- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A228670

Market Still Lacking Some Conviction On Ray Co., Ltd. (KOSDAQ:228670)

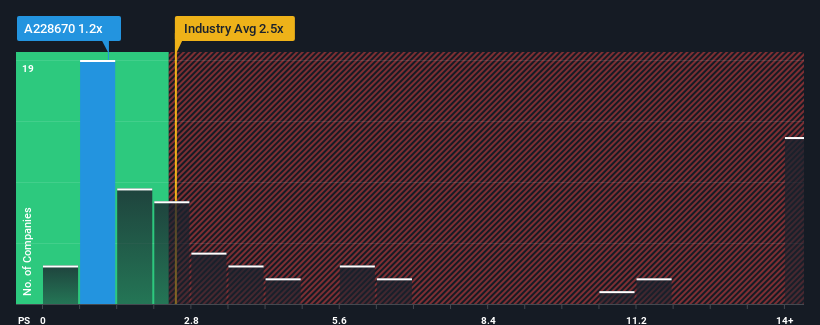

With a price-to-sales (or "P/S") ratio of 1.2x Ray Co., Ltd. (KOSDAQ:228670) may be sending bullish signals at the moment, given that almost half of all the Medical Equipment companies in Korea have P/S ratios greater than 2.5x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Ray

What Does Ray's P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Ray has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on Ray will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ray.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Ray would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 9.0% gain to the company's revenues. The latest three year period has also seen an excellent 148% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 21% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 19% each year, which is noticeably less attractive.

With this information, we find it odd that Ray is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Ray's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Ray's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Ray (1 is potentially serious!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A228670

Ray

RAY Co., Ltd. provides x-ray diagnostic equipment in the dental industry.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026