- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A226400

OSTEONIC Co., Ltd.'s (KOSDAQ:226400) 28% Share Price Surge Not Quite Adding Up

OSTEONIC Co., Ltd. (KOSDAQ:226400) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 29%.

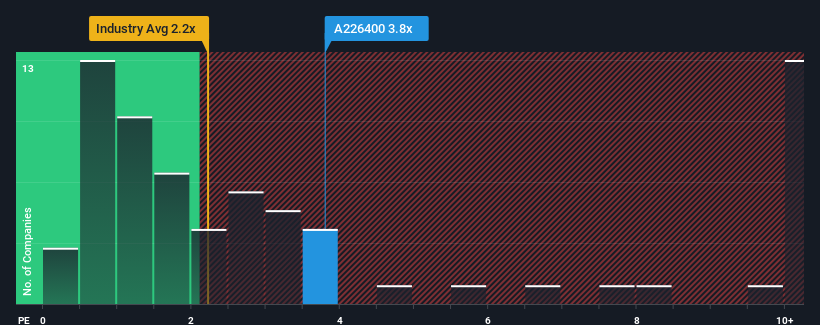

Following the firm bounce in price, given close to half the companies operating in Korea's Medical Equipment industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider OSTEONIC as a stock to potentially avoid with its 3.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for OSTEONIC

How Has OSTEONIC Performed Recently?

The revenue growth achieved at OSTEONIC over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on OSTEONIC's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, OSTEONIC would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 109% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 34% shows it's noticeably less attractive.

With this information, we find it concerning that OSTEONIC is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

OSTEONIC shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that OSTEONIC currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 2 warning signs for OSTEONIC you should be aware of, and 1 of them can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A226400

OSTEONIC

Osteonic Co., Ltd. develops, manufactures, and sells bone fixation systems.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives