- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A142280

Investors Shouldn't Be Too Comfortable With Green Cross Medical Science's (KOSDAQ:142280) Robust Earnings

Green Cross Medical Science Corporation's (KOSDAQ:142280) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

View our latest analysis for Green Cross Medical Science

A Closer Look At Green Cross Medical Science's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

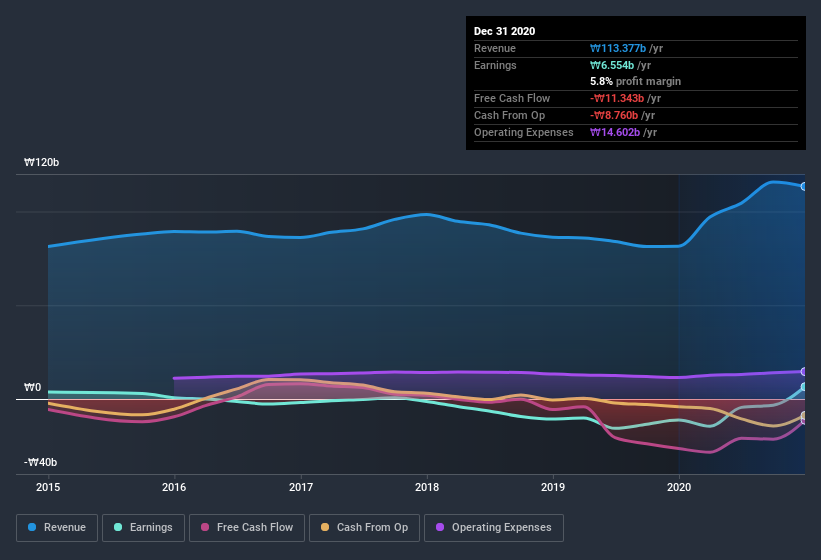

Green Cross Medical Science has an accrual ratio of 0.33 for the year to December 2020. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. In the last twelve months it actually had negative free cash flow, with an outflow of ₩11b despite its profit of ₩6.55b, mentioned above. We also note that Green Cross Medical Science's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₩11b.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Green Cross Medical Science.

Our Take On Green Cross Medical Science's Profit Performance

As we have made quite clear, we're a bit worried that Green Cross Medical Science didn't back up the last year's profit with free cashflow. As a result, we think it may well be the case that Green Cross Medical Science's underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Every company has risks, and we've spotted 2 warning signs for Green Cross Medical Science (of which 1 is concerning!) you should know about.

Today we've zoomed in on a single data point to better understand the nature of Green Cross Medical Science's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Green Cross Medical Science, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A142280

Green Cross Medical Science

Manufactures and sells diagnostic reagents and medical devices in South Korea and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives