- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A314930

Companies Like Biodyne (KOSDAQ:314930) Are In A Position To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Biodyne (KOSDAQ:314930) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Biodyne

Does Biodyne Have A Long Cash Runway?

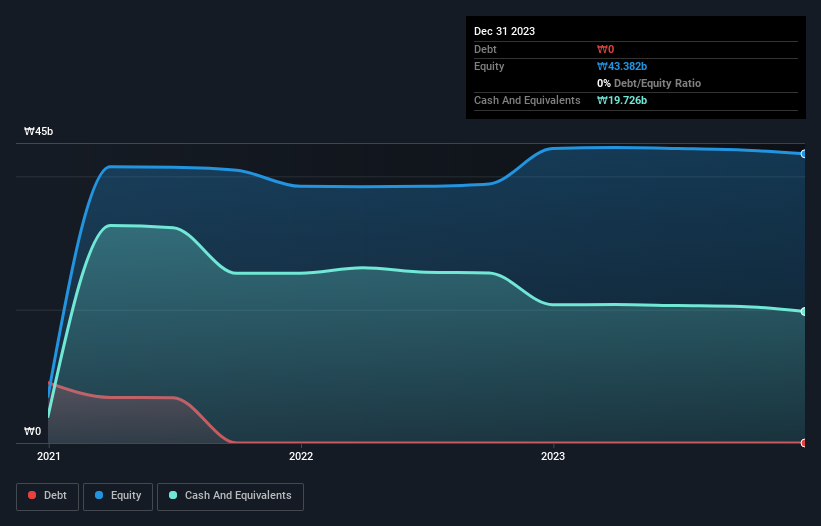

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Biodyne last reported its December 2023 balance sheet in February 2024, it had zero debt and cash worth ₩20b. Looking at the last year, the company burnt through ₩265m. So it had a very long cash runway of many years from December 2023. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. The image below shows how its cash balance has been changing over the last few years.

Is Biodyne's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Biodyne actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. The grim reality for shareholders is that operating revenue fell by 67% over the last twelve months, which is not what we want to see in a cash burning company. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Biodyne has developed its business over time by checking this visualization of its revenue and earnings history.

Can Biodyne Raise More Cash Easily?

Since its revenue growth is moving in the wrong direction, Biodyne shareholders may wish to think ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Biodyne has a market capitalisation of ₩337b and burnt through ₩265m last year, which is 0.08% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Biodyne's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Biodyne is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. While we must concede that its falling revenue is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Biodyne (1 shouldn't be ignored!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if Biodyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A314930

Biodyne

Develops and manufacturers medical devices, reagents, and consumables in South Korea.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives