- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A228670

Ray Co., Ltd. (KOSDAQ:228670) Not Doing Enough For Some Investors As Its Shares Slump 32%

The Ray Co., Ltd. (KOSDAQ:228670) share price has fared very poorly over the last month, falling by a substantial 32%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

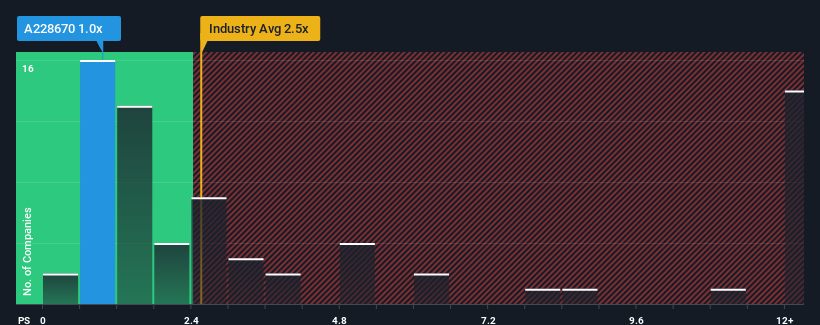

Since its price has dipped substantially, Ray may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Medical Equipment industry in Korea have P/S ratios greater than 2.5x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Ray

How Has Ray Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Ray has been doing quite well of late. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ray.Is There Any Revenue Growth Forecasted For Ray?

The only time you'd be truly comfortable seeing a P/S as low as Ray's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.0% last year. The latest three year period has also seen an excellent 148% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 21% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 45% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Ray's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The southerly movements of Ray's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Ray's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 2 warning signs for Ray (1 is significant!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A228670

Ray

RAY Co., Ltd. provides x-ray diagnostic equipment in the dental industry.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026