- South Korea

- /

- Capital Markets

- /

- KOSE:A005940

Top 3 KRX Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has seen a 2.8% decline, yet it remains up by 4.7% over the past year with earnings projected to grow by 30% annually. In light of these dynamics, identifying dividend stocks that offer stability and potential growth can be a prudent strategy for investors seeking reliable income in fluctuating markets.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.58% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.55% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 3.78% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.42% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.18% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.87% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.43% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.75% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.11% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.77% | ★★★★★☆ |

Click here to see the full list of 76 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Snt Dynamics Co., Ltd. manufactures and sells precision machinery, with a market cap of ₩564.33 billion.

Operations: Snt Dynamics Ltd. generates revenue from its Machinery Business, amounting to ₩5.21 billion, and its Transportation Equipment Business, which contributes ₩555.04 billion.

Dividend Yield: 4%

Snt Dynamics Ltd. offers a dividend yield of 3.97%, placing it among the top 25% of dividend payers in South Korea, with dividends well-covered by earnings due to a low payout ratio of 25%. However, its cash payout ratio is high at 89.4%, indicating potential sustainability concerns. The company has an unstable and volatile dividend history over its five-year payment period. Recent inclusion in the S&P Global BMI Index highlights its growing market presence despite declining sales figures reported recently.

- Unlock comprehensive insights into our analysis of Snt DynamicsLtd stock in this dividend report.

- Our valuation report here indicates Snt DynamicsLtd may be undervalued.

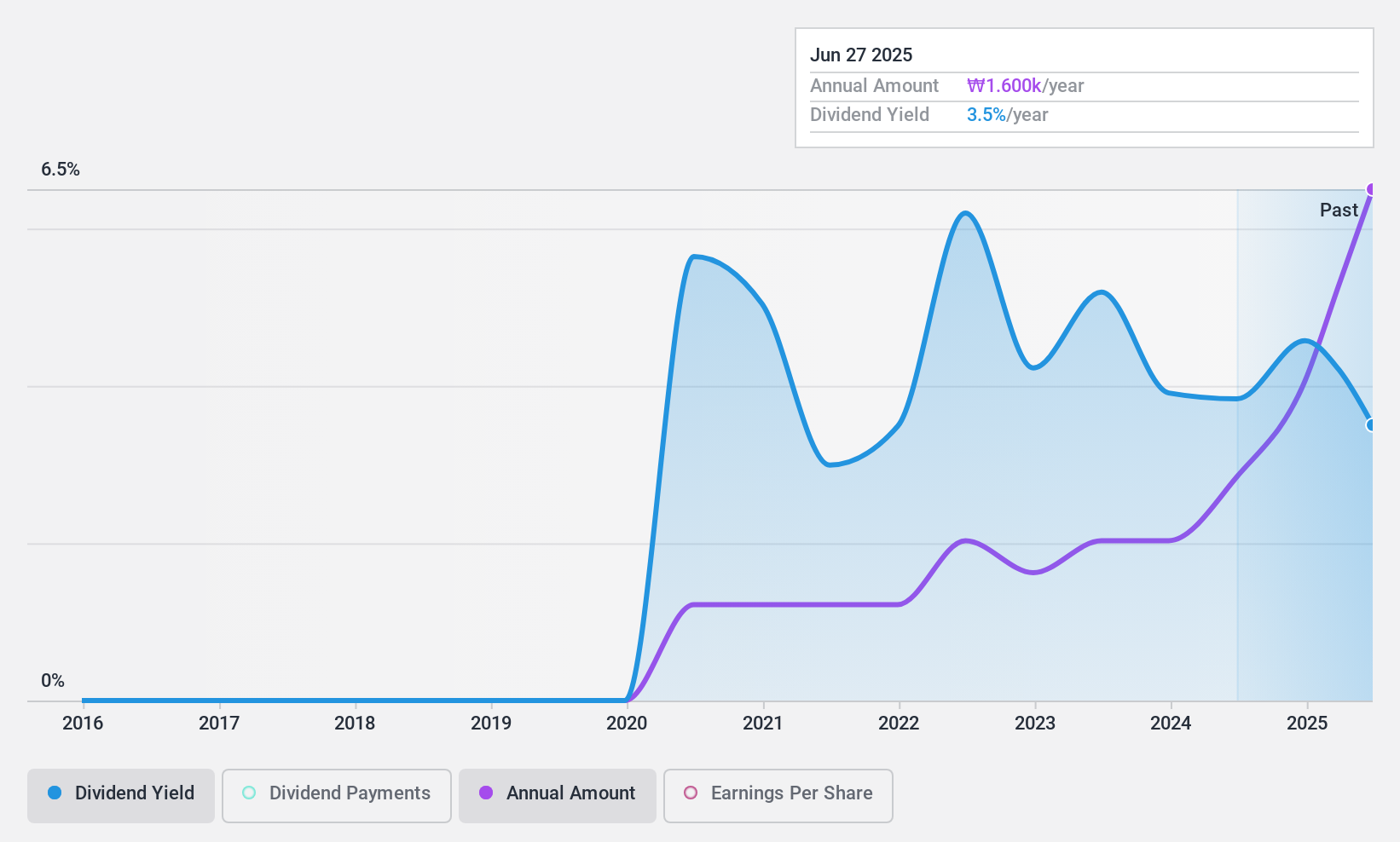

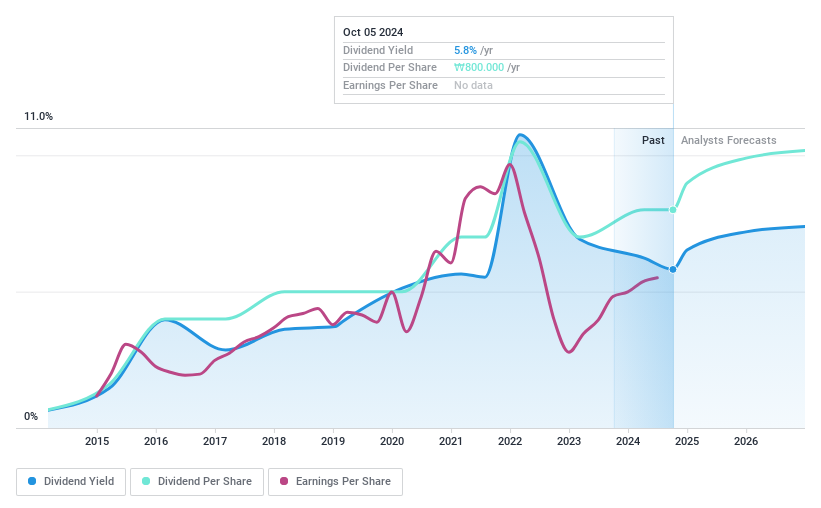

NH Investment & Securities (KOSE:A005940)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NH Investment & Securities Co., Ltd. operates in wealth management, investment banking, trading, and equity sales both in South Korea and internationally, with a market cap of ₩4.75 trillion.

Operations: NH Investment & Securities Co., Ltd.'s revenue segments include Sales at ₩2.77 billion, Trading at ₩2.65 billion, and Investment Banking (IB) at ₩0.86 billion.

Dividend Yield: 5.8%

NH Investment & Securities offers a dividend yield of 5.78%, ranking in the top 25% of South Korean payers, though its dividends are not well covered by free cash flows despite a low payout ratio of 45.6%. The company's earnings have grown significantly, yet dividends have been volatile and unreliable over the past decade. Recent inclusion in the S&P Global BMI Index underscores its market relevance, with earnings showing positive growth compared to last year.

- Navigate through the intricacies of NH Investment & Securities with our comprehensive dividend report here.

- Our expertly prepared valuation report NH Investment & Securities implies its share price may be lower than expected.

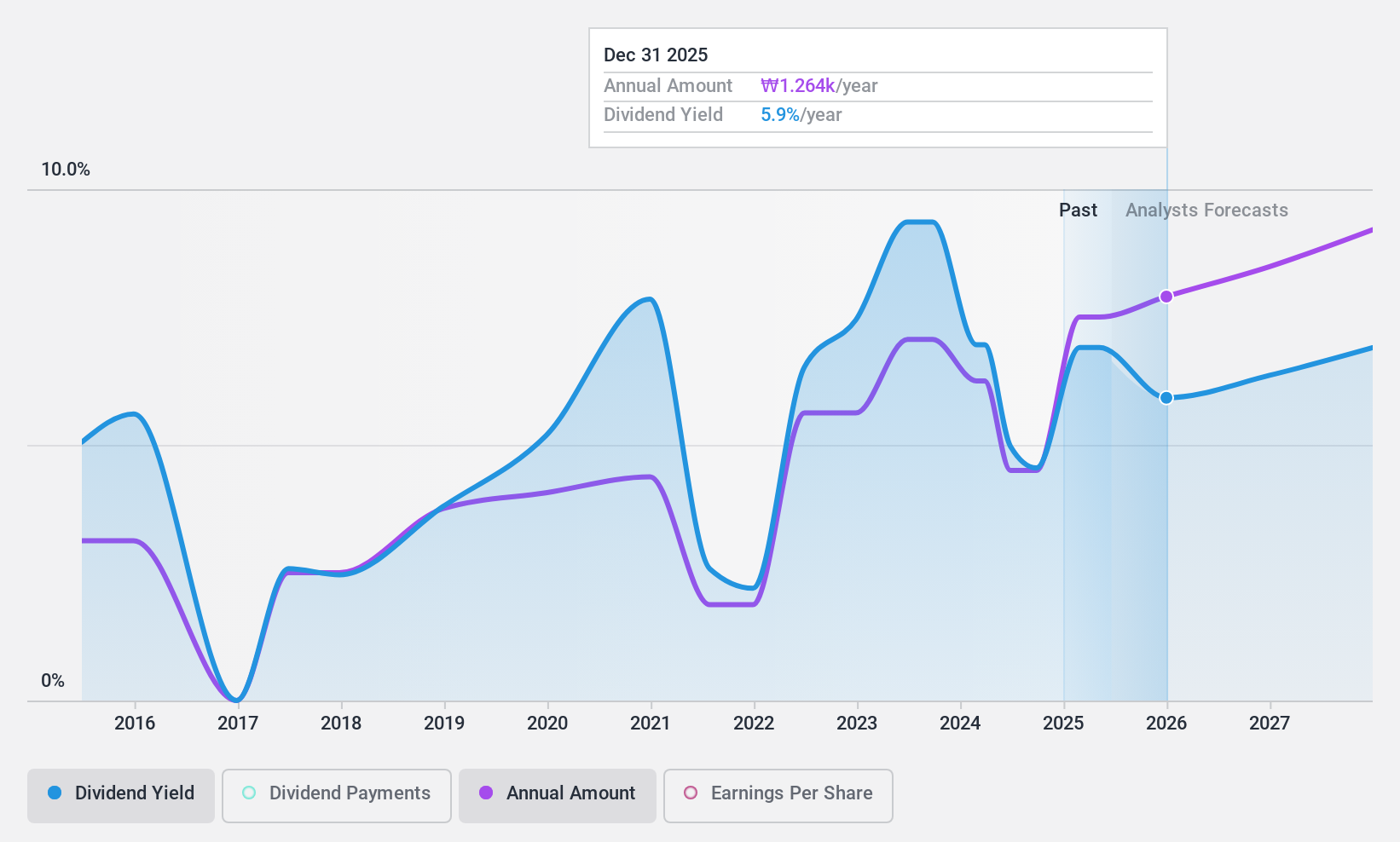

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Woori Financial Group Inc., along with its subsidiaries, functions as a commercial bank offering diverse financial services to individual, business, and institutional clients in Korea, with a market cap of ₩11.58 trillion.

Operations: Woori Financial Group Inc. generates revenue through its primary segments, which include Banking (₩7.41 billion), Capital (₩281.91 million), Credit Cards (₩440.47 million), and Investment Banking (-₩24.07 million).

Dividend Yield: 4.5%

Woori Financial Group's dividend yield is among the top 25% in South Korea, supported by a low payout ratio of 34%, indicating dividends are well covered by earnings. Despite this, its dividend history over the past decade has been volatile. Recent earnings reports show a strong performance with net income increasing to KRW 931.50 billion for Q2 2024, supporting future dividend sustainability. A quarterly cash dividend of KRW 180 per share was affirmed recently.

- Get an in-depth perspective on Woori Financial Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Woori Financial Group's current price could be quite moderate.

Next Steps

- Navigate through the entire inventory of 76 Top KRX Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NH Investment & Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005940

NH Investment & Securities

Engages in the wealth management, investment banking, trading, and equity sales businesses in South Korea and internationally.

Undervalued with adequate balance sheet and pays a dividend.