- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A059210

Meta Biomed's (KOSDAQ:059210) Stock Price Has Reduced 58% In The Past Five Years

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example, after five long years the Meta Biomed Co., Ltd. (KOSDAQ:059210) share price is a whole 58% lower. We certainly feel for shareholders who bought near the top. The falls have accelerated recently, with the share price down 15% in the last three months.

View our latest analysis for Meta Biomed

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

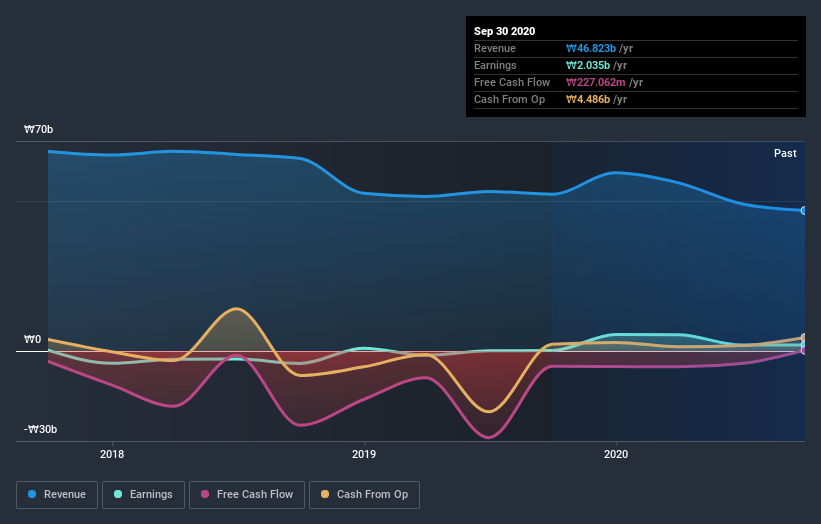

Meta Biomed became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

We don't think that the 0.4% is big factor in the share price, since it's quite small, as dividends go. It could be that the revenue decline of 6.5% per year is viewed as evidence that Meta Biomed is shrinking. This has probably encouraged some shareholders to sell down the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Meta Biomed shareholders gained a total return of 22% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Meta Biomed you should be aware of, and 1 of them doesn't sit too well with us.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Meta Biomed, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A059210

Meta Biomed

Engages in the research, development, and production of dental and surgical materials in South Korea, Asia, Europe, the United States, and Africa.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives