- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A150840

IntroMedic's (KOSDAQ:150840) Stock Price Has Reduced 68% In The Past Three Years

This week we saw the IntroMedic Co., Ltd. (KOSDAQ:150840) share price climb by 13%. But over the last three years we've seen a quite serious decline. Indeed, the share price is down a tragic 68% in the last three years. So the improvement may be a real relief to some. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Check out our latest analysis for IntroMedic

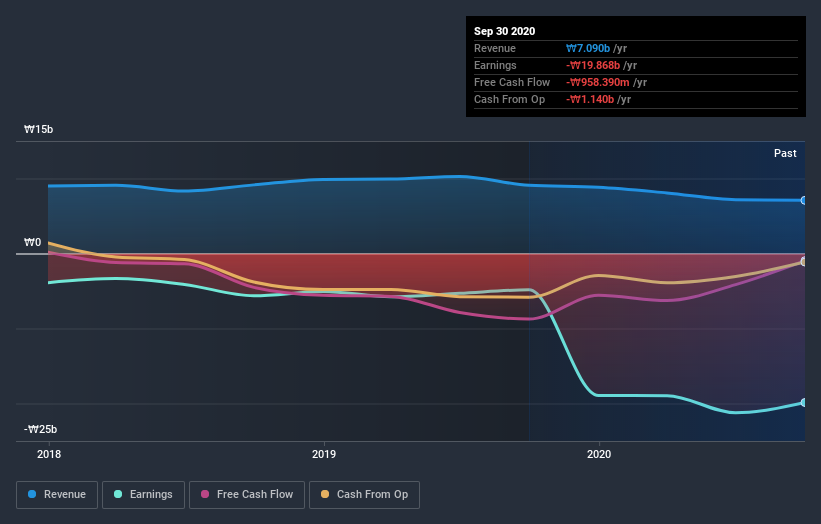

IntroMedic isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, IntroMedic's revenue dropped 6.9% per year. That is not a good result. The share price decline of 19% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at IntroMedic's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 69% in the last year, IntroMedic shareholders lost 42%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand IntroMedic better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for IntroMedic you should be aware of, and 1 of them doesn't sit too well with us.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade IntroMedic, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A150840

IntroMedic

IntroMedic Co., Ltd. develops and supplies medical equipment in South Korea and internationally.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives