- South Korea

- /

- Food

- /

- KOSDAQ:A290720

Foodnamoo., Inc.'s (KOSDAQ:290720) Shares Leap 28% Yet They're Still Not Telling The Full Story

Foodnamoo., Inc. (KOSDAQ:290720) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 63% share price decline over the last year.

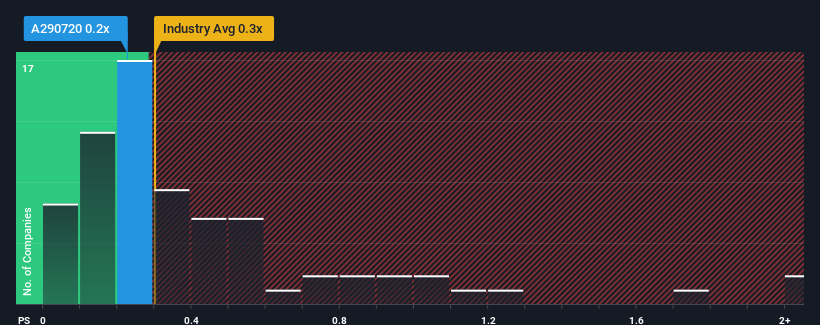

Even after such a large jump in price, it's still not a stretch to say that Foodnamoo's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Food industry in Korea, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Foodnamoo

What Does Foodnamoo's P/S Mean For Shareholders?

For example, consider that Foodnamoo's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Foodnamoo's earnings, revenue and cash flow.How Is Foodnamoo's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Foodnamoo's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 8.7%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Foodnamoo's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Its shares have lifted substantially and now Foodnamoo's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Foodnamoo revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Foodnamoo has 4 warning signs (and 3 which can't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A290720

Foodnamoo

Manufactures and sells food products in Korea and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives