- South Korea

- /

- Food

- /

- KOSE:A017810

Market Participants Recognise Pulmuone Corporate's (KRX:017810) Revenues Pushing Shares 31% Higher

Pulmuone Corporate (KRX:017810) shares have continued their recent momentum with a 31% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

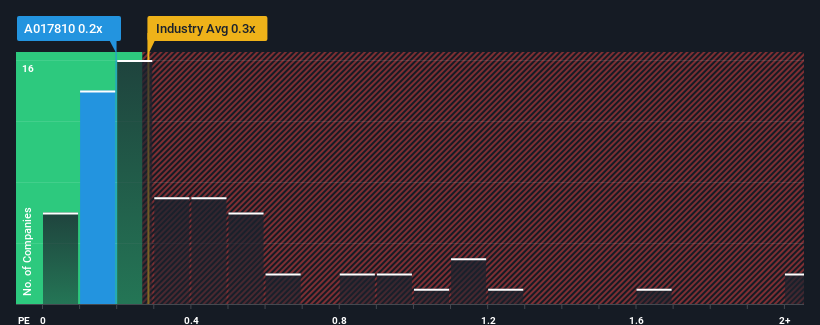

In spite of the firm bounce in price, there still wouldn't be many who think Pulmuone's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Korea's Food industry is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Pulmuone

What Does Pulmuone's Recent Performance Look Like?

Pulmuone has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Pulmuone, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Pulmuone?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Pulmuone's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.5% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 30% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 8.5% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we can see why Pulmuone is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Pulmuone's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that Pulmuone maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Pulmuone (including 2 which make us uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A017810

Pulmuone

Manufactures, sells, and distributes foods and beverages in South Korea, the United States, China, and Japan.

Low unattractive dividend payer.