- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

3 KRX Growth Companies With Insider Ownership Up To 38%

Reviewed by Simply Wall St

The South Korea stock market has finished lower in seven straight sessions, plunging more than 170 points or 6.4 percent along the way. Despite this downturn, investors are looking for opportunities in growth companies with high insider ownership, which can signal confidence from those closest to the company's operations and prospects. In this article, we will explore three KRX-listed growth companies where insiders hold up to 38% of shares.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 97.6% |

| Park Systems (KOSDAQ:A140860) | 33% | 35.7% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Here we highlight a subset of our preferred stocks from the screener.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.51 trillion.

Operations: CLASSYS Inc. generates revenue primarily from its Surgical & Medical Equipment segment, which amounted to ₩204.37 billion.

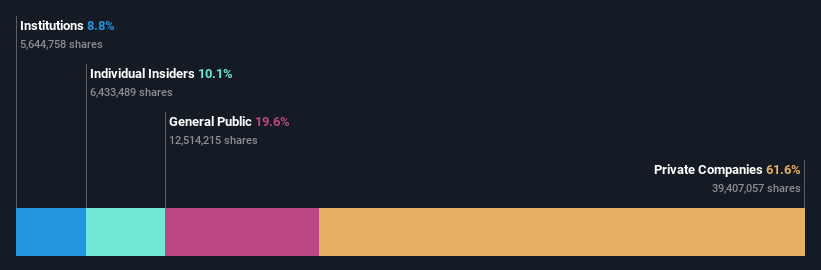

Insider Ownership: 10.1%

CLASSYS Inc. demonstrates strong growth potential with earnings forecasted to grow 22.5% annually, although this is slower than the South Korean market average of 28.7%. The company’s revenue is expected to increase by 19.3% per year, outpacing the market's 10.3%. Insider ownership remains significant, and recent presentations at major conferences highlight its proactive investor engagement strategy. Despite trading at a discount to its estimated fair value, CLASSYS maintains a high return on equity forecast of 28.1%.

- Click to explore a detailed breakdown of our findings in CLASSYS' earnings growth report.

- Our expertly prepared valuation report CLASSYS implies its share price may be too high.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea and has a market cap of ₩1.91 trillion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, which amounted to ₩296.59 billion.

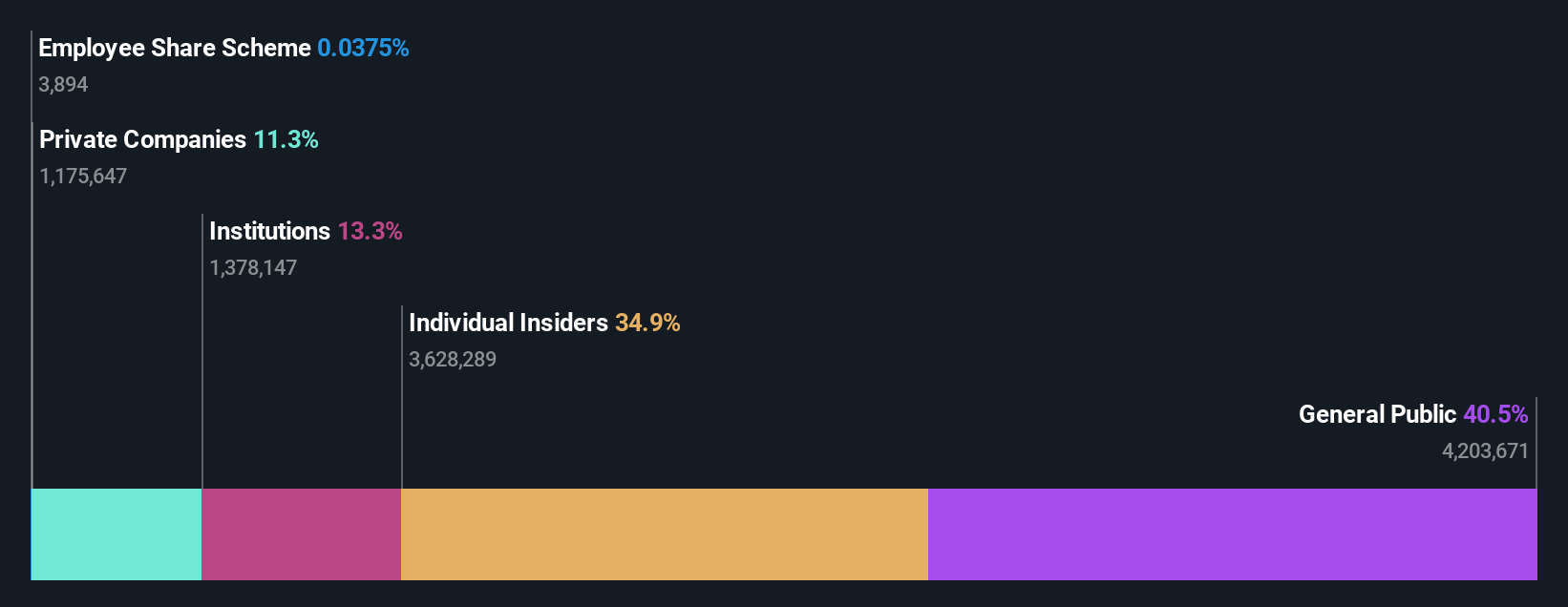

Insider Ownership: 38.9%

PharmaResearch is trading at 55.8% below its estimated fair value, indicating potential undervaluation. Despite high share price volatility over the past three months, the company's earnings grew 63.2% last year and are forecast to grow 22.22% annually over the next three years, outpacing market revenue growth expectations of 10.3%. Insider ownership is substantial, aligning management's interests with shareholders'. Analysts predict a stock price increase of 32.1%, reflecting strong growth prospects and good relative value compared to peers and industry standards.

- Dive into the specifics of PharmaResearch here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that PharmaResearch is priced lower than what may be justified by its financials.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment in South Korea and internationally, with a market cap of ₩2.57 trillion.

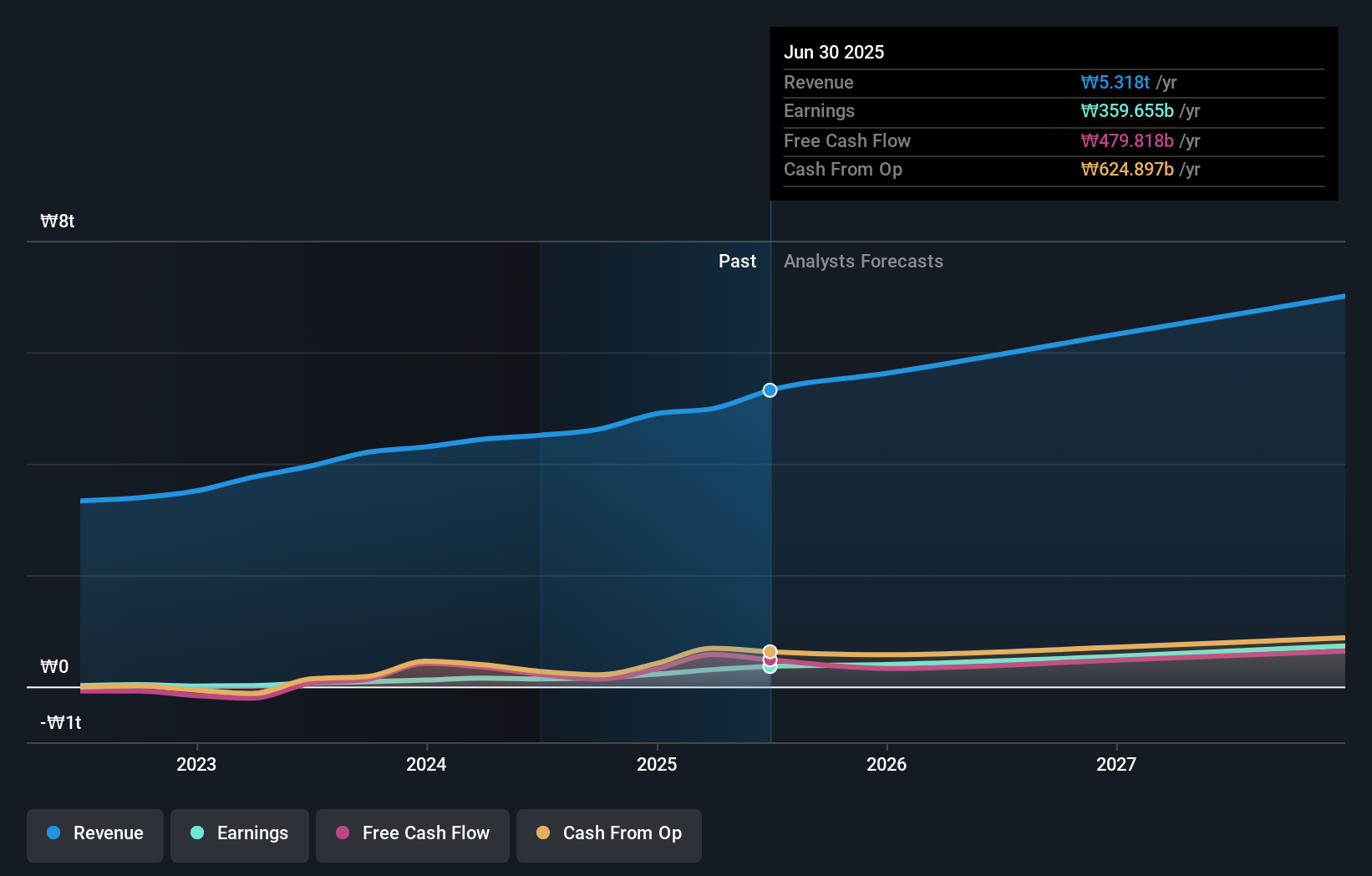

Operations: The company's revenue segments are comprised of ₩1.78 trillion from Construction and ₩3.35 trillion from Heavy Industry.

Insider Ownership: 16.4%

Hyosung Heavy Industries is trading at 60.7% below its estimated fair value, suggesting significant undervaluation. Despite a highly volatile share price over the past three months, earnings grew by 117.9% last year and are forecast to grow 34.66% annually over the next three years, surpassing market expectations of 28.7%. Analysts agree on a potential stock price increase of 48.7%. Insider ownership aligns management's interests with shareholders', enhancing confidence in future growth prospects.

- Navigate through the intricacies of Hyosung Heavy Industries with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Hyosung Heavy Industries' share price might be on the cheaper side.

Key Takeaways

- Unlock more gems! Our Fast Growing KRX Companies With High Insider Ownership screener has unearthed 85 more companies for you to explore.Click here to unveil our expertly curated list of 88 Fast Growing KRX Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214150

High growth potential with excellent balance sheet.