Cash Flows now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TFBANK

TF Bank

A digital bank, provides consumer banking services and e-commerce solutions through a proprietary IT platform in Sweden .

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives