- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A335810

Some Confidence Is Lacking In Precision Biosensor, Inc. (KOSDAQ:335810) As Shares Slide 30%

Precision Biosensor, Inc. (KOSDAQ:335810) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

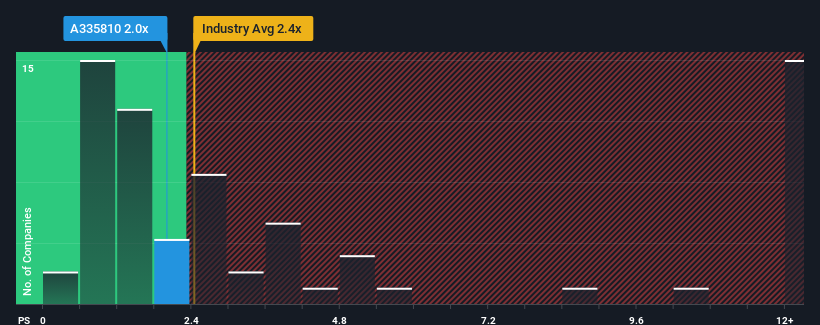

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Precision Biosensor's P/S ratio of 2x, since the median price-to-sales (or "P/S") ratio for the Medical Equipment industry in Korea is also close to 2.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Precision Biosensor

How Has Precision Biosensor Performed Recently?

For example, consider that Precision Biosensor's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Precision Biosensor will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Precision Biosensor's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 54% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 30% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Precision Biosensor is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Precision Biosensor's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Precision Biosensor looks to be in line with the rest of the Medical Equipment industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Precision Biosensor's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware Precision Biosensor is showing 3 warning signs in our investment analysis, and 2 of those can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A335810

Precision Biosensor

An in-vitro diagnostics company, manufactures, distributes, and sells diagnostic reagents and analyzing devices in South Korea.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026