- Japan

- /

- Professional Services

- /

- TSE:4318

Unveiling Undiscovered Gems In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indices like the Russell 2000 underperforming their larger-cap counterparts and economic indicators suggesting a cooling labor market, investors are increasingly attentive to the Federal Reserve’s anticipated rate cut. In this environment, identifying undiscovered gems—stocks that offer potential growth despite broader market challenges—requires a keen eye for companies with strong fundamentals and resilience in sectors poised to benefit from shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.86% | 6.39% | 4.69% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dongwon F&B (KOSE:A049770)

Simply Wall St Value Rating: ★★★★★☆

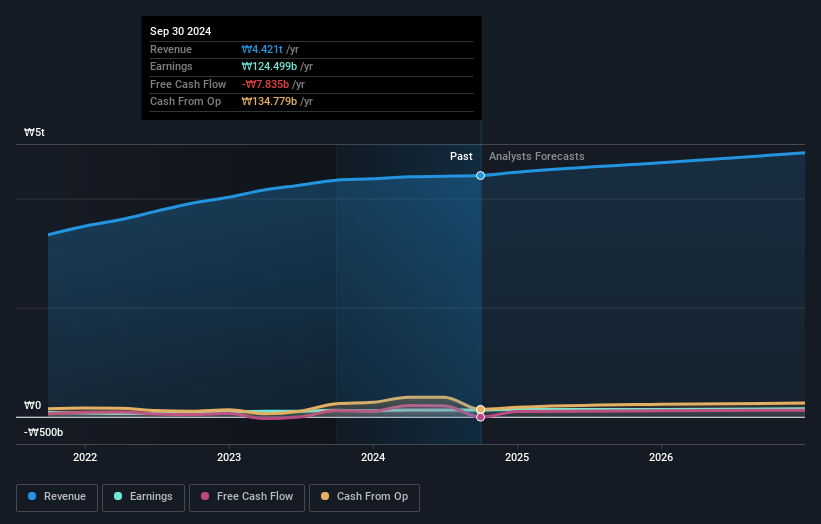

Overview: Dongwon F&B Co., Ltd. operates as a food supplier in South Korea with a market capitalization of approximately ₩612.64 billion.

Operations: Dongwon F&B generates significant revenue from its General Food and Seasoning Distribution segments, with the latter contributing ₩2.32 trillion. The company's net profit margin reflects its financial efficiency in managing these operations.

Dongwon F&B, a notable player in its sector, has shown resilience with earnings growth of 5.8% over the past year, outpacing the food industry's 1.8%. The company is trading at 81.8% below its estimated fair value, presenting an attractive valuation opportunity. Despite a reduction in debt to equity from 82.4% to 46.2% over five years, it still holds a high net debt to equity ratio of 41.1%. Recent third-quarter results reveal sales increased to KRW 7,178 million from KRW 6,558 million last year; however, net income slightly decreased from KRW 44 billion to KRW 43 billion.

- Click here and access our complete health analysis report to understand the dynamics of Dongwon F&B.

Assess Dongwon F&B's past performance with our detailed historical performance reports.

QuickLtd (TSE:4318)

Simply Wall St Value Rating: ★★★★★★

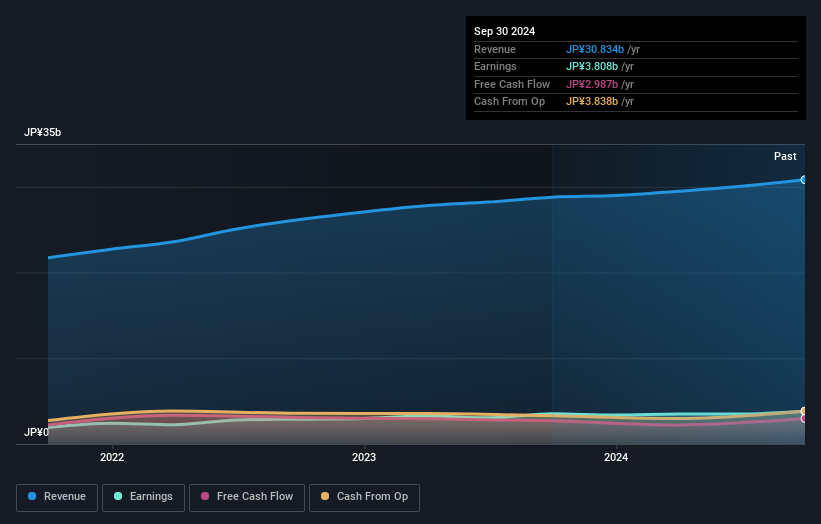

Overview: Quick Co., Ltd. operates in recruiting, human resources services, information publishing, and Internet-related businesses both in Japan and internationally with a market cap of ¥42.03 billion.

Operations: QuickLtd generates revenue primarily through its recruiting and human resources services, alongside information publishing and Internet-related businesses. The company has a market cap of ¥42.03 billion.

QuickLtd, a smaller player in the industry, is trading at a significant discount of 44.3% below its estimated fair value. With earnings growth averaging 15.6% annually over the past five years, it shows potential despite not outpacing the broader Professional Services industry's recent growth of 8.3%. The company's debt situation appears well-managed with cash exceeding total debt and a reduced debt-to-equity ratio from 2% to just 0.6%. Additionally, QuickLtd has increased its dividend to ¥47 per share for Q2 FY2025 from ¥36 last year, indicating confidence in its financial health and future prospects.

- Delve into the full analysis health report here for a deeper understanding of QuickLtd.

Gain insights into QuickLtd's past trends and performance with our Past report.

Cybozu (TSE:4776)

Simply Wall St Value Rating: ★★★★★★

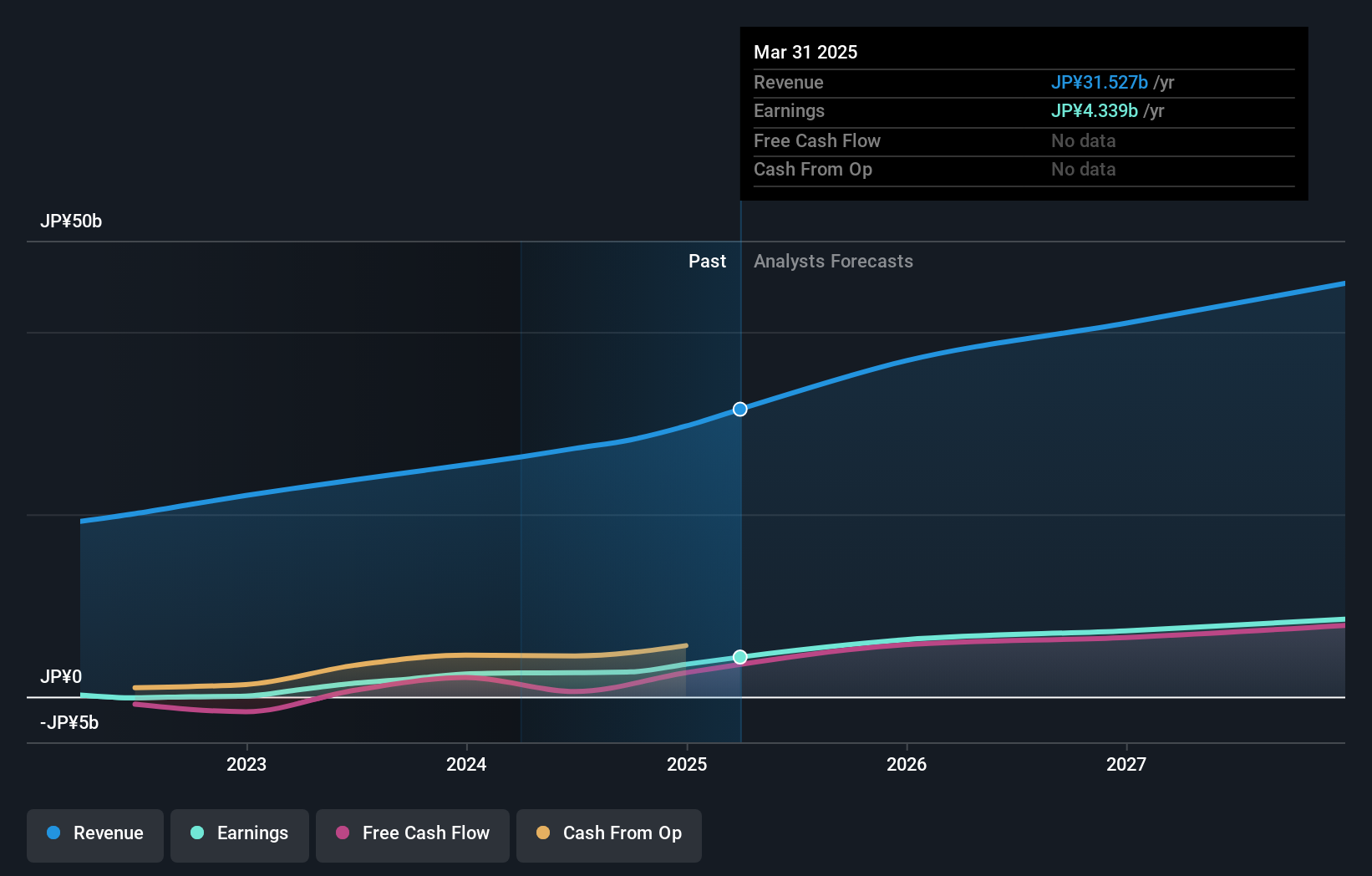

Overview: Cybozu, Inc. develops, sells, and operates groupware solutions across several countries including Japan, China, Vietnam, Taiwan, Malaysia, Australia, and the United States with a market capitalization of approximately ¥99.05 billion.

Operations: Cybozu generates revenue primarily from its software development and sales segment, amounting to ¥28.16 billion. The company's financial focus is on optimizing its cost structure to enhance profitability, with a notable emphasis on managing expenses related to software development and sales operations.

Cybozu, a nimble player in the software sector, showcases impressive growth with earnings surging 39% last year, outpacing the industry average of 14%. The company stands debt-free now, a notable shift from five years ago when its debt-to-equity ratio was 24.6%. Trading at approximately 7.5% below its fair value estimate further highlights its potential appeal for investors. With high-quality earnings and positive free cash flow, Cybozu's strategic buyback program aims to repurchase up to 3 million shares by December end to optimize capital structure amid evolving business landscapes.

Where To Now?

- Explore the 4507 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuickLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4318

QuickLtd

Engages in the recruiting, human resources service, information publishing, and Internet-related businesses in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives