- South Korea

- /

- Diversified Financial

- /

- KOSE:A034310

NICE Holdings (KRX:034310) Could Be A Buy For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that NICE Holdings Co., Ltd. (KRX:034310) is about to go ex-dividend in just three days. If you purchase the stock on or after the 29th of December, you won't be eligible to receive this dividend, when it is paid on the 22nd of April.

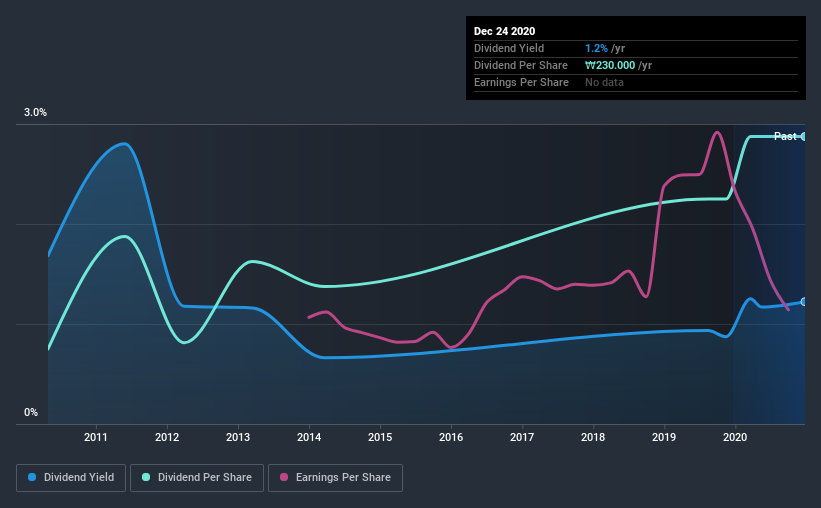

NICE Holdings's upcoming dividend is ₩230 a share, following on from the last 12 months, when the company distributed a total of ₩230 per share to shareholders. Last year's total dividend payments show that NICE Holdings has a trailing yield of 1.2% on the current share price of ₩18800. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for NICE Holdings

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. NICE Holdings is paying out just 20% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see how much of its profit NICE Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're encouraged by the steady growth at NICE Holdings, with earnings per share up 5.7% on average over the last five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. NICE Holdings has delivered 14% dividend growth per year on average over the past 10 years. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

Is NICE Holdings an attractive dividend stock, or better left on the shelf? NICE Holdings has seen its earnings per share grow slowly in recent years, and the company reinvests more than half of its profits in the business, which generally bodes well for its future prospects. In summary, NICE Holdings appears to have some promise as a dividend stock, and we'd suggest taking a closer look at it.

While it's tempting to invest in NICE Holdings for the dividends alone, you should always be mindful of the risks involved. Our analysis shows 3 warning signs for NICE Holdings and you should be aware of them before buying any shares.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading NICE Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NICE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A034310

NICE Holdings

Provides credit information services in South Korea, Europe, China, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026