Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that HITEJINRO Co., Ltd. (KRX:000080) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for HITEJINRO

What Is HITEJINRO's Debt?

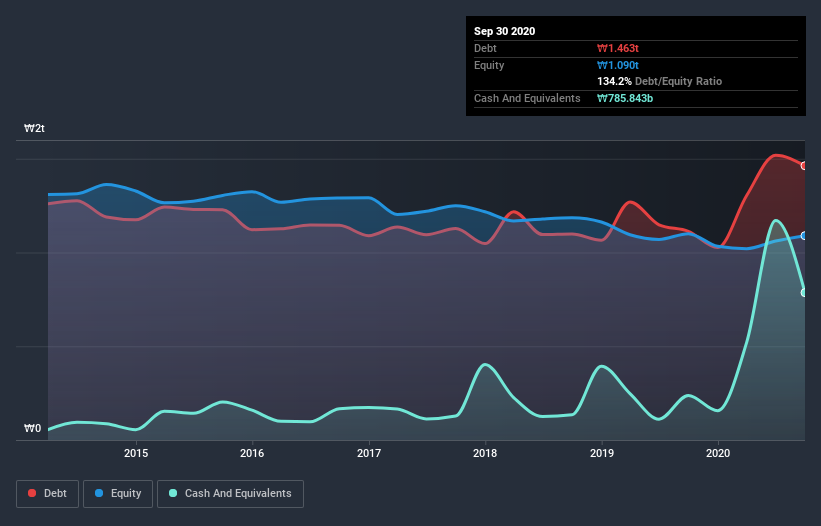

You can click the graphic below for the historical numbers, but it shows that as of September 2020 HITEJINRO had ₩1.46t of debt, an increase on ₩1.11t, over one year. However, it does have ₩785.8b in cash offsetting this, leading to net debt of about ₩677.0b.

How Strong Is HITEJINRO's Balance Sheet?

According to the last reported balance sheet, HITEJINRO had liabilities of ₩2.03t due within 12 months, and liabilities of ₩837.1b due beyond 12 months. Offsetting these obligations, it had cash of ₩785.8b as well as receivables valued at ₩475.3b due within 12 months. So its liabilities total ₩1.61t more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of ₩2.55t, so it does suggest shareholders should keep an eye on HITEJINRO's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

HITEJINRO's net debt is sitting at a very reasonable 1.8 times its EBITDA, while its EBIT covered its interest expense just 4.9 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Pleasingly, HITEJINRO is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 186% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if HITEJINRO can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, HITEJINRO actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

The good news is that HITEJINRO's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But truth be told we feel its level of total liabilities does undermine this impression a bit. When we consider the range of factors above, it looks like HITEJINRO is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for HITEJINRO you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade HITEJINRO, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HITEJINRO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A000080

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.